A Permanent Account Number or PAN card is a vital doc in India. You’ll want it to file revenue tax returns, to make funds above Rs. 50,000, and even to open a checking account. A PAN card is a legitimate proof of id in India and it may be issued to residents of India (together with minors), non-resident Indians (NRIs), and even international residents. The process for software varies for these classes of individuals however if you’re an Indian citizen and questioning how one can apply for PAN card on-line, we’ll give a solution on this information.

These steps are for people solely, and never for different classes beneath which a PAN card could be issued, similar to an affiliation of individuals, physique of people, firm, belief, restricted legal responsibility partnership, agency, authorities, Hindu undivided household, synthetic juridical individual, or native authority.

Documents required to apply for a PAN card on-line

Indian residents want three forms of paperwork to apply for a PAN card. These are an id proof, an age proof, and a proof of date of beginning.

-

Identity proof paperwork (one in every of):

- Elector’s picture id card

- Ration card having {photograph} of the applicant

- Passport

- Driving licence

- Arm’s license

- Aadhaar card issued by the Unique Identification Authority of India

- Photo id card issued by the Central Government or State Government or a Public Sector Undertaking

- Pensioner Card having {photograph} of the applicant

- Central Government Health Scheme Card or Ex-servicemen Contributory Heath Scheme picture card

- Certificate of id in authentic signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officer, because the case could also be

- Bank certificates in authentic on letter head from the department (together with identify and stamp of the issuing officer) containing duly attested {photograph} and checking account variety of the applicant

-

Address proof doc (one in every of)

- Advertisement -- copy of the next paperwork of no more than three months previous

- electrical energy invoice

- landline phone or broadband connection invoice

- water invoice

- client gasoline connection card or e-book or piped gasoline invoice

- checking account assertion

- depository account assertion

- bank card assertion

- copy of submit workplace go e-book having deal with of the applicant

- passport

- passport of the partner

- voter ID card

- newest property tax evaluation order

- driving licence

- domicile certificates issued by the Government

- Aadhaar card issued by the UIDAI

- allotment letter of lodging issued by the Central Government or State Government of no more than three years previous

- property registration doc

- certificates of deal with signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officer

- employer’s certificates in authentic

- copy of the next paperwork of no more than three months previous

-

Proof of date of beginning (one in every of):

- beginning certificates issued by the Municipal Authority or any workplace authorised to challenge Birth and Death Certificate by the Registrar of Birth and Deaths or the Indian Consulate as outlined in clause (d) of sub part (1) of part 2 of the Citizenship Act, 1955 (57 of 1955)

- pension fee order

- marriage certificates issued by Registrar of Marriages

- matriculation certificates

- passport

- driving licence

- domicile certificates issued by the Government

- affidavit sworn earlier than a Justice of the Peace stating the date of beginning

If you’re looking to get a PAN card for any class aside from particular person, the complete record of legitimate paperwork for a PAN card is on the Income tax department’s website.

How a lot does it value to apply for a PAN card on-line

For Indian residents, making use of for a brand new PAN card prices Rs. 116 (plus on-line fee fees or round Rs. 5). The charge is Rs. 1,020 for international residents (with round Rs. 5 as on-line fee fees).

How to apply for PAN Card on-line

Follow these steps to apply for a PAN card on-line in India:

-

You can apply for a PAN card on-line both by way of NSDL or UTITSL web sites. Both have been authorised to challenge PAN playing cards in India. For this tutorial, we’ll present you ways to apply for a PAN card by way of the NSDL website.

-

On the web page linked within the earlier step, you will notice a type titled Online PAN software. Under Application Type choose New PAN – Indian Citizen (Form 49A). If you’re a international nationwide, choose New PAN – Foreign Citizen (Form 49AA).

-

Select the class of PAN card you want. For most individuals, this will probably be Individual.

-

Now fill in your private particulars similar to identify, date of beginning, cell quantity, and so on., enter the captcha code and click on Submit.

-

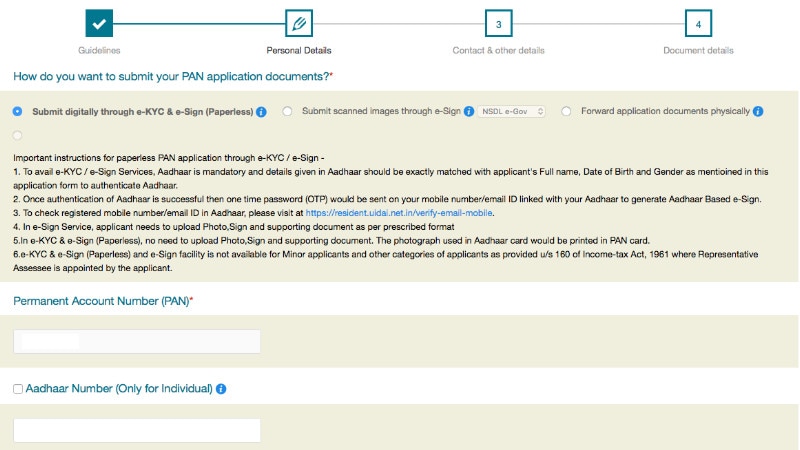

Now you may have three decisions — authenticate by way of Aadhaar to keep away from sending any paperwork, scan paperwork and add them by way of e-sign, or to bodily submit paperwork.

-

We selected to authenticate by way of Aadhaar as all it wants is an OTP and fee. If you don’t need that possibility, the steps for the opposite two are related besides the half the place you may have to ship paperwork.

-

Enter all particulars similar to Aadhaar quantity (optionally available) as requested on display, and click on Next.

-

This step requires you to fill in your identify, date of beginning, deal with, and so on. Do that, and click on Next.

-

Now you’ll hit the banana pores and skin that’s the AO code (Assessing Officer code). This appears sophisticated however is definitely fairly easy. Just choose one of many 4 decisions on the prime — Indian Citizens, NRI and Foreign Citizens, Defence Employees, or Government Category.

-

Then beneath Choose AO Code, choose your state and space of residence. Wait for just a few seconds and you will notice a full record of AO codes within the field under. Carefully scroll and look for the class that applies finest to you. There are totally different classes for firms, non-salaried folks, authorities servants, non-public sector staff, and so on. If you don’t know which class you fall beneath, contact a chartered accountant to discover out. Click on the right AO code and it’ll be auto-filled within the type above. Click Next.

-

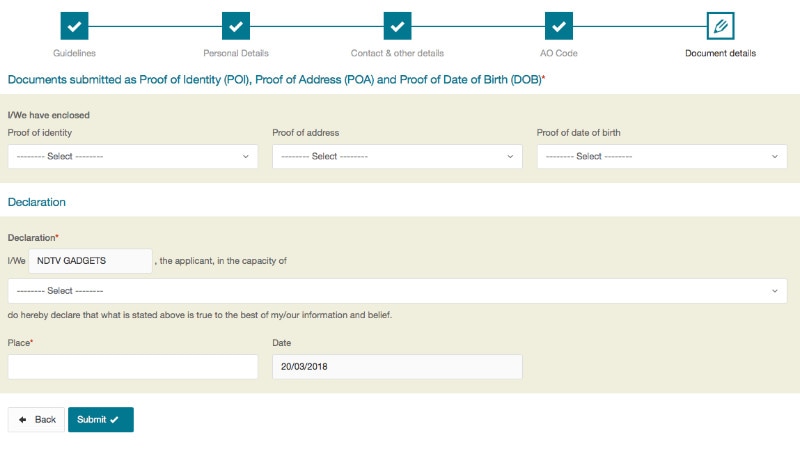

Select the paperwork you may have submitted as proof of age and residence from the drop-down menu, fill in required particulars, after which click on Submit.

-

Now you’ll be redirected to the fee web page and you may select one in every of many widespread on-line fee strategies. The charge for PAN card functions for Indian residents is Rs. 115.90 inclusive of all taxes. A small charge is added to this as on-line fee fees so the entire works out to round Rs. 120.

-

Once you may have paid, you’ll be requested to authenticate by way of Aadhaar OTP, or submit paperwork by way of e-sign, or to bodily ship the paperwork to NSDL. You may also obtain an e mail acknowledgement from NSDL about your software and your PAN card will probably be couriered to you as soon as the appliance has been processed. Keep the acknowledgement quantity useful, we advocate that you simply both reserve it someplace protected or print it.

For extra tutorials, go to our How To part.