Tyler Atkinson and Alex Richter

The Federal Open Market Committee has larger the benchmark federal price range charge by means of 5 proportion issues (500 foundation issues) over the previous 18 months so that you can deliver down inflation. While the labor marketplace has indisputably cooled, it stays robust by means of nearly any measure.

During the 3 months resulted in September, the unemployment charge averaged 3.7 p.c, simply above the charge when the financial tightening cycle started in March 2022 and close to its lowest stage since the overdue Sixties. Similarly, payrolls expanded by means of 266,000 jobs over the three-month length, nicely above estimates of what is had to account for pattern labor pressure enlargement.

At the identical time, a three-month reasonable of the activity emptiness charge—activity openings as a proportion of the labor pressure—fell from 7.1 p.c in March 2022 to five.5 p.c in August, in line with the Bureau of Labor Statistics’ most up-to-date Job Openings and Labor Turnover Survey (JOLTS).

Historically, this type of fast cooling in the labor marketplace has simplest happened all through sessions of recession and emerging unemployment (Chart 1).

Any decline in the emptiness charge exceeding 0.5 proportion issues used to be related to a recession in prepandemic instances. The present decline in the emptiness charge is now greater than thrice that threshold. Many different signs of labor marketplace tightness, reminiscent of the quits charge (overall quits as a proportion of employment) or surveys of families on activity availability, display a equivalent or better stage of cooling in the labor marketplace.

Why this labor marketplace ‘de-tightening’ cycle differs from historic precedent

Last July, an influential FEDS Notes article by means of economist Andrew Figura and Federal Reserve Governor Chris Waller (“What does the Beveridge curve tell us about the likelihood of a soft landing?”) argued {that a} cushy touchdown used to be conceivable as a result of the unheard of stage of labor marketplace tightness. As the labor marketplace slowed, companies may just scale back their activity postings as an alternative of resorting to layoffs. Under this speculation, the emptiness charge would go back to its prepandemic stage with out a lot building up in the unemployment charge, reaching a cushy touchdown.

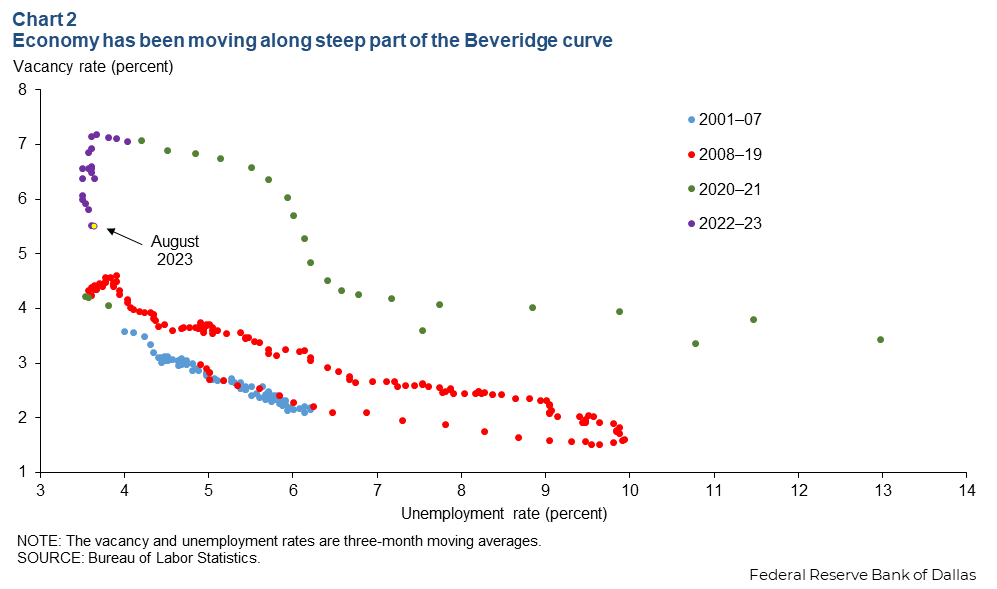

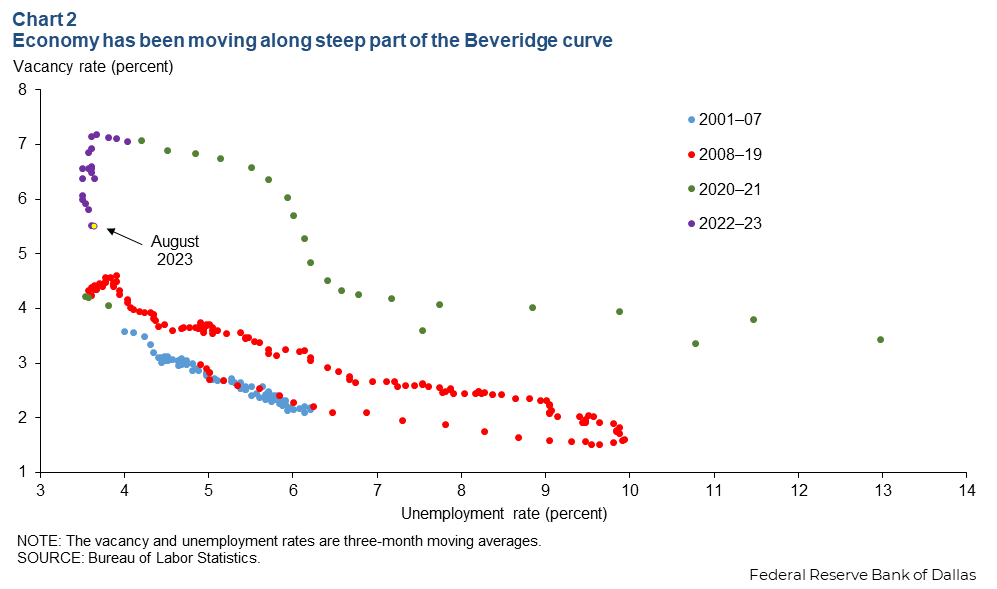

The Beveridge curve—the courting between emptiness and unemployment charges—supplies a extra formal representation. Chart 2 plots emptiness and unemployment charges since 2001, the first yr of the JOLTS survey. Over the industry cycles from 2001 to 2007 and from 2008 to 2019 there used to be a transparent damaging courting.

As the emptiness charge declined, the unemployment charge rose. During the 2020 and 2021 pandemic years, this courting in large part remained intact, excluding with the curve transferring to the proper as a result of the particular cases of the pandemic made hiring harder given any stage of vacancies.

Since early 2022, on the other hand, the curve seems to were utterly vertical. With vacancies at an unheard of stage, the economic system has been ready to transport alongside the steep portion of the Beveridge curve and scale back the emptiness charge and not using a simultaneous building up in the unemployment charge, in keeping with the Figura-Waller speculation.

The newest vacancy-unemployment charge pair, in August 2023, is coming near the most sensible finish of the prepandemic Beveridge curves. This presentations the labor marketplace may well be nearing a flatter portion of the Beveridge curve, the place a extra standard tradeoff will have to reemerge.

Given the strange nature of this industry cycle, there is uncertainty about what emptiness charge threshold will cause an building up in the unemployment charge, and as soon as that happens, whether or not the tradeoff will glance very similar to previous de-tightening cycles.

A idea of latest unemployment dynamics and potentialities for a cushy touchdown

Central to the Figura-Waller expectation of transferring down a steep Beveridge curve used to be an assumption that activity separations (transitions from employment to unemployment) would stay traditionally low. An building up in separations would generally tend to shift the Beveridge curve out, leading to a better unemployment charge for any emptiness charge.

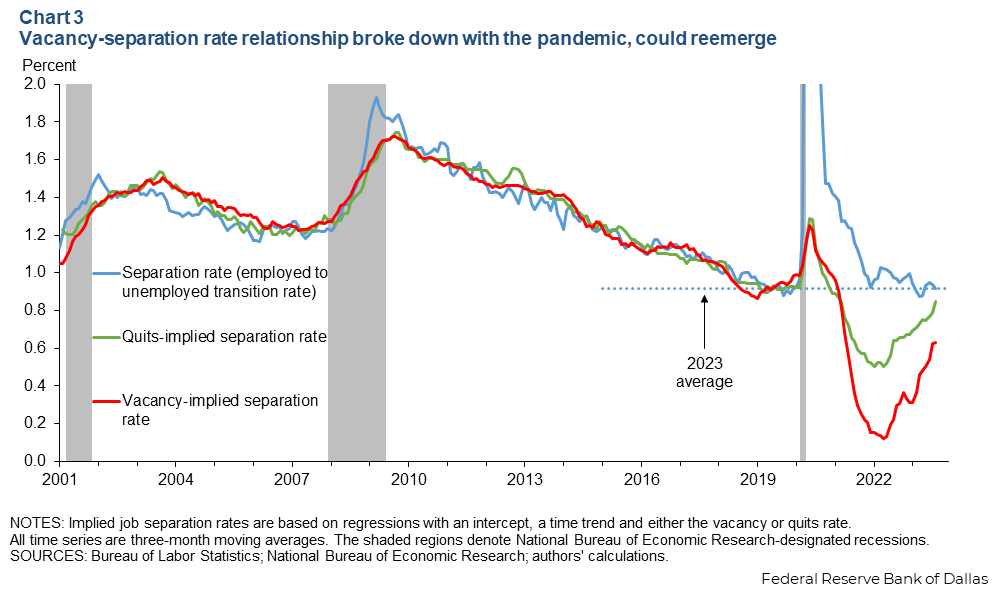

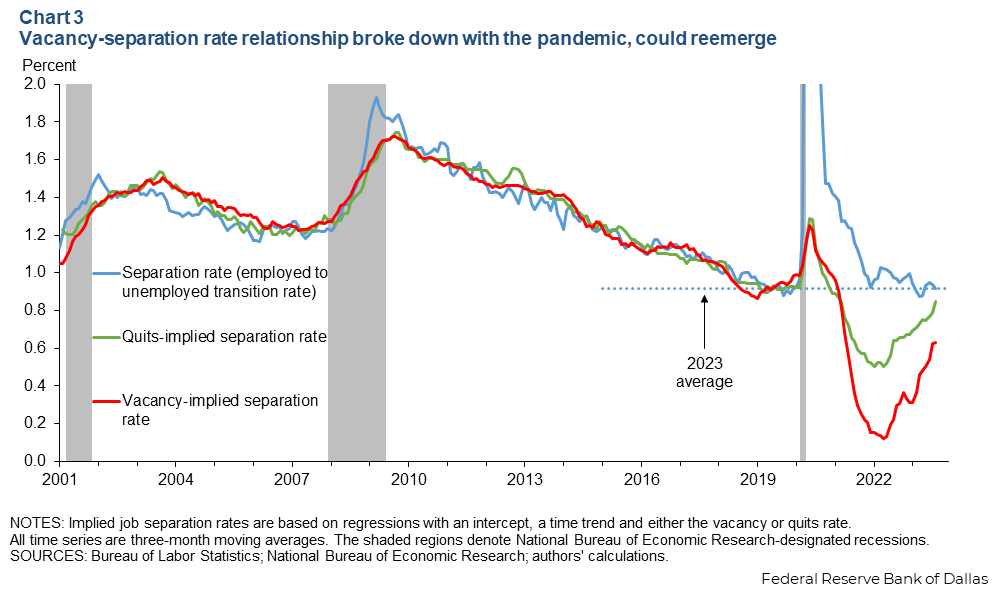

In early 2022, anticipating the separation charge to stay low as vacancies fell wasn’t a given. There is most often a robust damaging courting between activity separation charges and emptiness charges.

The purple line in Chart 3 presentations the fitted values from regressing the separation charge on an intercept, a time pattern and the emptiness charge from 2001 via 2019. Since the pandemic, the courting has damaged down, as proven by means of the massive hole between the purple and blue strains since 2020.

As the economic system reopened following pandemic-induced industry closures, labor call for used to be extremely robust. Vacancies rose sharply and considerably exceeded their 2019 ranges. Based on the historic courting, this may generally result in a pointy lower in activity separations, underneath 2019 ranges.

However, separations can have hit a decrease certain, as there is most likely a minimal choice of layoffs and turnover into unemployment that all the time happens in the labor marketplace irrespective of the stage of labor call for. Under this idea, activity separations would seem kind of consistent, as has been the case this yr, till vacancies decline to some degree the place the constraint is not binding.

The newest vacancy-implied separation charge stays underneath the 2023 reasonable charge. This signifies that the threshold has no longer been surpassed, and a few additional cooling of the labor marketplace is conceivable with out emerging unemployment. If vacancies proceed to fall and the threshold is surpassed, the unemployment charge would most likely upward thrust.

At the tempo of decline over the previous one year, the dangers of a difficult touchdown seem low, as the threshold would no longer be exceeded till mid-2024. However, the stage of labor marketplace tightness is unsure and is probably not well-captured by means of activity openings. Other signs, like the quits charge, have proven considerably extra cooling and are coming near ranges very similar to 2019.

If labor marketplace prerequisites are extra as it should be captured by means of the quits charge, then just a modest stage of extra cooling is most likely wanted prior to standard relationships and emerging activity separations reemerge, as proven in the inexperienced line in Chart 3.

Implications for the runway forward

The cooling of the labor marketplace and total economic system up to now has been nearly costless in relation to upper unemployment, resulting in a extremely strange industry cycle. An necessary driving force of this trend can have been an surprisingly secure separation charge, kind of consistent at a low stage regardless of a vital upward thrust and fall in labor marketplace tightness.

Despite this excellent news, the economic system must “land” prior to it may be definitively characterised as a cushy touchdown. Stabilizing at a still-overheated labor marketplace is most likely inconsistent with reaching the Fed’s goal of two p.c inflation in a well timed and sustainable way.

Optimistically, some extra cooling seems conceivable with out upper unemployment. However, a normalized labor marketplace most likely involves a more-usual courting between layoffs and labor marketplace tightness signs, and at some point, a better unemployment charge.

About the authors

The perspectives expressed are the ones of the authors and will have to no longer be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

[/gpt3]