S&P 500 erases all of Monday Tuesday decline — after which some — on again of newfound bullishness

The S&P 500 clawed again all the Monday-Tuesday decline on Wednesday on the again of Federal Reserve chairman (*300*) Powell’s remarks in Washington signaling a a extra average tempo of future will increase within the central financial institution’s benchmark in a single day lending charges.

The S&P 500 acquired as excessive as 4037 intraday Wednesday, surpassing final Friday’s holiday-shortened Black Friday shut of 4026. The low on Tuesday — touched once more early Wednesday — was within the space of about 3938.

All 11 sectors rallied within the S&P 500, with communication companies, tech and client discretionary outperforming and the opposite eight underperforming. The laggards had been mainly power, financials, industrials and client staples shares.

— Scott Schnipper

Powell continues to consider in a path to a soft-ish touchdown

Federal Reserve Chair (*300*) Powell says he continues to consider in a path to a “soft-ish” touchdown — even when the trail has narrowed over the previous 12 months.

“I would like to continue to believe that there’s a path to a soft or soft-ish landing” Powell stated on the Brookings Institution.

“Our job is to try to achieve that, and I think it’s still achievable,” Powell stated. “If you look at the history, it’s not a likely outcome, but I would just say this is a different set of circumstances.”

— Sarah Min

Slowing down on rate hikes is an effective approach to steadiness dangers, Powell says

Fed Chair (*300*) Powell stated throughout his remarks Wednesday that chilling curiosity rate hikes will assist steadiness administration dangers.

“We have a risk management balance to strike,” he stated. “We think that slowing down at this point is a good way to balance the risks.”

— Alex Harring

S&P 500 rises greater than 1%, Nasdaq cracks 2% following Powell’s remarks

The S&P 500 continued its ascent Wednesday on the heels of Fed Chair (*300*) Powell’s remarks, reaching greater than 1% up regardless of buying and selling down earlier within the day.

The broad index was up 1.3% round 2 p.m.

Meanwhile, the tech-heavy Nasdaq Composite was up greater than 240 points, or 2.2%, across the identical time.

— Alex Harring

Indexes bounce on Powell feedback

Fed Chair (*300*) Powell’s feedback indicating the central financial institution will gradual future curiosity rate hikes as quickly as December put upward strain on the three main indexes.

The S&P 500 jumped up 0.6% from the crimson on the news.

The Dow was close to flat after buying and selling down for a lot of the day.

The Nasdaq Composite gained steam to 1.3% up.

— Alex Harring

Powell says Fed can “moderate the pace” of future rate will increase on account of lagged impact of previous hikes

Federal Reserve chairman (*300*) Powell informed an viewers on the Brookings Institution Wednesday that the central financial institution can afford to ease again on its tighter financial coverage at its December assembly (on account of wrap up Dec. 14).

The lagged impact of upper charges already taken in 2022, plus the drawing down of the scale of the Fed’s steadiness sheet by quantitative tightening, imply “it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” Powell stated.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” stated the 69-year-old Fed chair.

In response to Powell’s remarks, the S&P 500 shortly gained to about 3970 vs about 3950 earlier than the tackle.

— Scott Schnipper, Jeff Cox

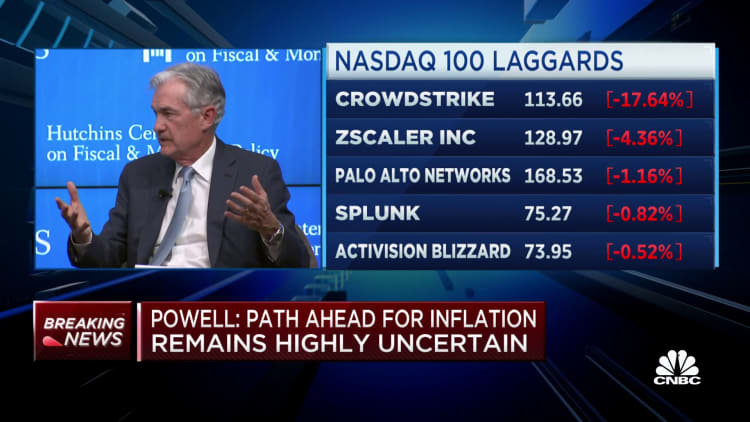

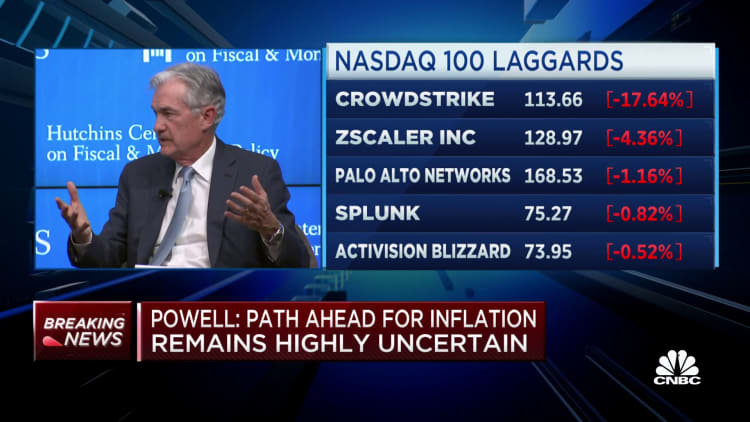

Stocks making the largest strikes noon

These are the businesses making the largest strikes noon:

CrowdStrike — Shares dropped 19% after the cybersecurity supplier stated new income development is weaker than expected. The firm did beat estimates on the highest and backside traces in its most up-to-date quarterly outcomes. Stifel downgraded the stock to carry from purchase after the earnings report.

Horizon Therapeutics — The pharmaceutical firm’s shares soared 26% after Horizon stated it was in preliminary talks about a possible sale with a number of giant pharma firms, together with Amgen, Sanofi and Johnson & Johnson’s Janssen Global Services unit.

Petco — Shares of Petco jumped 12% after reporting third-quarter income that was barely above Wall Street estimates. The pet product retailer’s comparable retailer gross sales rose 4.1%, above a StreetAccount estimate of three.5%. Its adjusted EPS was in-line with expectations.

— Tanaya Macheel

Credit Suisse analyst appears for S&P 500 to interrupt beneath 3,906 level mark

The S&P 500 is exhibiting indicators of stalling in its 200-day common in need of restoration aims, however energy is a corrective, in line with Credit Suisse.

Analyst David Sneddon stated the agency maintains its view that October introduced a bear market rally. He stated he is now on the lookout for a break beneath the three,906-3,907 level mark to determine what he referred to as a “double top.”

The present 200-day common sits at 4,052.

Stocks combined as traders look to second half of buying and selling day

Indexes had been down as traders seemed to the second half of the buying and selling day.

The Dow was down 0.8%. It was adopted by the S&P 500, which has misplaced 0.5%.

Meanwhile, the Nasdaq Composite shed 0.1% regardless of buying and selling up for a lot of the day.

Morning buying and selling was pushed by combined financial information, however observers anticipate many traders are awaiting Fed Chair (*300*) Powell’s speech at 1:30 p.m.

— Alex Harring

Indexes set to finish November up

Despite combined buying and selling for the ultimate day in November, the three main indexes stay poised to finish the month positively.

The Dow was on tempo to finish the month up just below 3%. The S&P 500 is poised so as to add 2.1%.

Lagging behind the opposite two, the Nasdaq Composite is on monitor to finish November 0.3% greater.

— Alex Harring

BlackRock’s DeSpirito calls healthcare a “superior” place to park

BlackRock’s Tony DeSpirito views healthcare as a “superior” space of the market to put money into, highlighting the sector’s cheap valuation and long-term development trajectory at an occasion Wednesday in New York City.

While the chief funding officer of U.S. basic equities additionally sees alternatives in utilities and staples, he views healthcare earnings as barely extra cheap, buying and selling at a roughly 10% low cost to the market.

“You get better long-term growth, better recession resiliency, and you got a better valuation,” DeSpirito stated, noting the sector is a big chubby in a slew of BlackRock’s funds.

The sector also needs to profit from the growing older inhabitants, provided that people devour extra healthcare as they age, he stated. That also needs to strengthen the demand outlook.

Despite the robust macro local weather, DeSpirito stated traders ought to keep invested available in the market, with this 12 months’s a number of contraction placing equities at a reduction versus the beginning of 2022.

“I think we should stay invested because equity is on sale, but we should do so in a resilient way because of the earnings risks that are out there,” he stated.

— Samantha Subin

Nasdaq briefly flashes crimson

The tech-heavy Nasdaq Composite briefly turned detrimental for the day, bringing at one level all three of the key indexes into the crimson. It then got here again as much as 0.2%.

It’s the one of the three main indexes up as merchants look to the top of the second hour of buying and selling. The Dow is down 171 points, or 0.5%, after beforehand shifting down greater than 200 points. The S&P 500 has dropped 0.2%.

Stocks have whipsawed over the course of the morning as traders weighed new financial information that provides conflicting concepts in regards to the state of the financial system.

Wayfair sees sturdy vacation weekend gross sales as prospects new and previous turned up for bargains

All indicators have been pointing to weak sales of home furnishings after customers spent closely within the class throughout the pandemic. In current days, firms like Williams-Sonoma and RH have obtained downgrades.

However, Wayfair shares are up greater than 6% in premarket buying and selling Wednesday after reporting sturdy five-day vacation weekend gross sales. From Thanksgiving to Cyber Monday, the corporate noticed a low-single digit gross sales enhance within the U.S. in contrast with the identical interval final 12 months.

The firm stated repeat prospects made up 73% of its orders throughout the vacation weekend, nevertheless it additionally pulled in new buyers. Sales additionally strengthened main into the vacation weekend.

The large query for retailers continues to be what is going to occur within the weeks main into Christmas. Bargain-hungry shoppers turned up in record numbers for the large gross sales however your complete season will hinge on what occurs over the subsequent few weeks.

-Christina Cheddar Berk

Job openings fall barely in October

Job openings fell in October barely greater than anticipated however remained nicely above the variety of out there staff, the Labor Department reported Wednesday.

The Job Openings and Labor Turnover Survey, a intently watched indicator of employment slack, confirmed there have been 10.33 million out there positions for the month. That was barely beneath the FactSet estimate of 10.4 million and down from 10.69 million in September.

There at the moment are 1.7 job openings per out there employee.

The quits degree, an indicator of employee confidence, fell barely to 4.03 million. The quits rate as a share of the workforce decreased to 2.6%, a 0.1 share level decline.

—Jeff Cox

Pending residence gross sales fell 4.6% in October

Pending residence gross sales, which experiences signed contracts on present houses, fell 4.6% in October, in line with the National Association of Realtors. The index fell for a fifth consecutive month.

The index declined 10.2% within the prior month in its lowest degree since June 2010, excluding April 2020, which was throughout the onset of the pandemic.

— Sarah Min

S&P 500 flat as traders enter first hour of buying and selling

The S&P 500 was flat as buying and selling kicked off.

The Dow, in the meantime, was barely down, having shed 49 points, or 0.15%.

The Nasdaq Composite, then again, climbed 0.4%.

— Alex Harring

Goldman Sachs expects these large takeaways from Powell speech

Federal Reserve Chairman (*300*) Powell in a speech later Wednesday possible will verify expectations of smaller rate will increase ahead whereas additionally signaling that he is nonetheless frightened about inflation, in line with Goldman Sachs.

In a consumer be aware Wednesday morning, the Wall Street agency’s economists outlined a number of main expectations when the central financial institution chief speaks on the Brookings Institution.

“Powell is likely to hint that the [Federal Open Market Committee] will slow the pace of rate hikes at the December meeting but push back against the recent easing in financial conditions with two hawkish counterpoints,” Goldman economist Ronnie Walker wrote.

“First, Powell is likely to suggest that the FOMC will need to raise the funds rate to a higher peak than it projected at the September meeting, echoing his remarks at the November press conference and following similar comments from several other FOMC members over the last few weeks,” Walker added. “Second, he is likely to emphasize that inflation remains too high and the labor market remains extremely tight.”

Goldman expects the Fed to lift its benchmark curiosity rate by 0.5 share level in December, adopted by three successive hikes of 0.25 share level earlier than pausing.

The Powell speech is due at 1:30 p.m. ET. A matter-and-answer session will observe.

—Jeff Cox

New Addams Family present ‘Wednesday’ might assist enhance Netflix, in line with Keybanc

The new Addams Family present “Wednesday” is now Netflix’s most watched collection in every week, with viewers logging 341 million hours within the first week of its launch, Keybanc says.

“Netflix’s successful launch of Wednesday … screens as an incremental positive against rather underwhelming viewership for The Crown (consistent w/w declines) and perceived viewership competition from [the] World Cup,” Keybanc Capital Markets analyst Justin Patterson stated.

Many traders have pointed to the declining viewership of “The Crown” as an incremental danger issue to Netflix’s paid internet additions, notably amid concern about World Cup competitors and a lighter content material slate, he wrote in a be aware Tuesday.

“We believe Wednesday’s strong start changes the conversation,” Patterson stated. “As such, we believe Wednesday’s performance over the next few weeks will be highly tracked, both at the aggregate viewership level and country level.”

Whether the efficiency turns into a extra significant drive of gross additions stays to be seen, at a minimal the success of “Wednesday” and fewer viewership competitors are positives for retention, he added.

— Michelle Fox

Third-quarter GDP will get revised greater

The U.S. financial system grew at a barely quicker tempo within the third quarter than was beforehand reported, with third-quarter GDP growth being revised as much as 2.9% from 2.6%.

To ensure, Tiffany Wilding of Pimco famous there is a “bit of noise that you have to take into account, because inventories and trade numbers can obviously be very volatile.”

“When you exclude those more volatile categories, growth was actually pretty subpar,” Wilding stated.

— Fred Imbert

Stock futures rise barely on new information exhibiting non-public hiring fell

Stock futures noticed a slight enhance after new data from processing firm ADP showed private hiring sharply fell in November.

Companies added simply 127,000 positions for the month, a notable drop from the 239,000 the agency reported for October and the smallest achieve since January. That got here in beneath the Dow Jones estimate of 190,000 for the month.

Investors might take the information as an indication that the financial system is tightening – one thing to cheer for these hoping it might affect the Fed to gradual or cease curiosity rate hikes as they develop more and more involved in regards to the affect of an incoming recession on the inventory market.

— Alex Harring, Jeff Cox

Stocks making the largest strikes within the pre-market

These are the shares making the largest strikes earlier than the bell:

Hormel – The meals producer’s inventory slid 6.4% within the premarket after reporting a combined quarter. Earnings beat estimates, however gross sales got here up in need of Wall Street forecasts. The firm additionally issued a weaker-than-expected outlook and stated it anticipated a continued unstable and excessive value surroundings.

Petco – Petco rallied 8% after its report of adjusted quarterly earnings of 16 cents per share matched Street forecasts and income was barely above estimates. A comparable retailer gross sales rise of 4.1% beat the FactSet consensus estimate.

CrowdStrike – The inventory plunged 17.6% within the premarket after the cybersecurity firm’s subscription numbers got here in beneath analyst forecasts. Though it reported better-than-expected revenue and income for its newest quarter, the corporate famous financial uncertainty is prompting prospects to delay spending.

—Peter Schacknow, Alex Harring

Amazon has most draw back amongst megacap web shares, Jefferies says

Another giant decline for shares might be notably painful for Amazon traders, in line with Jefferies.

In a be aware to shoppers on Tuesday evening, analyst Brent Thill examined the bear case eventualities for giant web and software program shares and located Amazon to be essentially the most uncovered in such a scenario.

“We believe that AMZN has the most downside in our mega-cap coverage given its exposure to inflationary cost headwinds and a potential impact from slowing consumption. We show that a bear case scenario of $60B in EBITDA at a 9x trough multiple would yield a $51 dollar stock, or ~45% downside from current levels,” Thill stated.

On the opposite hand, Microsoft was the “most insulated” by Jefferies’ calculations, with solely 27% draw back in a bear case situation.

Jefferies has a purchase ranking on each shares.

—Jesse Pound, Michael Bloom

Elon Musk says Fed should reduce charges instantly to keep away from extreme recession

Bitcoin, Ether on monitor to submit worst month since June

Bitcoin and Ether are every poised to make November the worst months since June as uncertainty over cryptocurrencies mounts.

Bitcoin is down 17.2% in contrast with the beginning of the month. If that stays when markets shut Wednesday, it might be the worst efficiency because it dropped 40.3% over the course of June.

Ether is slated to finish the month down 19%, which might even be the largest misplaced since June’s 47.4% drop.

The slides come as traders develop more and more cautious of crypto following the collapse of exchange FTX.

— Gina Francolla, Alex Harring

Euro zone inflation drops, fueling hopes of ECB rate hike slowdown

Euro zone inflation dropped by more than expected in November, fueling market hopes that record-high value development throughout the bloc has peaked and the European Central Bank will start slowing its curiosity rate hikes subsequent month.

The client value index grew by 10% year-on-year, down from 10.6% in October and comfortably beneath a consensus projection of 10.4% in a Reuters ballot of analysts.

However, meals value inflation, a key fear for policymakers, continued to speed up, with falling power costs accounting for the majority of the slowdown.

– Elliot Smith

European markets greater as traders monitor euro zone inflation information

European markets had been cautiously greater on Wednesday as regional traders monitored the newest inflation information from the euro zone in November.

The pan-European Stoxx 600 was up 0.8% in early commerce, with autos including 1.8% to guide gains as all sectors and main bourses entered constructive territory.

Elsewhere in a single day, Asia-Pacific shares had been largely greater on Wednesday even as the studying for China’s November manufacturing unit exercise fell short of expectations, dropping to the bottom studying since April.

Yield curve inversion between 2Y/10Y Treasuries widened Tuesday

A key a part of the yield curve intently watched by Wall Street traders and analysts alike inverted additional on Tuesday, probably signaling a recession ahead.

The yield on the 10-year U.S. Treasury ticked up about 4 foundation points to commerce at 3.752% on Tuesday. At the identical time, the two-year yield rose barely to 4.481%. Yields transfer inverse to cost, and a foundation level is the same as 0.01%.

The distinction between yields, referred to as the yield curve, is a recession sign when traders are getting higher payback for snapping up shorter-term bonds than long term ones. Currently, the unfold between the 10-year and 2-year Treasury bonds is greater than 73 foundation points, the widest in many years.

What this inversion signals is that the Fed might have tamed inflation sufficient to chill down the financial system and might be able to pause or pivot quickly. It may also be learn as an indication {that a} recession is on the horizon.

—Carmen Reinicke

ADP jobs report, JOLTS rolling out Wednesday

Two experiences issued on Wednesday ought to give traders some perception into the state of the U.S. labor market upfront of Friday’s large payrolls report.

The ADP jobs studying is due Wednesday at 8:15 a.m. ET. Economists polled by Dow Jones anticipate that non-public employers grew their payrolls by 190,000 positions in November, a decline from October’s increase of 239,000.

At 10 a.m., the U.S. Bureau of Labor Statistics will concern the outcomes of the Job Openings and Labor Turnover Survey (JOLTS). FactSet estimates that there have been 10.4 million job openings in October. Back in September, employment openings totaled 10.7 million.

Fed policymakers hold a detailed eye on the JOLTS report, looking for clues on the state of the labor market and whether or not it wants additional cooling.

The predominant occasion in financial information this week would be the November nonfarm payrolls report, due Friday at 8:30 a.m. Dow Jones expects that payrolls grew by 200,000, which is down from October’s increase of 261,000. Economists are additionally calling for the unemployment rate to carry regular from the prior month at 3.7%.

–Darla Mercado

CrowdStrike, NetApp stoop in after hours buying and selling

Just a few shares plunged in after hours buying and selling Tuesday after releasing earnings outcomes that fell in need of Wall Street’s expectations.

CrowdStrike — CrowdStrike Holdings plunged greater than 18% after giving mild steerage for fourth-quarter income, regardless that its earnings outcomes topped Wall Street estimates.

NetApp — NetApp inventory fell 10.8% after cloud companies and information administration supplier noticed weaker-than-expected income in its newest quarter. NetApp reported adjusted earnings per share of $1.48, beating estimates of $1.33. But its income of $1.66 billion fell in need of the $1.68 billion Wall Street anticipated, per Refinitiv. NetApp additionally issued weak ahead steerage.

Read more about stock moves here.

—Carmen Reinicke

Stock futures open little modified Tuesday night

Stock futures had been little modified Tuesday night as Wall Street awaits a Wednesday speech from Federal Reserve Chair (*300*) Powell which will give additional perception into future rate hikes.

Futures tied to the Dow Jones Industrial Average rose one level, or 0.003%. S&P 500 futures and Nasdaq 100 futures slipped 0.03% and 0.08%, respectively.

—Carmen Reinicke