Ameya Engineers IPO Allotment Status is to be finalized on September 5, 2022 (Allotment Today or Tomorrow). The refund will probably be initiated on September 6 and the shares will probably be credited to the Demat account on September 7. Ameya Engineers IPO itemizing is on September 8. The IPO buyers can examine their Ameya Engineers IPO allotment standing on-line on the Skyline web site or they’ll examine it by way of their checking account and Demat login as offline mode. Check out right here step to step information from the place you may examine Ameya Engineers IPO allotment standing on-line or offline.

Basis of Allotment:

Based on the retail subscription the Ameya Engineers IPO foundation of allotment will probably be round 243:1 (Approx).

Ameya Engineers IPO Allotment Status Links (Allotment in Progress)

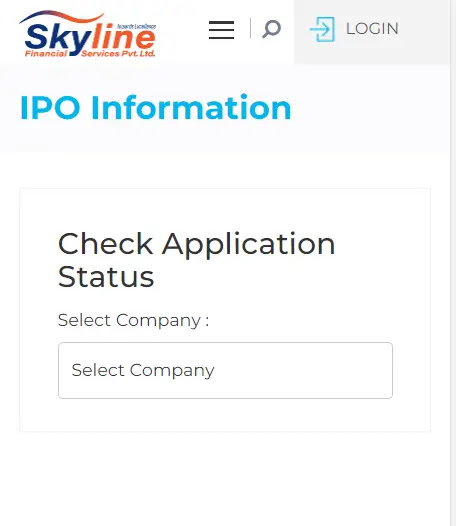

#Step 1: How to examine Ameya Engineers IPO Allotment Status on Skyline?

- Log on to Skyline IPO allotment web page – Skyline.com/ipo-allotment-status/

- Select IPO Name ‘Ameya Engineers‘ from the drop-down menu bar

- Select Option from PAN Number, utility Number, or DP ID Option

- As per choice add PAN Number, utility Number, or Demat Account Number

- Click on the ‘Search’ Button

- You will be capable of see your Ameya Engineers IPO allotment standing on the display screen (cellular/desktop).

#Step 2: How to examine Ameya Engineers IPO Allotment Status on BSE?

- Log on to the BSE IPO allotment web page – bseindia.com/investors/appli_check.aspx

- Select IPO Name ‘Ameya Engineers‘ from the drop-down menu bar

- Select Option from PAN Number, utility Number, or DP ID Option

- As per choice add PAN Number, utility Number, or Demat Account Number

- Click on the ‘Search’ Button

- You will be capable of see your Ameya Engineers IPO allotment standing on the display screen (cellular/desktop).

#Step 3: How to examine Ameya Engineers IPO Allotment Status in Demant Account?

- Call Your Broker or Login to Your Demat Account / Trading Account

- Check whether or not the inventory is credited to your account or not

- If you bought the allotment the credited shares will seem within the Demat account

#Step 4: How to examine Ameya Engineers IPO Allotment Status in Bank Account?

- Login to your Bank Account from which you utilized the Ameya Engineers IPO

- Check the Balance Tab

- If you bought the allotment the Amount will probably be debited

- If you didn’t get the allotment the Amount will probably be launched

- If you bought the allotment you bought an SMS “Dear Customer, Bank Name Account 00001 is debited with INR 00000.00 on Date. Info: IPOName. The Available Balance is INR 000000.”

Ameya Engineers IPO Subscription Status

| Category | Day 2 | Day 3 | Day 4 |

| NII | 3.85 | 10.68 | 259.16 |

| RII | 27.55 | 72.56 | 243.53 |

| Total | 15.70 | 41.62 | 251.35 |

Ameya Engineers IPO Investor Categories

- Qualified Institutional Buyers (QIB): Financial Institutions, Banks, FIIs, and Mutual Funds

- Non-Institutional Investors(NII): Individual Investors, NRIs, Companies, Trusts, and so on

- Retail Individual Investors (RII): Retail Individual Investors or NRIs

- Employee (EMP): Eligible Employees

- Others: Eligible Shareholders

Ameya Engineers IPO Date & Price Band

| Ameya Engineers IPO Open: | August 25, 2022 |

| Ameya Engineers IPO Close: | August 30, 2022 |

| Ameya Engineers IPO Size: | Approx ₹7.14 Crores, 2,100,000 Equity Shares |

| Face Value: | ₹10 Per Equity Share |

| Ameya Engineers IPO Price Band: | ₹34 Per Equity Share |

| Ameya Engineers IPO Listing: | NSE SME |

| Retail Quota: | 50% |

| QIB Quota: | -% |

| NII Quota: | 50% |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

Ameya Engineers IPO Market Lot

The Ameya Engineers IPO minimal market lot is 4000 shares with a ₹136,000 utility quantity.

| Minimum IPO Lot Size: | Minimum 4000 shares for 1 lot |

| Minimum Amount: | ₹136,000 for 1 lot |

Ameya Engineers IPO Allotment & Listing Dates

The Ameya Engineers IPO date is August 25 and the IPO shut date is August 30. The IPO allotment date is September 5 and the IPO would possibly listing on September 8.

| Ameya Engineers IPO Open Date: | August 25, 2022 |

| Ameya Engineers IPO Close Date: | August 30, 2022 |

| Basis of Allotment: | September 5, 2022 |

| Refunds: | September 6, 2022 |

| Credit to Demat Account: | September 7, 2022 |

| Ameya Engineers IPO Listing Date: | September 8, 2022 |

Note: Ameya Engineers IPO Registrar is chargeable for the IPO allotment and refund course of. If you could have any queries relating to the Ameya Engineers IPO Allotment date and time please contact the registrar along with your queries.

Ameya Engineers IPO Allotment Status FAQs

When is Ameya Engineers IPO Allotment Date?

Ameya Engineers IPO Allotment standing to be accessible on September 5, 2022.

What will probably be Ameya Engineers IPO Refund Date?

What is the possibility to get the Ameya Engineers IPO Allotment?

How to examine the Ameya Engineers IPO Allotment Status?

How to examine the Ameya Engineers IPO Allotment Status by way of Registrar?

What is Ameya Engineers IPO Listing Date?

Ameya Engineers IPO itemizing date is September 8, 2022. The IPO is to listing on NSE.

Follow IPO Watch for the Upcoming IPO news and their opinions, additionally hold following us on Twitter, Facebook, and Instagram. For our newest movies, subscribe to our YouTube channel.

– Source : IPOWATCH