There may be affiliate hyperlinks on this web page, which implies we get a small fee of something you purchase. As an Amazon Associate we earn from qualifying purchases. Please do your personal analysis earlier than making any on-line buy.

We all like saving cash, proper?

And relating to this space of life, there are a mess of apps, web sites, and instruments which can be particularly designed to assist when it comes your payments, purchases, and different life bills.

Today, we’ll be speaking in regards to the 21 greatest cash saving apps for 2022.

Money saving apps that can show you how to funds higher, spend wiser… and perhaps even stash a little bit money alongside the best way.

We will uncover quite a lot of areas the place it can save you a little bit right here and there, all whereas working in direction of the larger image that’s monetary stability.

So let’s get on with … in any case, time is cash!

Best Money Saving Apps for 2022

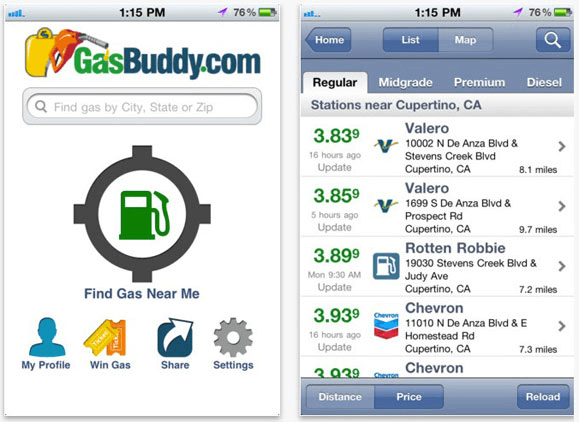

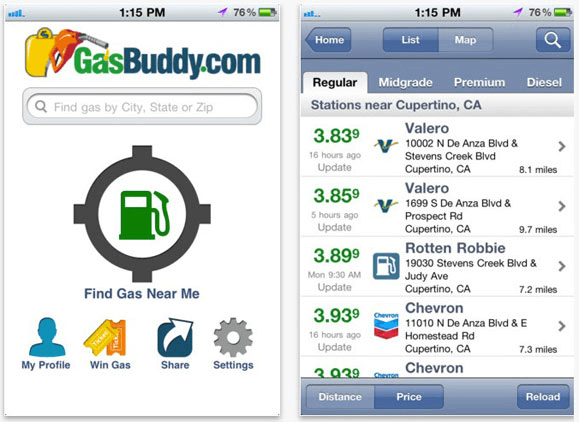

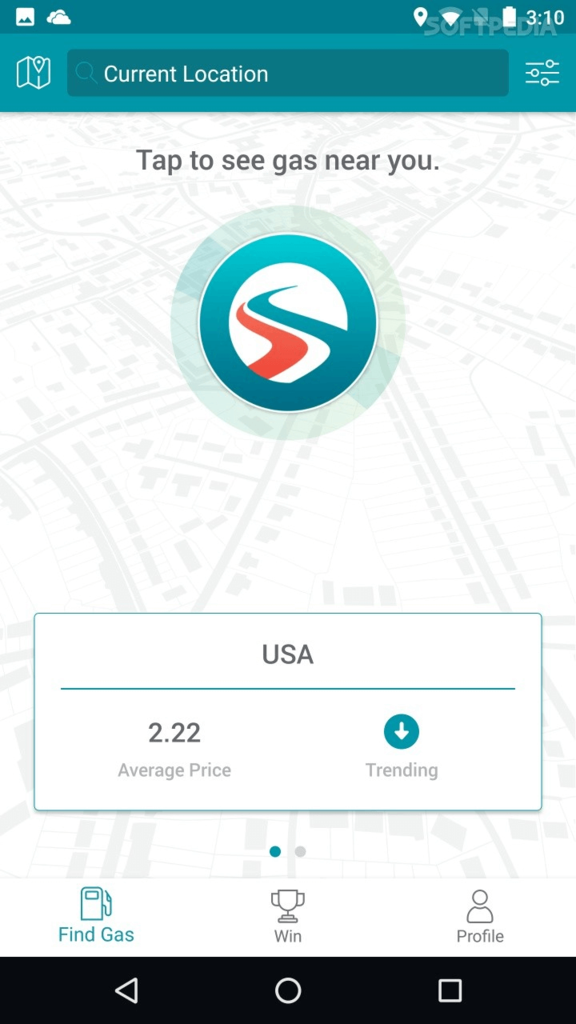

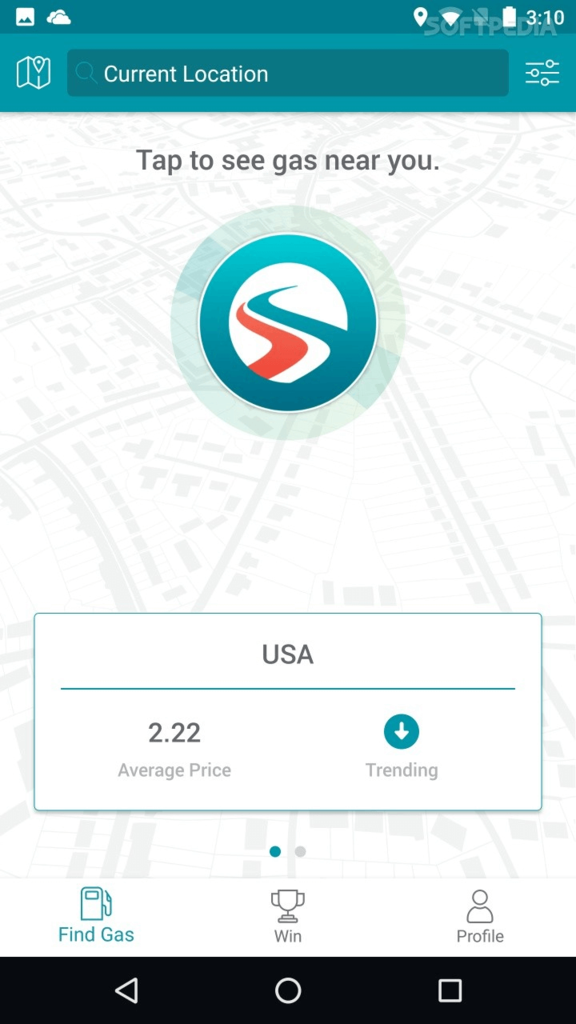

1. GasBuddy

GasBuddy is an app that presents customers 27 methods to avoid wasting money on fuel at 150,000 fuel stations throughout North America. It presents an area for drivers to search out and report fuel costs so you possibly can find the least costly gas when it’s time to replenish. Since its inception in 2000, GasBuddy has helped customers save $3 billion on fuel.

GasBuddy is a social app within the sense that it

depends on consumer stories to offer essentially the most present fuel costs. When you’re within the

app, it is possible for you to to see the final time a listed fuel value was up to date by a

consumer, so it is possible for you to to have an

thought of simply how correct the value is. Unless you modify the settings, the

costs you see replicate Regular fuel costs. However, this setting could be simply

modified by hitting the “Fuel Type” button on the backside of your display screen.

No registration or membership is required to

use GasBuddy, nonetheless, in case you select to create an account, you possibly can earn factors

for reporting fuel costs–and you possibly can take part in challenges to earn

leaderboard factors, which you should use to

enter into drawings to win free fuel.

This free app permits you to begin looking

for costs in your space instantly, and it additionally shows the typical value of

fuel at that second and whether or not costs are transferring up or down.

Upon opening the app, merely select the big

“Find Gas Near Me” icon or use the search subject to sort in a metropolis or zip code.

You can at all times select to see fuel costs in an inventory kind or on a map–whichever

you favor.

GasBuddy enables you to view fuel by:

- Distance: This reveals fuel costs beginning with

the places closest to you - Price: This filters your choices by value,

beginning with the bottom value close to you - Top Tier: This shows fuel stations in your

space that solely provide Top Tier fuel. (Top Tier is the quantity of detergent added

to fuel, which might have an effect on emissions and automobile efficiency.) The fuel stations

proven utilizing this filter don’t promote decrease high quality fuel.

This app can prevent some huge cash in case you often journey for work or you might have an extended commute.

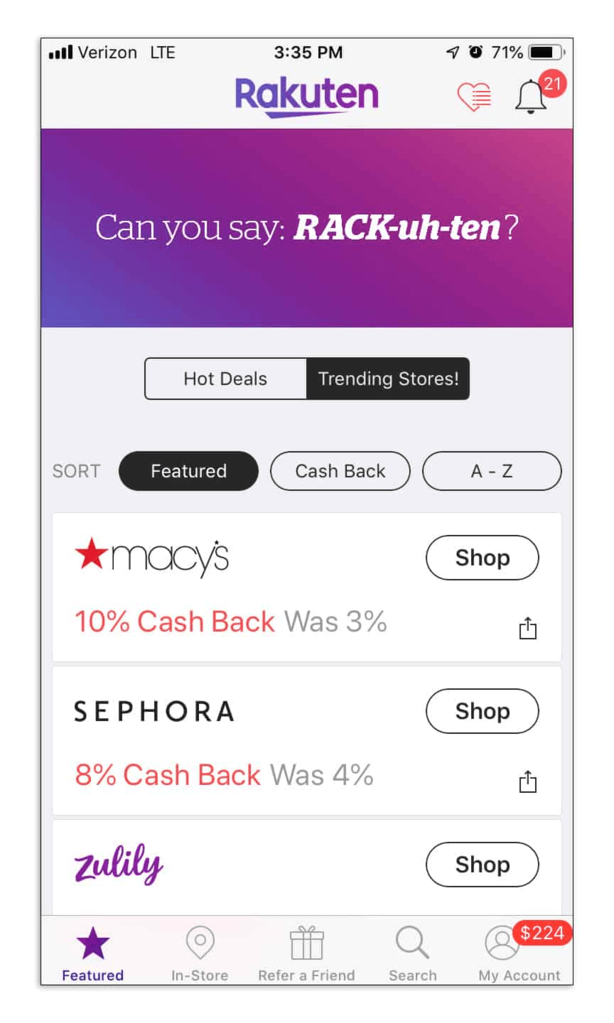

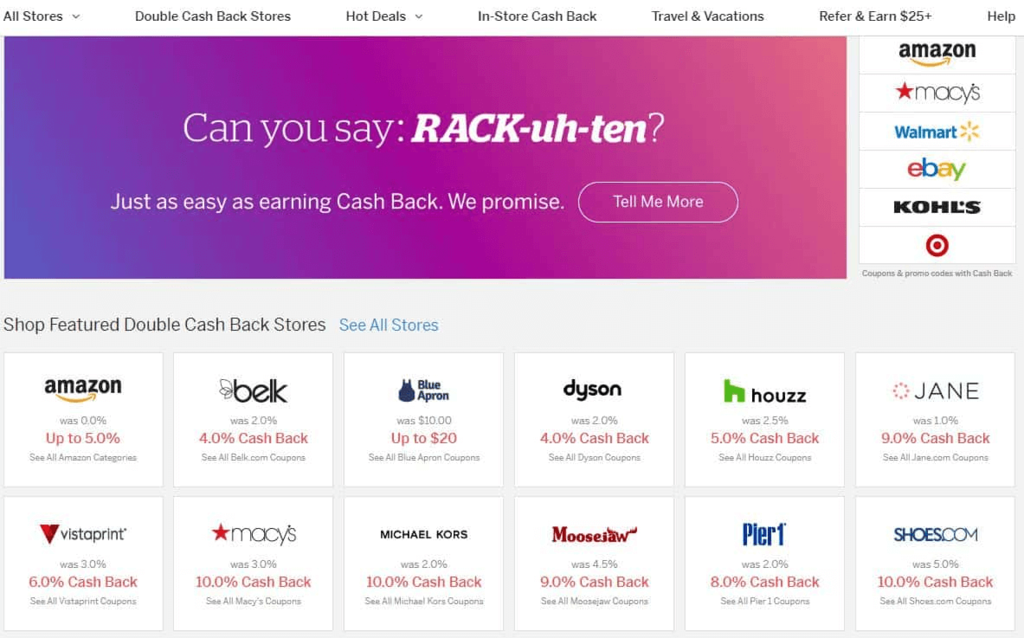

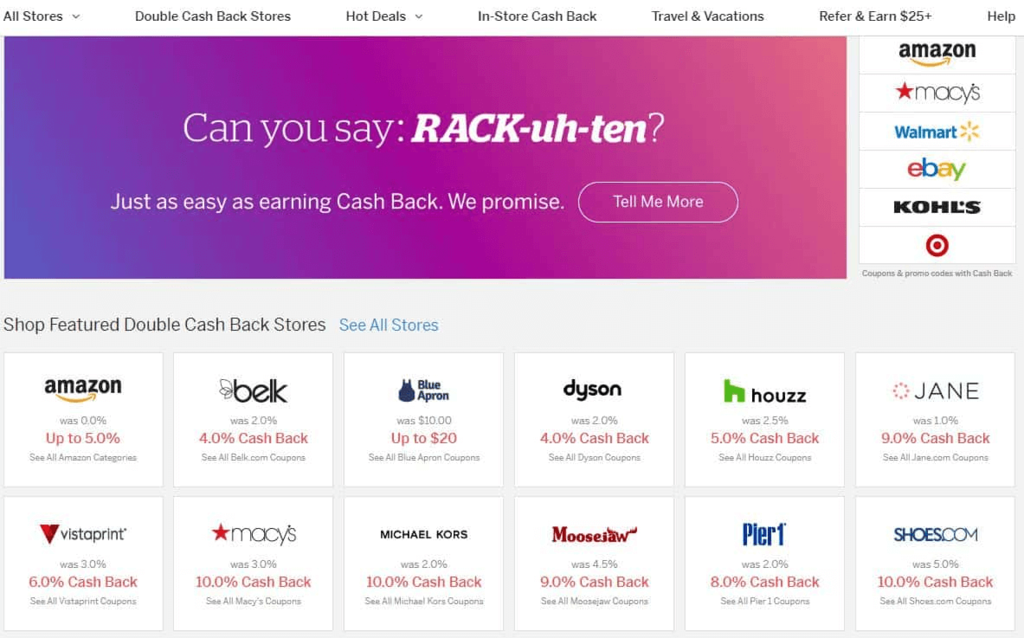

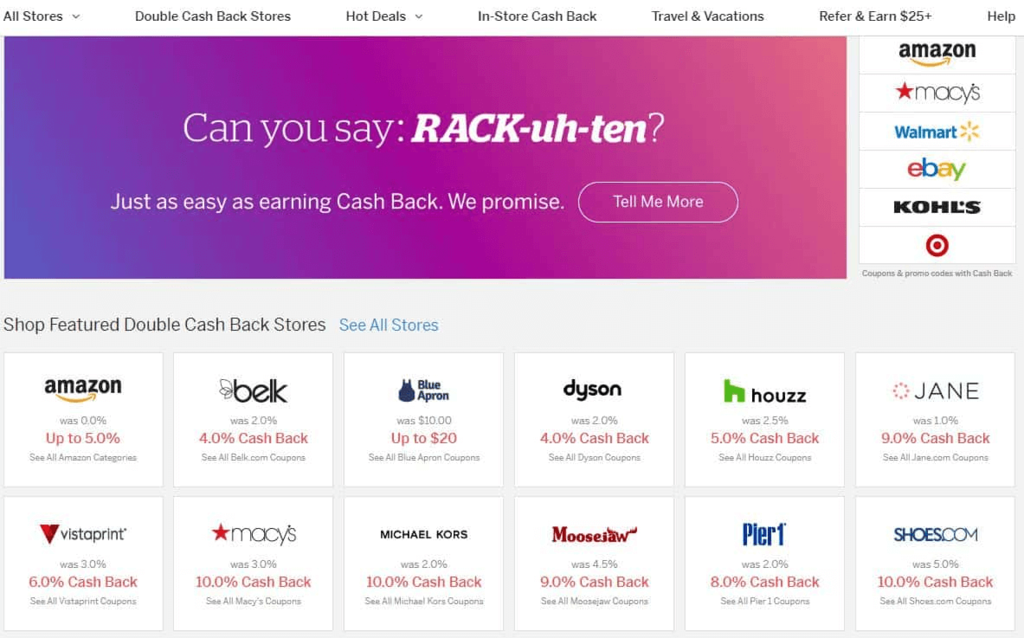

2. Rakuten

Formerly Ebates, Rakuten presents Cash Back, offers, and rewards on merchandise and companies worldwide. There are at the moment 12 million members within the U.S. who’ve cumulatively earned over $1 billion in Cash Back presents utilizing Rakuten.

To get began, you merely have to create an

account and begin procuring straight on the web site or by way of the Rakuten app

by discovering a retailer, promo code, or deal. Your Cash Back might be utilized to your

account as soon as your transaction is full. Rakuten typically presents $10 bonuses

upon signing up and you possibly can earn much more by referring your folks.

You can earn money again with Rakuten in quite a lot of methods:

- Through the app: When you’ve began a

Shopping Trip, a notification will seem throughout the app so you understand Cash Back

has been activated. The notification will take you to the shop’s web site to

begin procuring. If your chosen retailer doesn’t provide Cash Back, a window will open

to provide you with a warning so that you don’t make a purchase order pondering you’re going to get money

again when it’s not really relevant - Cash Back Button: This automated instrument

proactively finds reductions so you possibly can earn money again with out even having to

open the positioning. Download the Rakuten Cash Back button in your browser retailer,

which might be seen in your browser bar after the obtain is full. Once

you might have this button, every time you go to a retailer’s web site, you’ll get an

on-screen notification of the Cash Back and coupons accessible at that retailer.

Click on the notification (it would point out that it has been activated) to

begin incomes Cash Back instantly. If the shop doesn’t help the Cash Back

Button, the notification merely received’t seem. - Cash Back Visa: Rakuten

presents a Cash Back Visa® Credit Card, which permits customers to earn limitless

further Cash Back rewards wherever Visa is accepted with no annual charge.

Qualifying on-line purchases made by way of Rakuten qualify for an additional 3% Cash

Back, and all different purchases earn 1% Cash Back. - In-Store: Start by linking your financial institution card to

your Rakuten account. Then, while you need to redeem an In-Store provide, simply

activate the provide and pay for it within the retailer utilizing the cardboard that you simply linked

to your account. - Email: If you’re subscribed to

Rakuten emails, you possibly can click on on the hyperlinks talked about within the emails to activate

your Cash Back. - Rakuten.com: Shop straight

from the web site by clicking on a retailer’s link listed on Rakuten.com.

Rakuten additionally options rotating double money again shops and

particular offers comparable to:

- Free presents

- Free transport

- Buy on-line, decide up in retailer

- Buy one, get one free

- Gift playing cards

At the tip of every quarter, you’ll get your earned Cash Back by way of a PayPal fee or you possibly can request a examine by way of the mail. Shoppers like this money-saving instrument as a result of it’s a passive means to save cash. Users typically report logging on to buy for a selected merchandise with out even contemplating potential coupon choices, solely to discover a Rakuten pop-up on their display screen providing a big amount of money again for buying the merchandise.

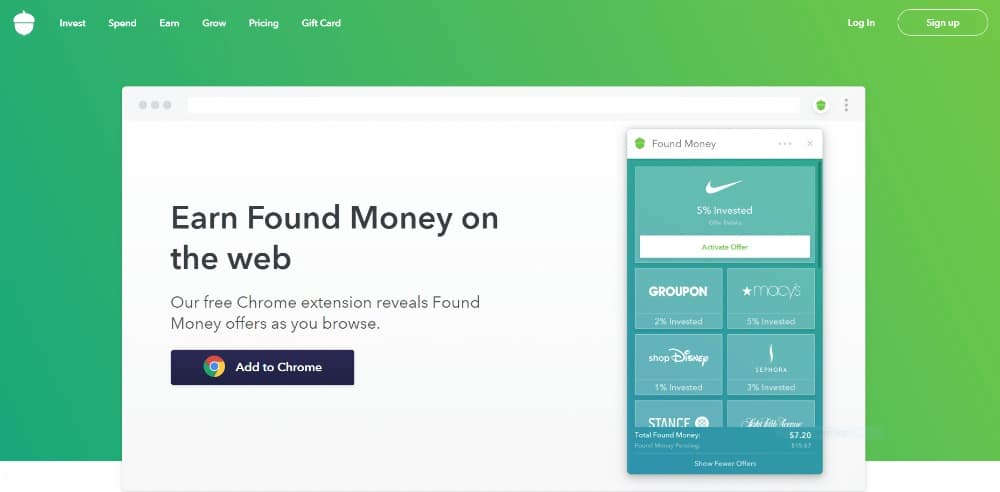

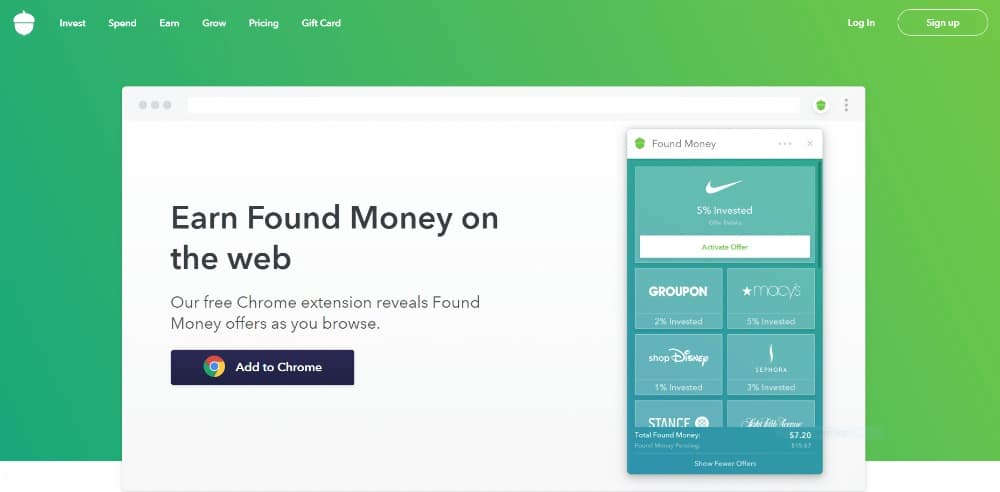

3. Acorns

The greatest cash saving apps aren’t nearly coupon clipping anymore… they’re about saving for the long run.

Retirement.

After all, with all of the discuss of social safety probably changing into out of date in a number of years… it’s actually in our personal arms to plan for our “golden years”.

And then there may be our children’ futures.

College, marriage, a home of their very own.

Acorns is devoted to serving to save your “spare change”… and turning it right into a worthwhile funding.

There are three sides to Acorns administration:

- Acorns Core

- Acorns Later

- Acorns Spend

The Acorns Core account takes typically lower than 5 minutes to arrange… and will robotically add cash to your diversified portfolio, constructed with assist from a Nobel laureate. Features embrace:

- Invest the Change® from on a regular basis purchases, set it and neglect it with a Recurring Investment, and continue to grow from reinvested dividends

- Smart Portfolios put collectively by successful economists to robotically rebalance when the market strikes

- Access to Grow Magazine

- Found Money, 200+ prime manufacturers put money into you while you store

- Customer Support

An Acorns Later account is the place the corporate recommends an IRA that is proper for you… and updates it commonly to match your objectives. That takes much less an one minute to arrange. Other options embrace:

Set an computerized Recurring Contribution

Set apart additional money for a greater life later — as little as $5 can add up

Assisted rollovers if you have already got an IRA or 401k now

The Acorns Spend account is a debit card that places your checking account to work for you. In a nutshell (pun supposed), the Acorns Spend account options:

- Real-Time Round-Ups

- Automatic retirement financial savings

- Custom Spend Strategies and extra

- Digital direct deposit

- Mobile examine deposit and examine sending

- Free bank-to-bank transfers

- Unlimited free or fee-reimbursed ATMs nationwide

- All the Found Money that comes with Acorns Core, plus as much as 10% invested in you from native locations you go to every single day

- No overdraft or minimal steadiness charges

- Unlimited free or fee-reimbursed ATMs nationwide — with an funding account and a retirement account in-built

There is a flat monthly fee related to Acorns, primarily based on which plan you choose to go together with… beginning at simply $1 monthly.

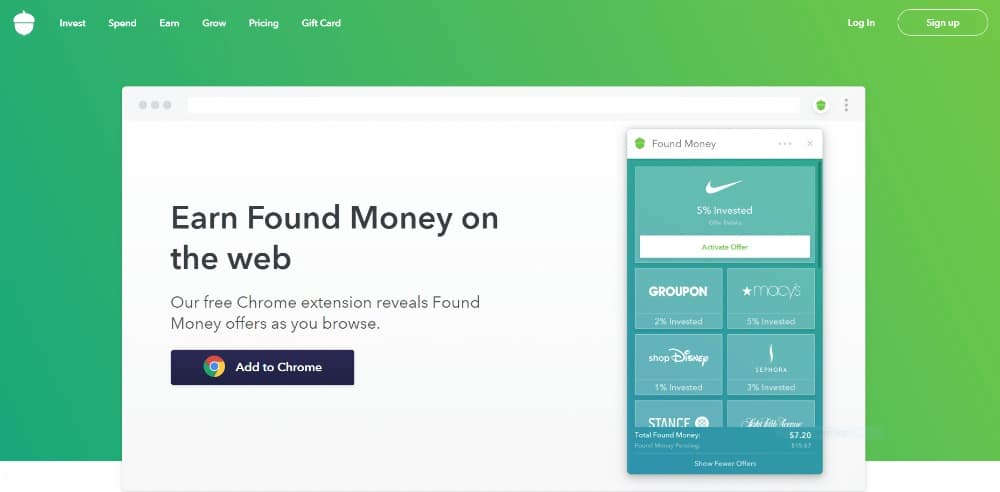

Acorns’ Found Money function is included with all plans, and includes a chrome browser extension. It is free to obtain and use.

Simply click on on the link, and while you store with certainly one of our 200+ Found Money companions, they robotically put money into your Acorns Core account. The proportion varies by companion, and the cash usually arrives in your Acorns Core account inside 30-120 days.

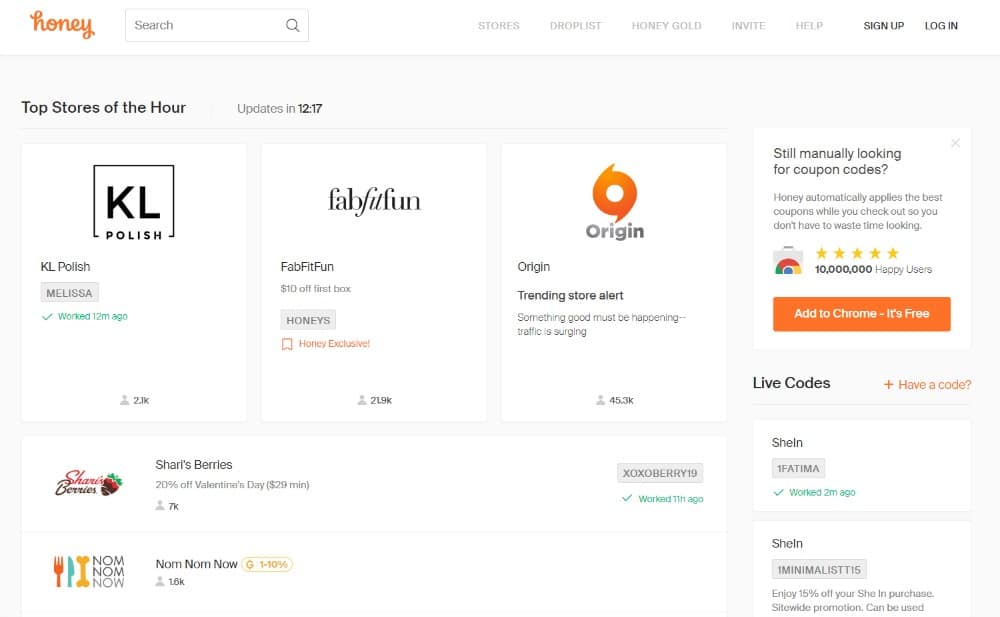

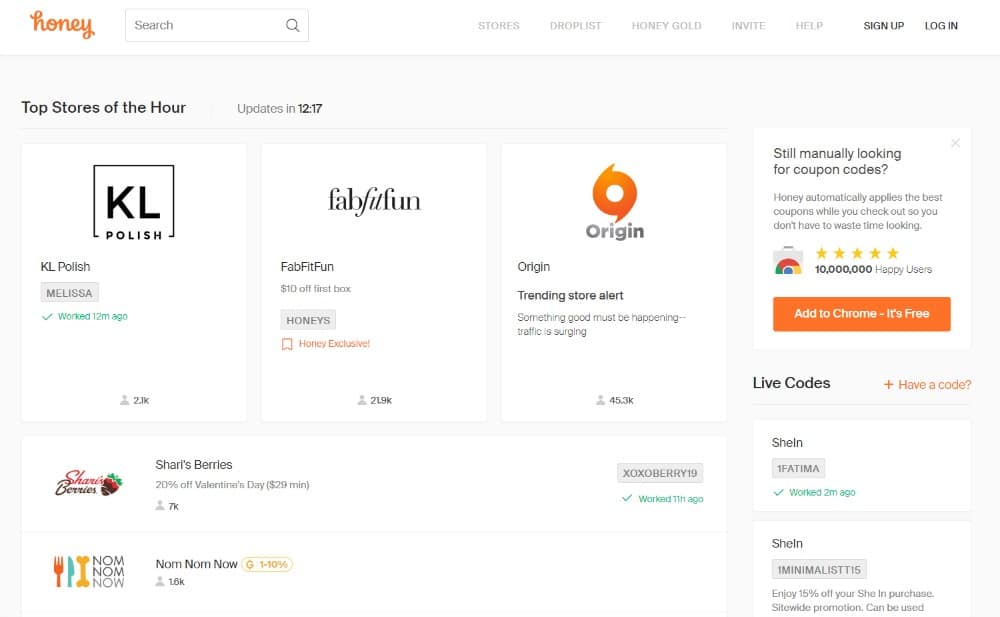

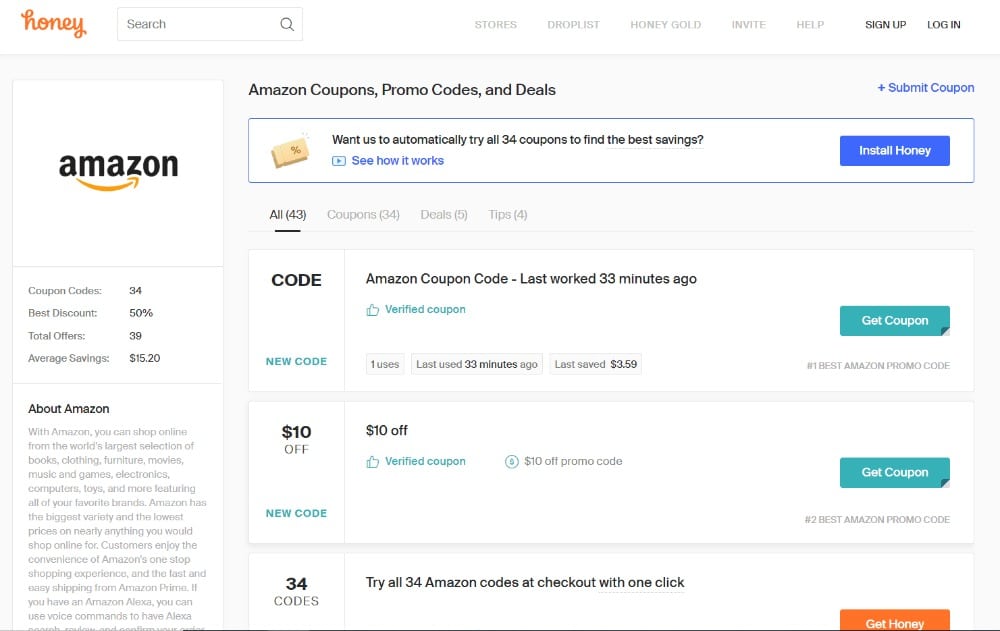

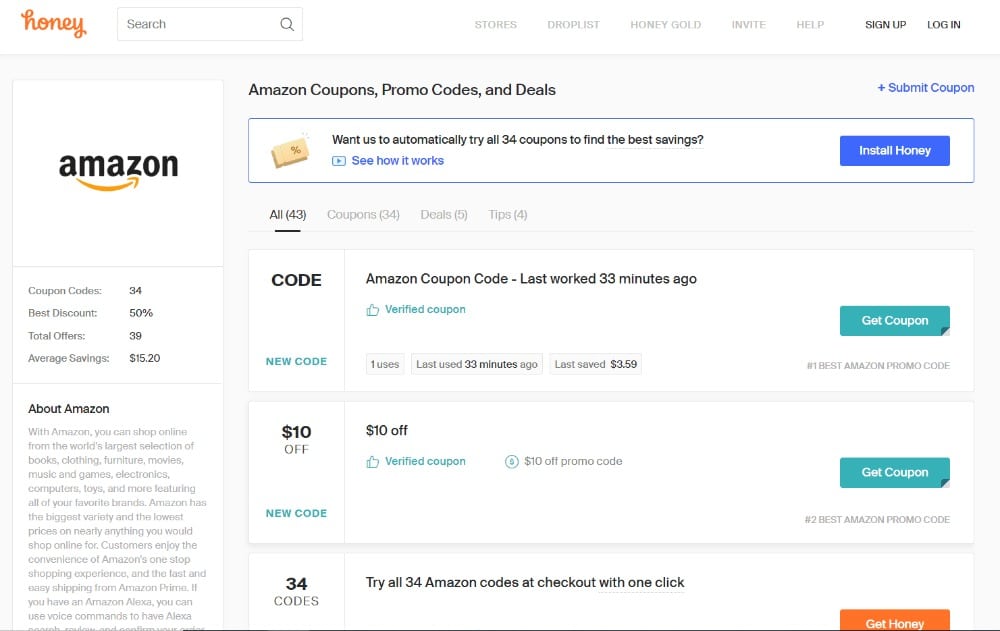

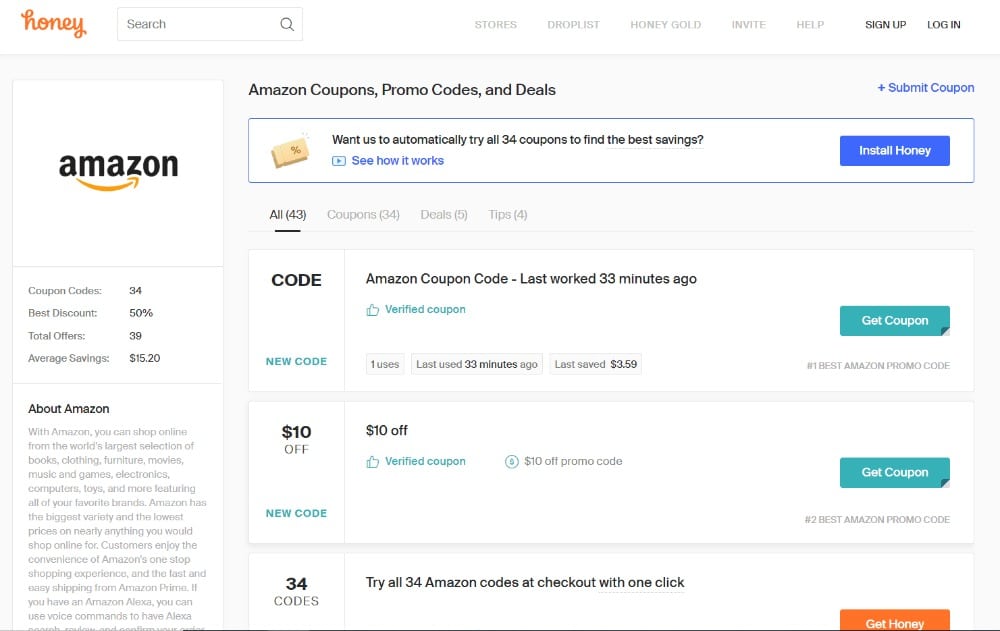

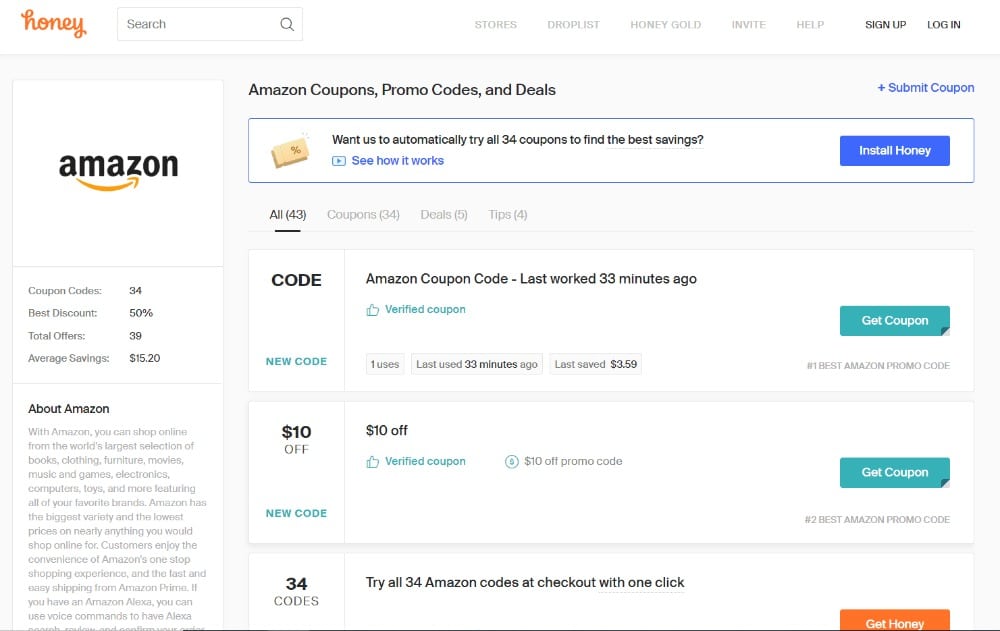

4. Honey

Take coupon clipping to the subsequent degree with Honey.

According to Time Magazine, “It’s basically FREE money.”.

So, is it?

If so, I’m sport.

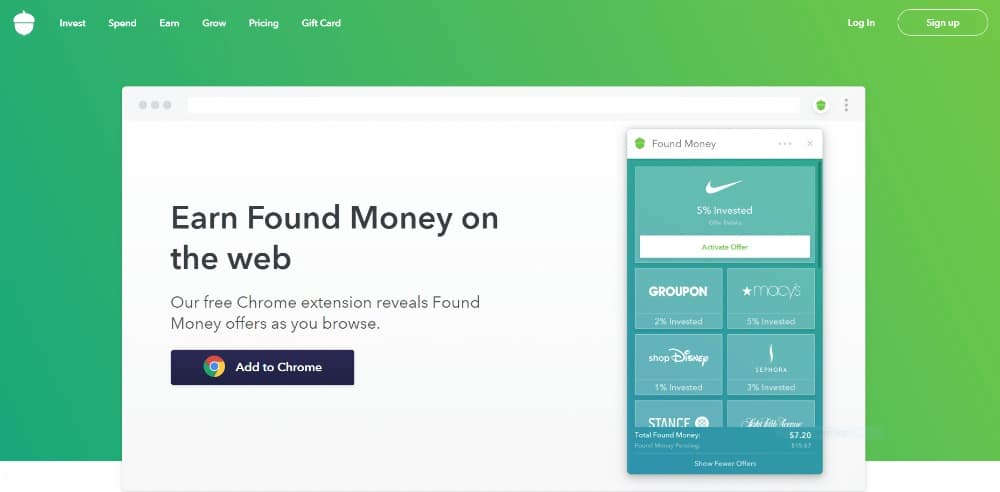

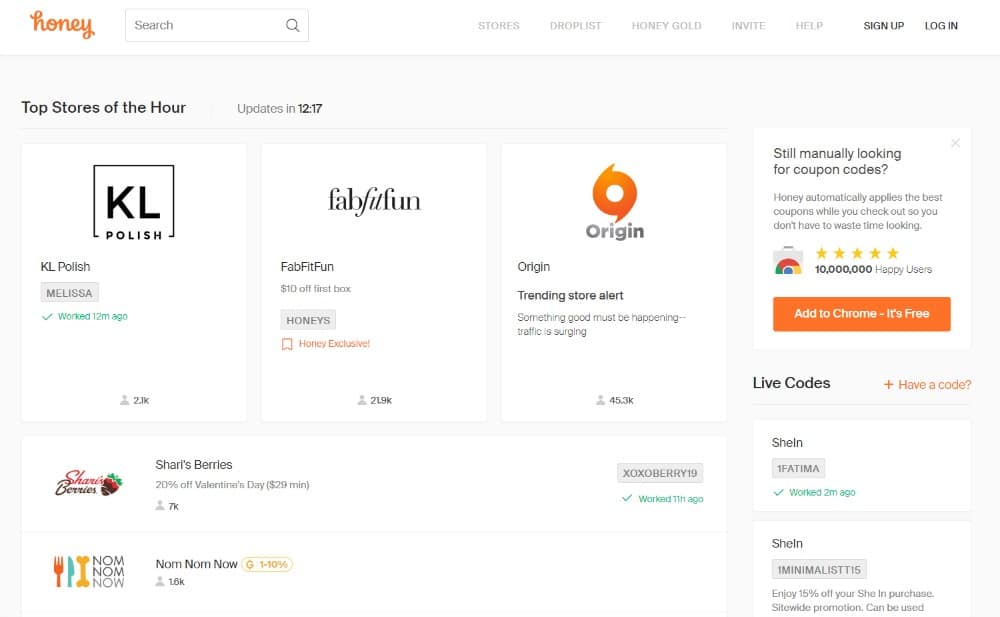

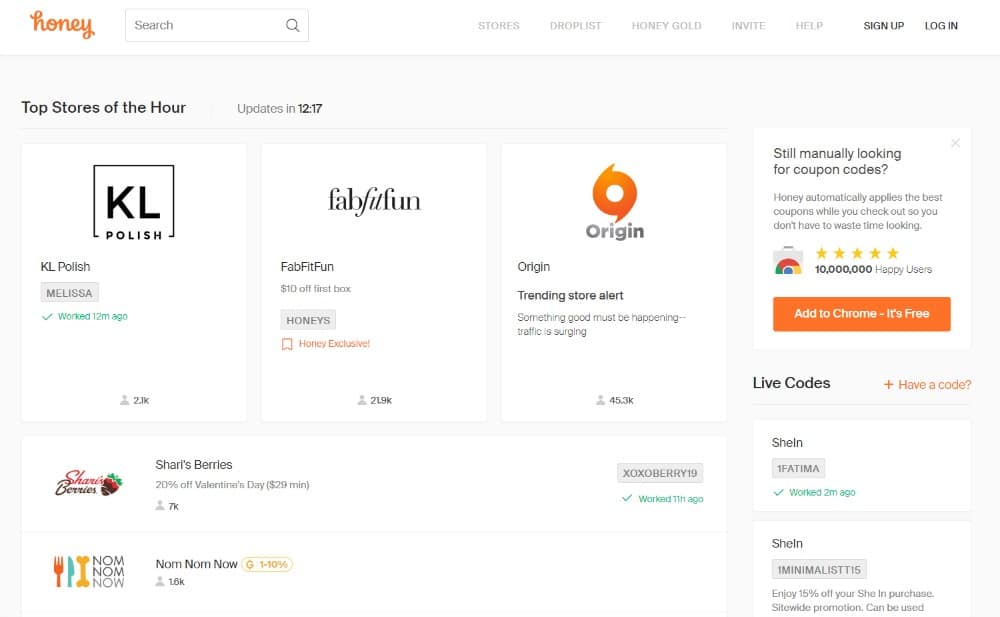

Honey prides itself on doing the work for you relating to looking for coupon codes.

You can merely add the “honey” button to your chrome browser and let the app maintain the remaining.

And with only one easy click on of the “honey” button throughout checkout… and the app will robotically apply one of the best coupon codes to your procuring cart at over 10,000 shops.

Honey additionally companions with Amazon to find one of the best time to purchase, with value historical past charts and alerts for when your favourite merchandise go on sale.

There is even a “trending” part, with the day’s hottest offers.

If you’re a bit skeptical over sharing non-public information… Honey claims they don’t promote it, however it’s one thing to concentrate on.

You can check out our in-depth review of Honey to learn more.

5. Rocket Money

The founders of Rocket Money created the app to assist customers achieve management of their cash. Rocket Money will help you enhance your monetary well being by figuring out and cancelling unused subscriptions, decreasing your recurring payments, and pursuing refunds on outages and charges.

Companies know when prospects join for auto-pay for a service, they’re unlikely to cancel their computerized funds–even after they’ve stopped utilizing the service. Because of this widespread oversight by individuals, corporations find yourself earning profits off of unused companies. To date, customers have saved a complete of over 14 million {dollars} utilizing Rocket Money, with out giving up any companies they need or want.

Rocket Money makes use of one of the best encryption software program accessible, so that you don’t have to fret in regards to the safety of your private information. Further, not solely will Rocket Money not promote your information to different corporations, additionally they assure that their app is at all times utilizing the identical up-to-date trade insurance policies and procedures that banks use for storing customers’ information, which is 256-bit encryption.

Rocket Money’s servers are securely hosted utilizing Amazon Web Services, which can be trusted and utilized by NASA, the Department of Defense, and many different organizations that require the best ranges of safety.

Using the app is straightforward. To register, you’ll have to enter your on-line banking credentials–however don’t fear– Rocket Money makes use of Plaid to securely connect with over 15,000 monetary establishments country-wide, which permits them read-only entry to your transactions (so Rocket Money can’t make adjustments to your checking account in any means). With this information in hand, the professionals behind the app then get to work advocating for your monetary wellbeing.

You may also join a invoice by both logging onto your related on-line account or by taking an image of the invoice. Rocket Money’s negotiators can then discover hidden reductions or promo charges that can be utilized to cut back your invoice.

The negotiators work with the businesses that

are billing you to choose a greater charge or to search out some one-time credit

that may be utilized to your account with out downgrading or eradicating any

companies.

After the negotiation is completed, you may get

an e-mail telling you the way a lot cash the negotiators have been capable of save for you.

This app is free to obtain, however

an improve to unlock further companies is $35.99 (or you possibly can decide to pay $4.99

monthly). If you select the month-to-month choice, you possibly can cancel some companies

instantly after signing up, and then downgrade to the free choice.

If you utilize Rocket Money that can assist you decrease your payments, you’ll be charged 40% of your annual financial savings throughout your first 12 months of use–this charge might be charged as quickly as their negotiation is full with the corporate that’s billing you–which implies they might cost you earlier than you see the monetary distinction in your invoice from the corporate. Some customers discover this function of the service to be inconvenient, however in case you plan for it forward of time, it nonetheless finally ends up saving you cash.

You can shortly and simply unlink your financial institution credentials if you wish to take a break from or cease utilizing this service. However, Rocket Money presents customers distinctive insights into your automated month-to-month payments that may show you how to regain management of your spending fairly than assuming you’re at all times getting one of the best deal.

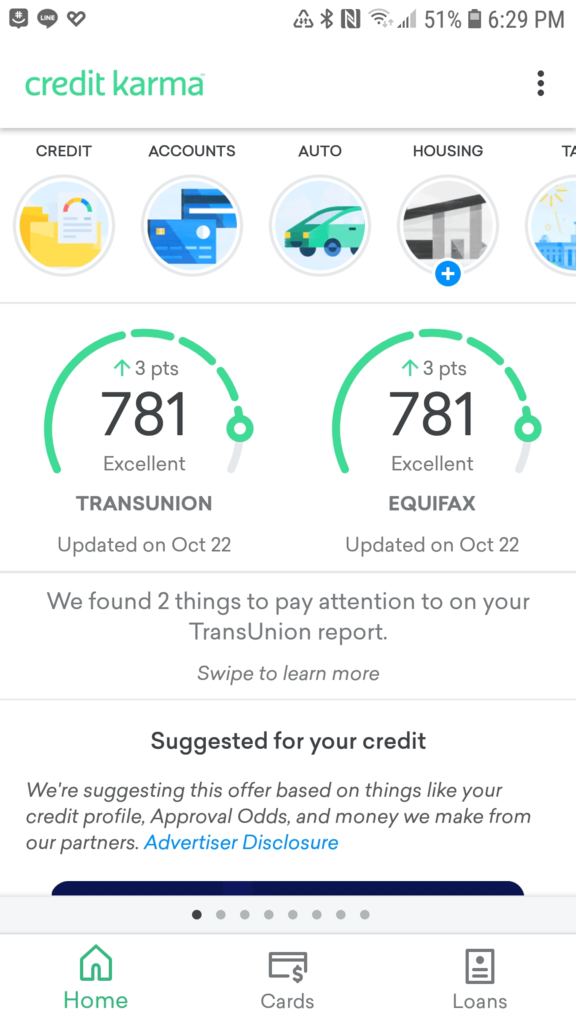

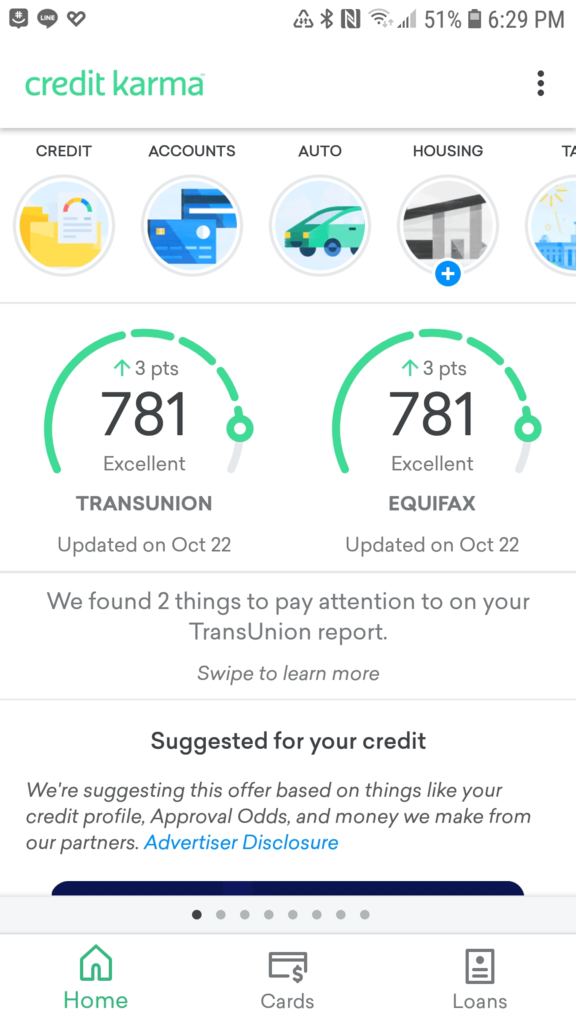

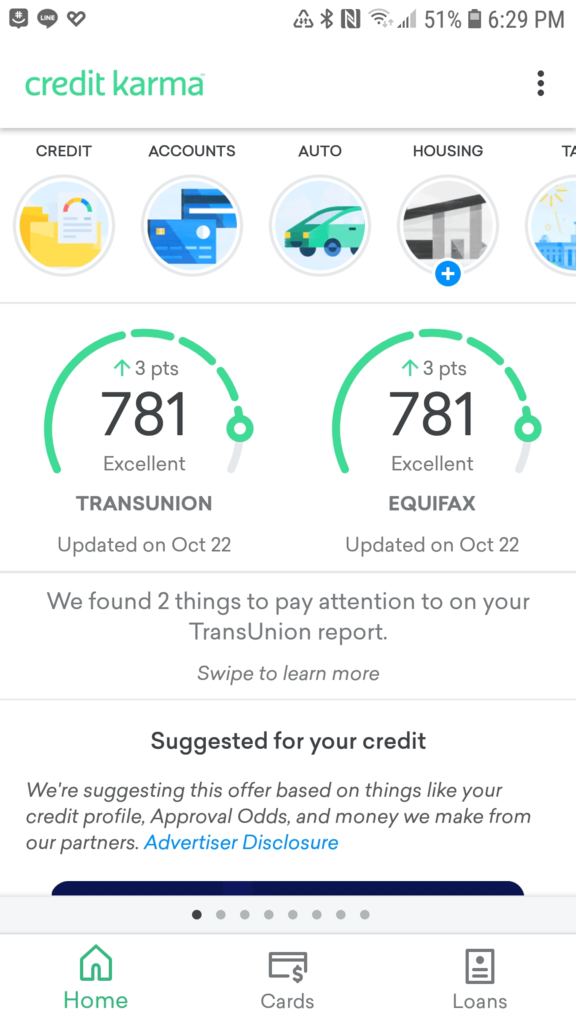

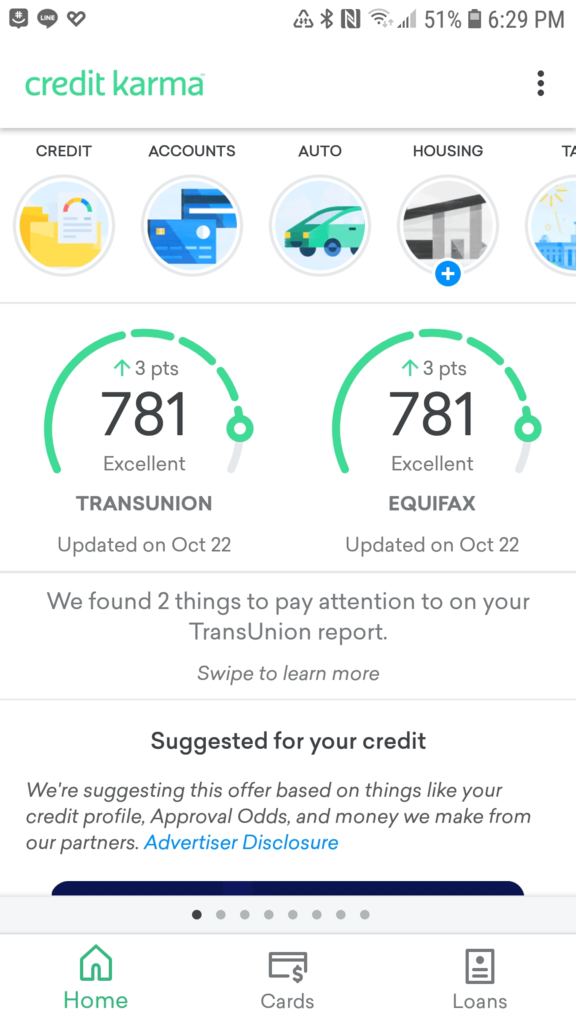

6. Credit Karma

Credit Karma has been freely giving free credit score scores since 2008 and now have over 100 million members. This free service offers customers entry to credit score scores, monitoring, and stories as a result of when you understand your monetary standing, you may make knowledgeable choices. Credit Karma will help you see in case you’re paying an excessive amount of curiosity on one thing or if you’ll want to dispute one thing in your credit score–and then show you how to take motion to repair it.

Credit Karma additionally offers customers personalised bank card and mortgage suggestions that may show you how to get monetary savings primarily based in your credit score profile. For instance–they make it easy by laying out which credit cards might be right for you if you have bad credit and which may be good if you have good credit.

Their

aim is to offer customers the instruments and training which can be wanted to make actual

monetary progress. Once you join, you’ll get entry and weekly updates to your

credit score scores and stories from TransUnion and Equifax. If something adjustments with

your credit score swiftly, Credit Karma will notify you instantly, as

they’re in your aspect relating to id theft.

They additionally provide free instruments like financial calculators (like a debt compensation calculator and a easy mortgage calculator) and informative articles that can assist you perceive credit score a bit higher. They even provide 1000’s of precise shopper opinions on monetary merchandise comparable to bank cards and loans so you possibly can examine actual individuals’s experiences and make knowledgeable monetary choices.

Credit Karma members (in fact) admire that the

companies they provide are free, but in addition report that the app could be very user-friendly and the corporate makes it straightforward to attach

with others who’re excited about studying extra about their cash and loans. Credit

Karma could also be particularly useful for you in case you are on the point of purchase a home

or make a big buy requiring a mortgage.

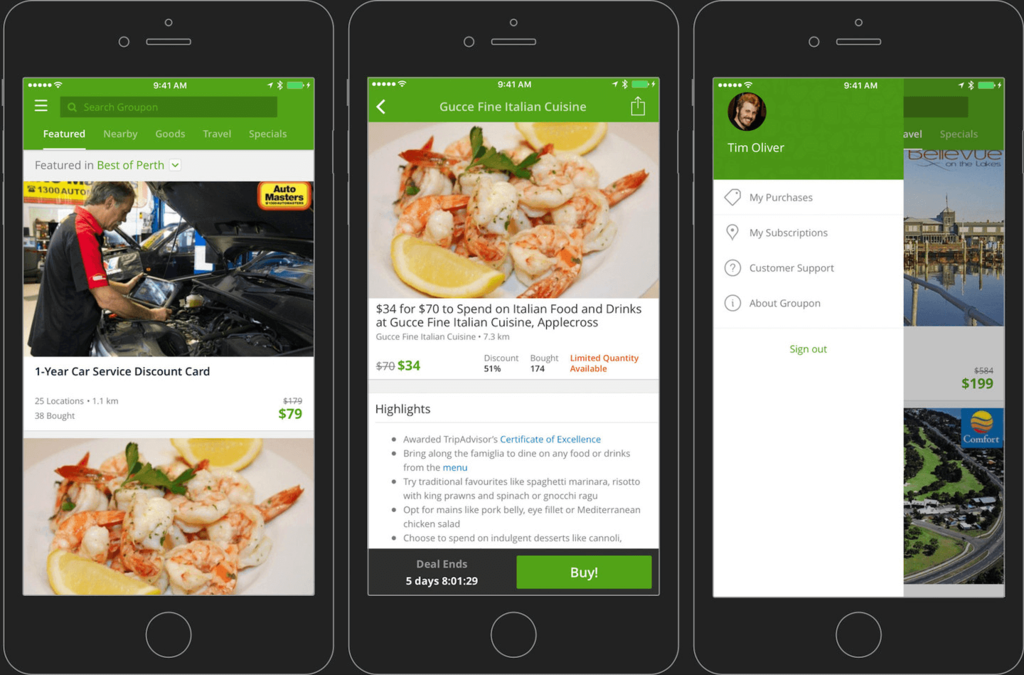

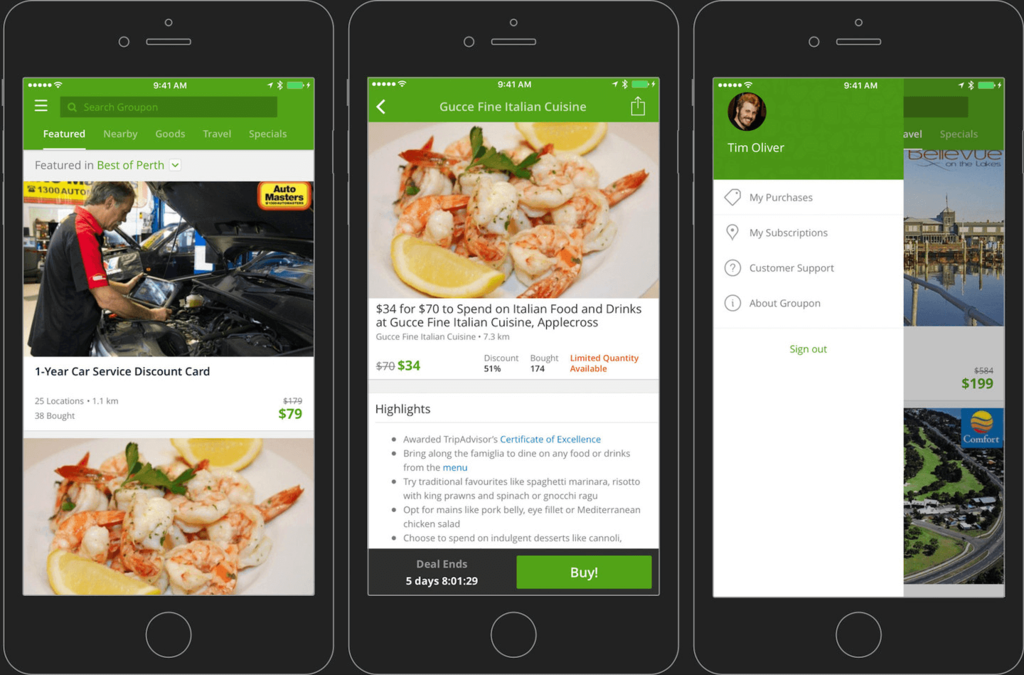

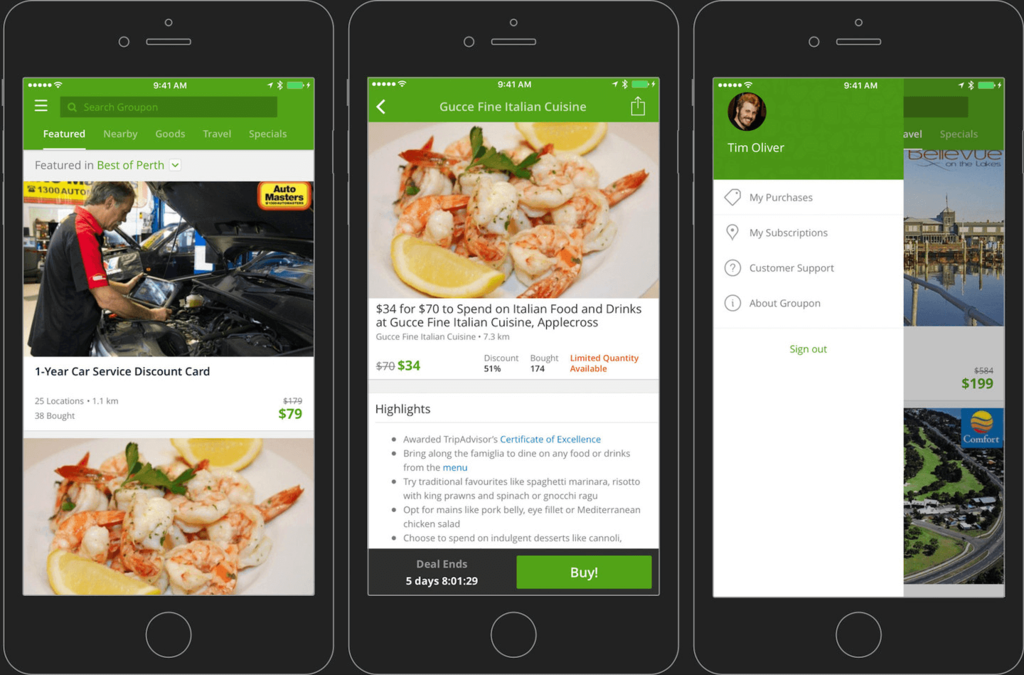

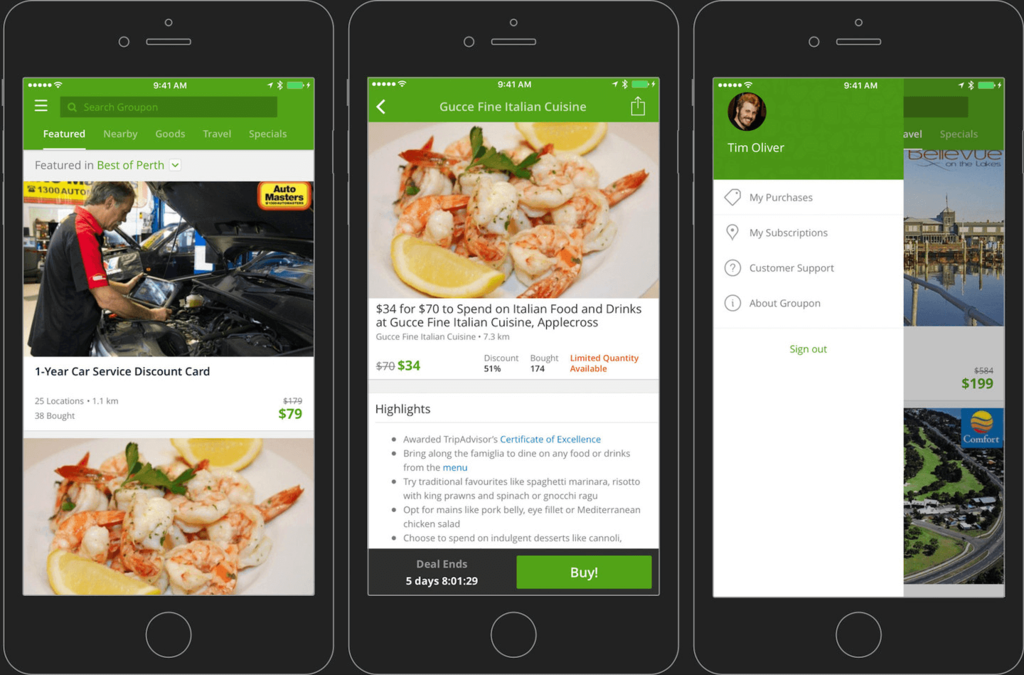

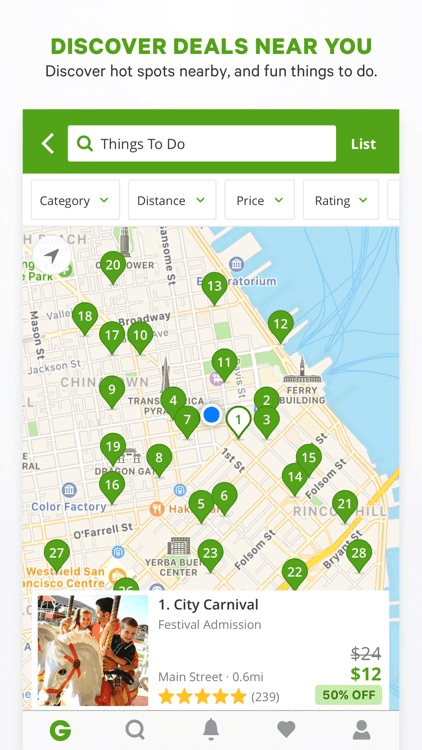

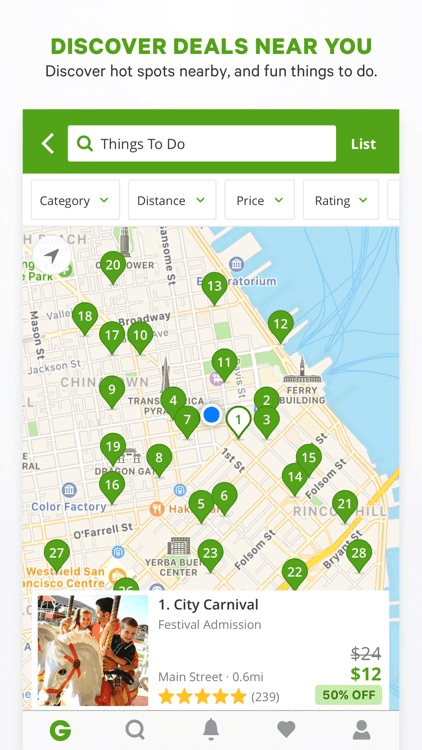

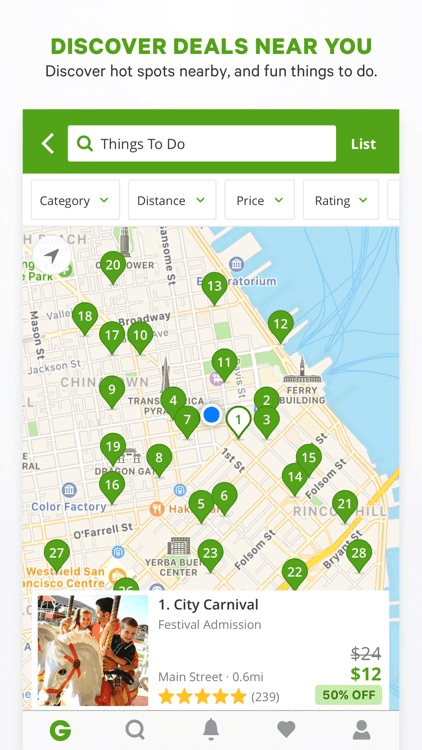

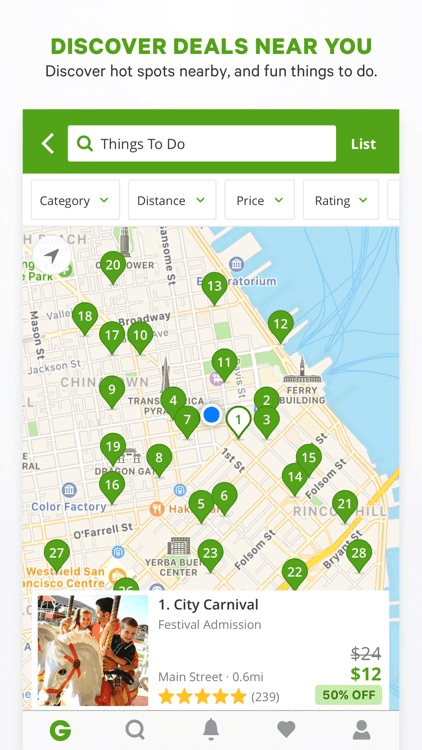

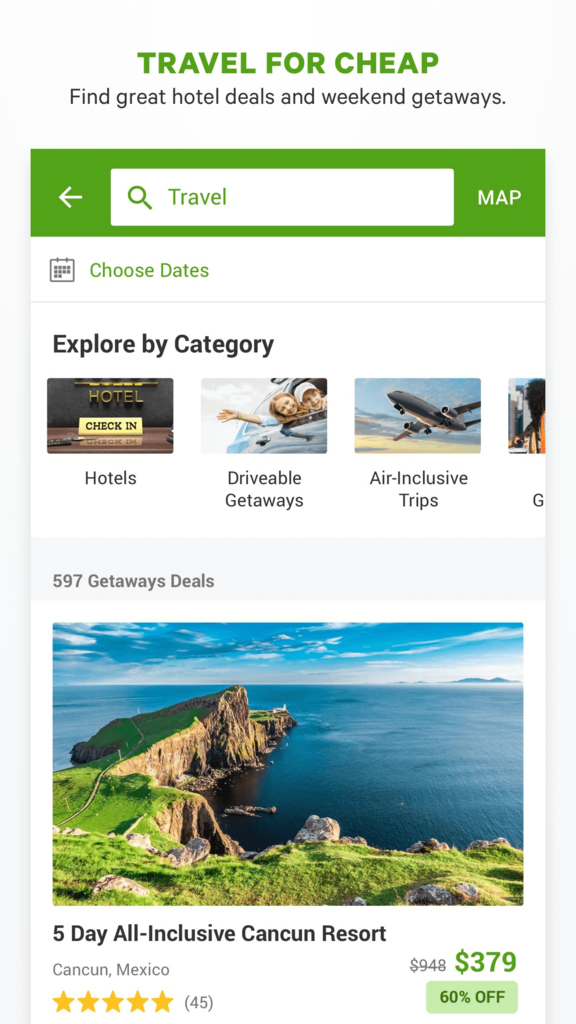

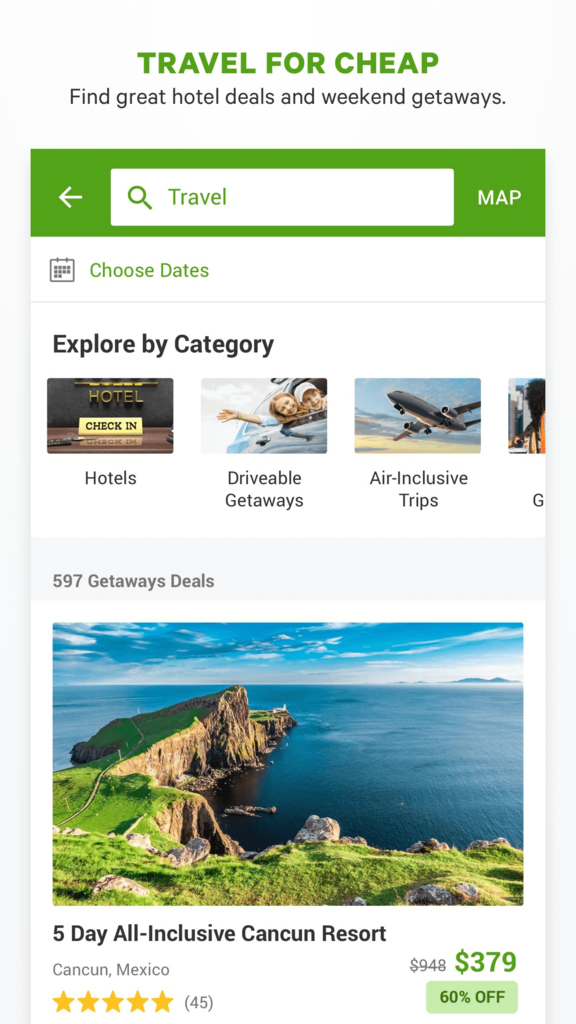

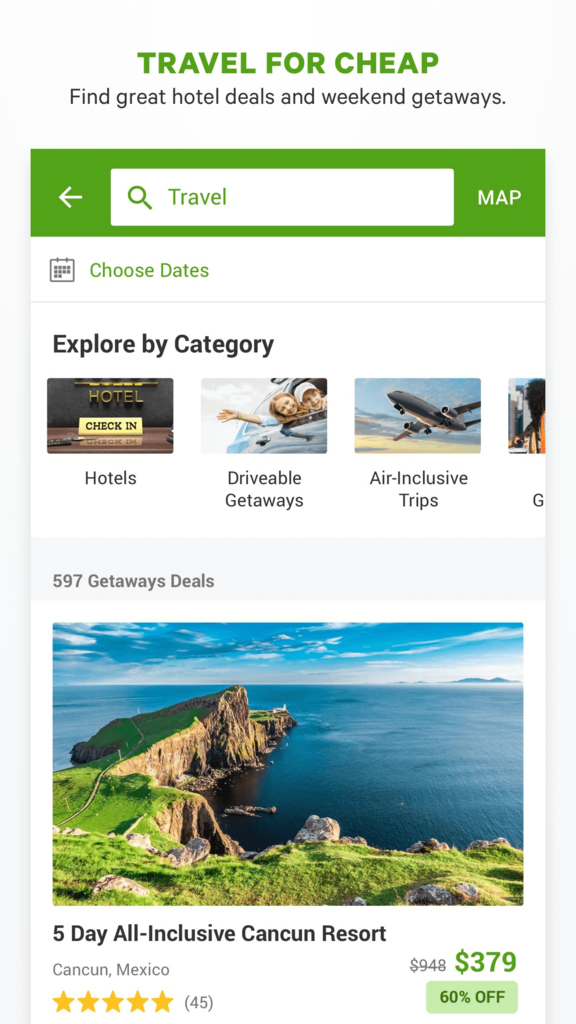

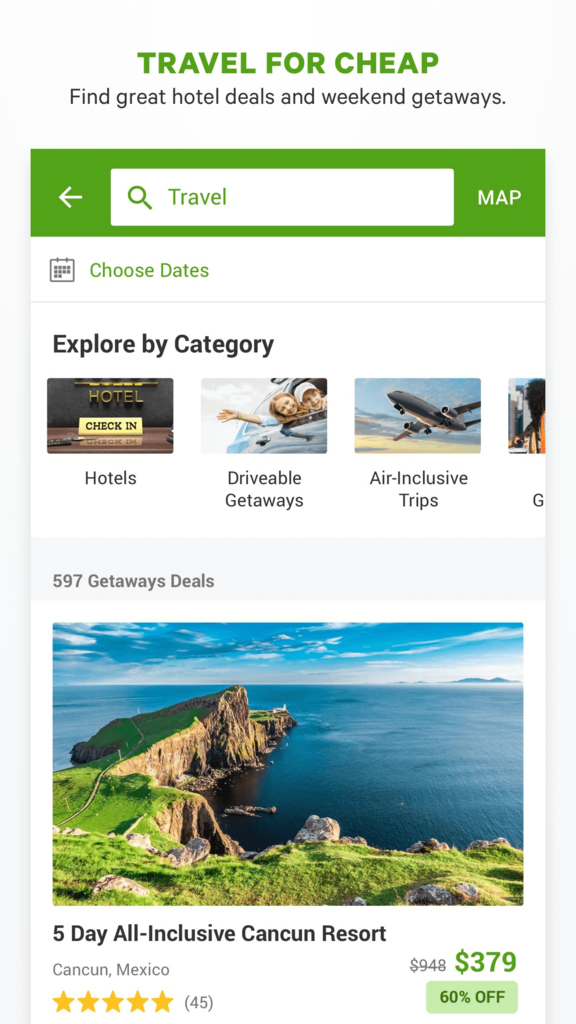

7. Groupon

Groupon is an “experiences” market that’s recognized for its comfort and discovery parts. This app presents limitless alternatives to get essentially the most worth out of issues to do in your metropolis or wherever you’re touring.

As a shopper, Groupon will help you uncover

new experiences by enabling cellular commerce in real-time (providing short-term

financial savings) throughout native companies, occasions, and journey locations. Groupon presents unbeatable offers which can be

accessible instantly for 50 to 70% off one of the best issues to do, locations to see,

restaurant venues, and in style shops in over 500 cities. Whether you’re

trying to take an enormous trip otherwise you need to exit on a easy date evening,

this money-saving useful resource will help join you with inexpensive enjoyable.

Offering every day and weekly specials, Groupon

will at all times have some sort of deal that’s proper for you. Having simply celebrated its tenth birthday,

this money-saving app continues to be providing customers all the enjoyable and distinctive

experiences they might ever want for.

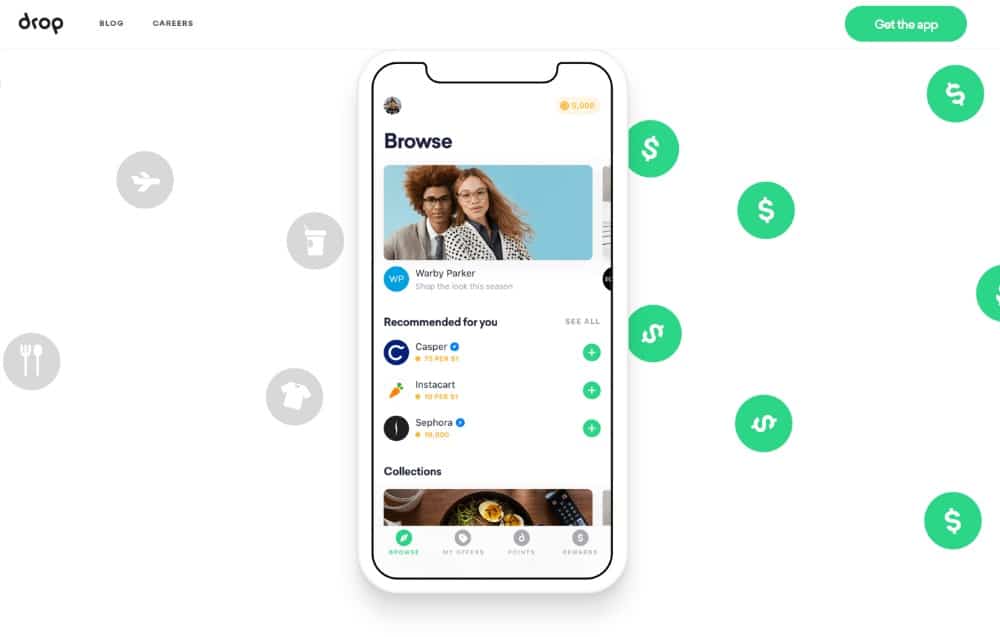

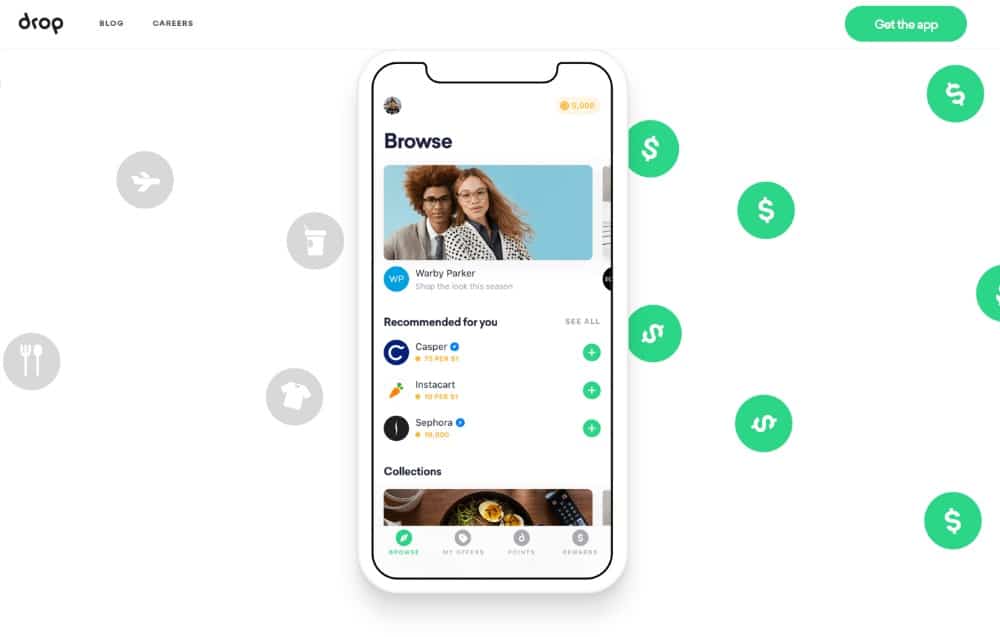

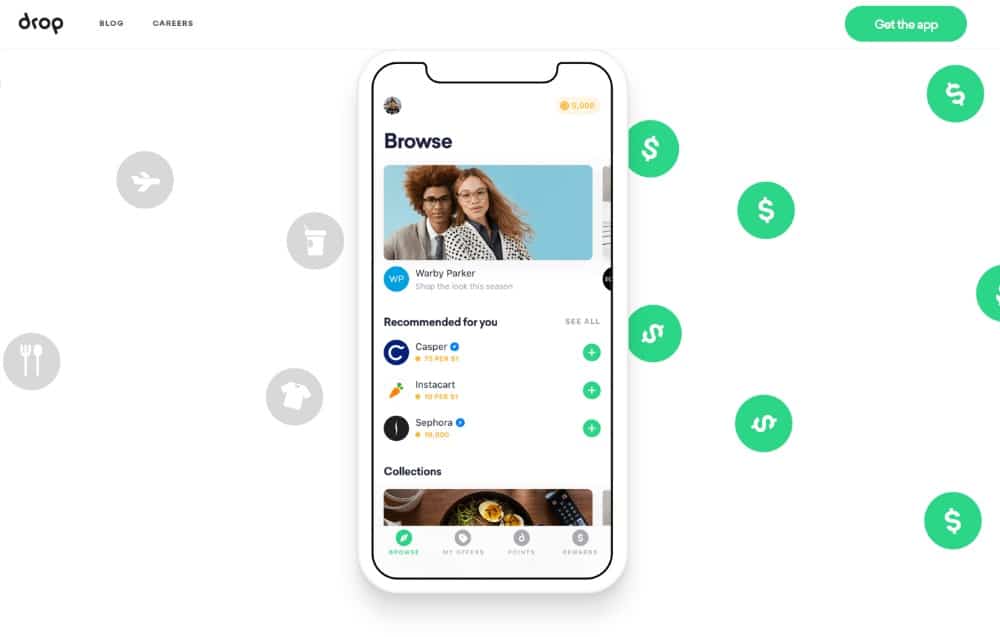

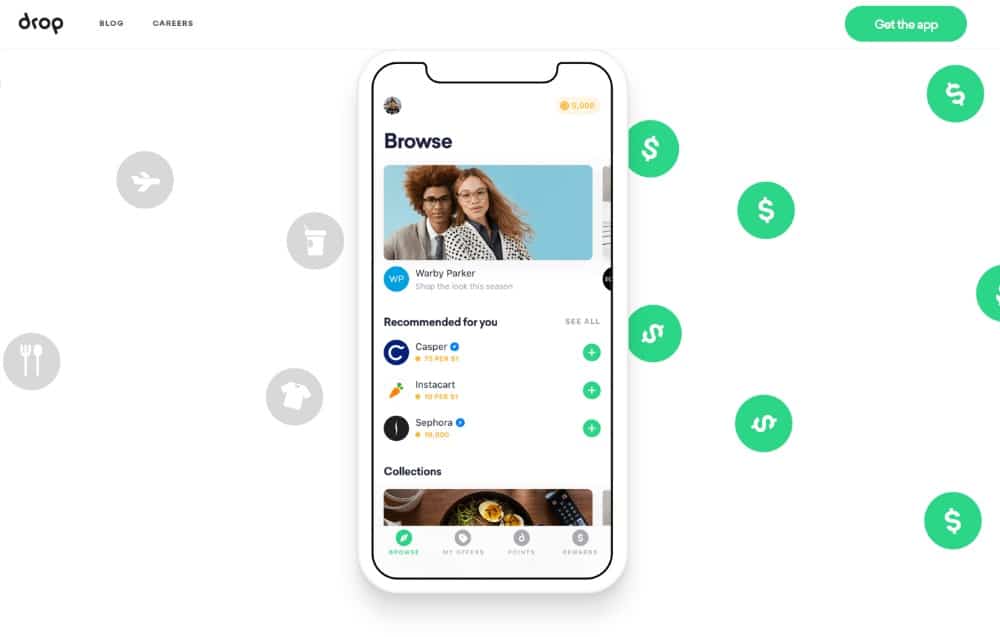

8. Drop

So, in case you’re a “rewards point” chaser… and like simplicity… Drop often is the app for you.

Through the app, members merely link their debit and bank cards to robotically earn factors… eliminating the necessity to scan receipts, enter promo codes or join for further loyalty applications.

You will earn 500 factors for linking your first card, 2000 factors for a second.

Drop lets its members earn factors and immediately redeem rewards whereas procuring in any respect their favourite manufacturers.

To get started, simply add your phone number (since everything is done via your smartphone) and select features offers from your five favorite partner stores/services etc.

The list is rather diverse… allowing you to earn rewards for things like grocery shopping, taking an Uber to work, grabbing a snack, and more. Some popular companies include:

- Costco

- Casper

- Whole Foods

- Gap

- Trader Joe’s

- Forever 21

- AMC

- Sephora

- Best Buy

- McDonalds

- Walmart

- Jet.com

Each partner holds different point values based on your spending.

There is no clear cut structure.

That being said, while your reward rate will vary, most members earn between 1-2% in gift card rewards for every dollar they spend.

And, like many apps that rely on partnerships to profit, Drop will entice you to spend more at certain places from time to time.

These incentives or “power offers” result in increased reward dollars… should you choose to take advantage.

For example, you’ll get “offers” for extra points when you spend a certain amount at your favorite store.

You’ll also earn “supercharge” bonuses when you hit up your favorite location at least 5 times.

Things like that.

At the end of the day, you may wind up spending more than you’d like using the app… simply to earn rewards faster.

It’s a Catch 22.

Spending more leads to more Drop points.

If you’re trying to avoid this, you can simply get friends to sign up… which is a free and effective way to earn more points (1,000 per friend up to $100).

And once you’ve earned up enough Drop points (at least 5000), you can exchange the points for gift cards.

Gift cards hold different values based on retailer. Here are some of them:

- Starting at $5: Starbucks, Aerie

- Starting at $10: Old Navy, Dunkin’ Donuts, iTunes, Amazon, American Eagle, Gap

- Starting at $15: Groupon, AMC, Banana Republic

- Starting at $20: Whole Foods

- Starting at $25: Barnes & Noble, Applebees, Apple, JC Penney

- Starting at $50: Hotels.com, Best Buy

- Starting at $100: American Airlines

You won’t lose points unless you close down your account.

Drop does have a FAQ section, if you care to delve deeper for actual reward point values.

If a fear of overspending concerns you… walk away.

But… if you have restraint and are shopping at Drop retailers anyway… why not get something out of it?

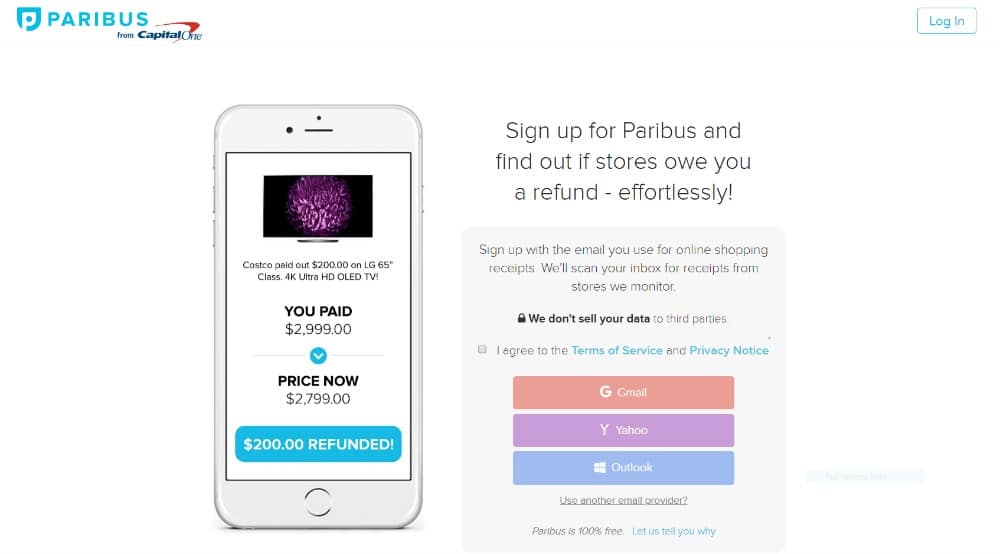

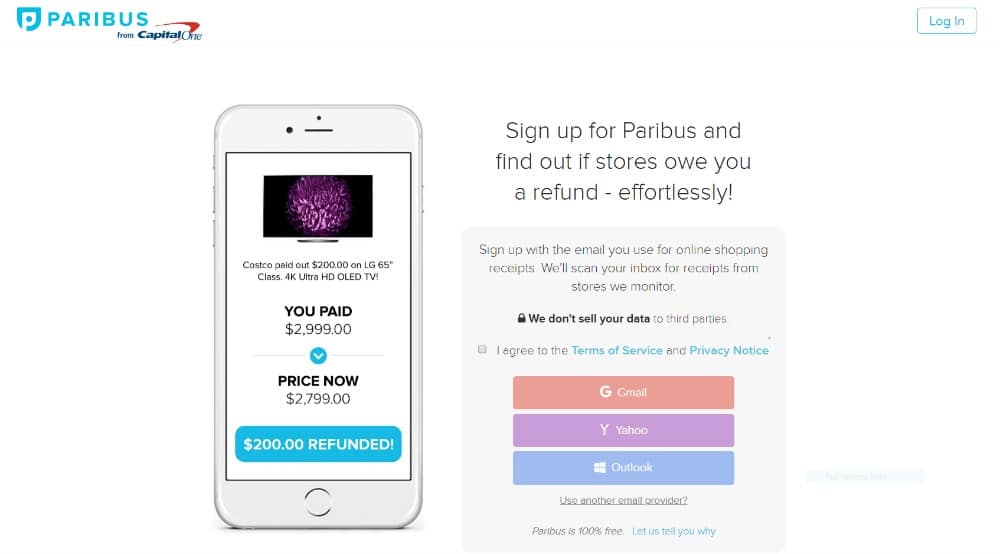

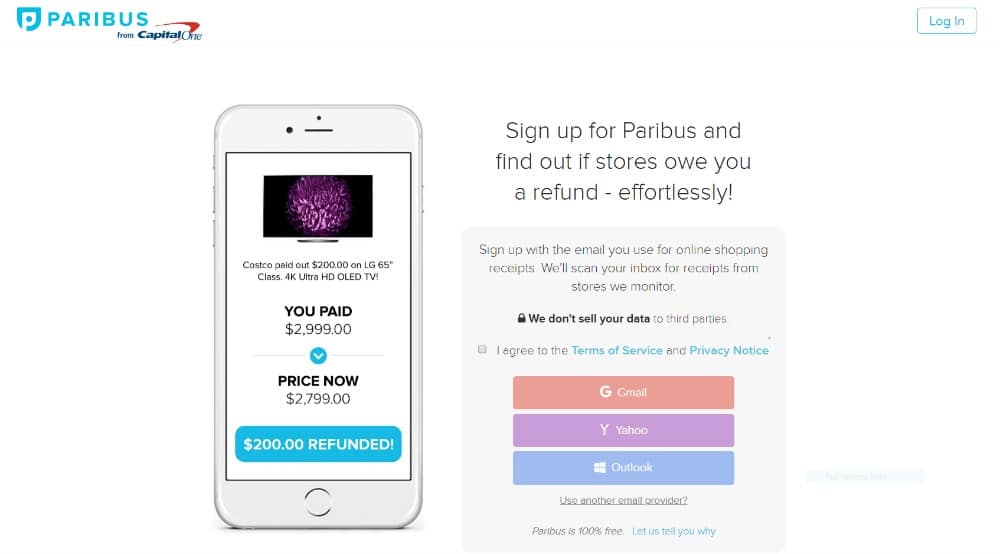

9. Paribus

Disclaimer: As a reminder of the affiliate disclosure at the top of the page, Paribus compensates us when you sign up for Paribus using the links we provided.

Perhaps the most unique money saving apps I’ve come across in my research, Paribus is like having a retail lawyer on retainer — and it’s 100% free to join!

What do I mean by this?

Good question…

For starters, Paribus tracks customer policies at popular online merchants such as Target and Gap.

Then, once users make their purchase, Paribus checks for potential savings or refund opportunities… based on purchase history.

Simply put:

When a price drops after you buy (within the time allowed in the merchant’s price drop policy), Paribus helps you get a refund for the difference.

Paribus can correspond with these merchants on your behalf, using your email address and name to attempt to get you the benefits.

You can activate your free membership with a Gmail, Yahoo or Outlook account.

By signing up, you authorize Paribus to act as your agent in performing this and other services for you.

Paribus terms and conditions are pretty clear when it comes to how these refunds work. For instance, the price drop must typically be $3.00 or more for Paribus to file a refund claim.

Also, claims can only be filed once per item or deal… even if the price drops lower a second time.

Another cool service Paribus offers is shipping refunds if delivery guarantees are not met. For instance, if something is labeled “guaranteed shipping” by a certain date and doesn’t arrive, Paribus may try and obtain either a partial or full shipping refund… or some other benefit.

Paribus charges no fees for the price drop Service… and refunds are credited directly back to the credit card (or other form of payment) you used when making the purchase, usually within 3-7 days.

As an added bonus, Paribus will send you a monthly summary of refunds obtained. Paribus is owned by Capital One, and their app and summary documents feature a user friendly interface.

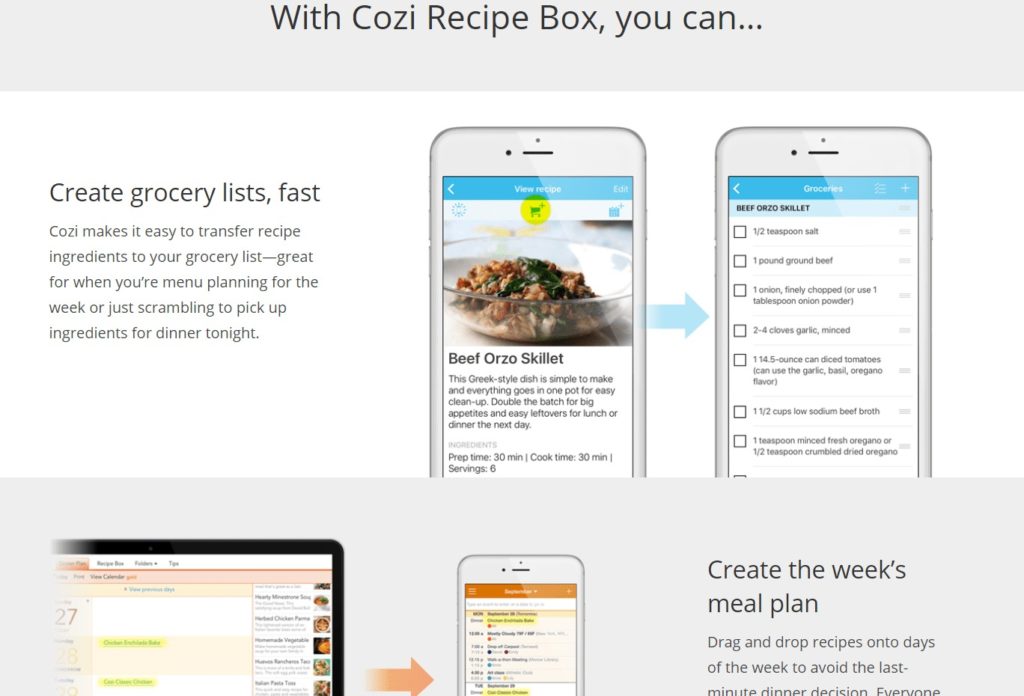

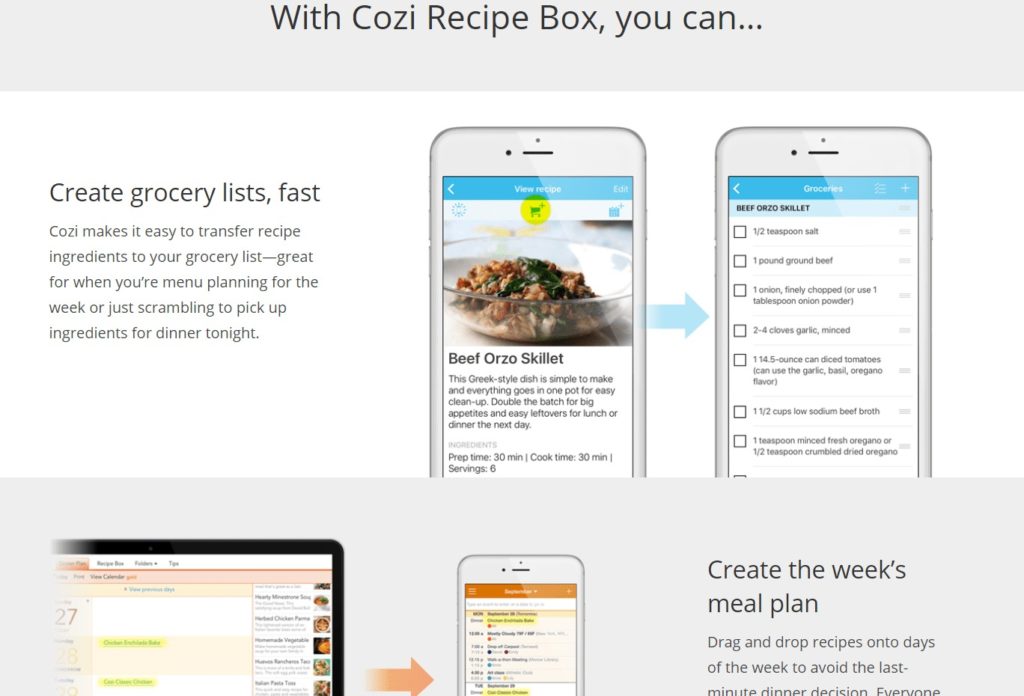

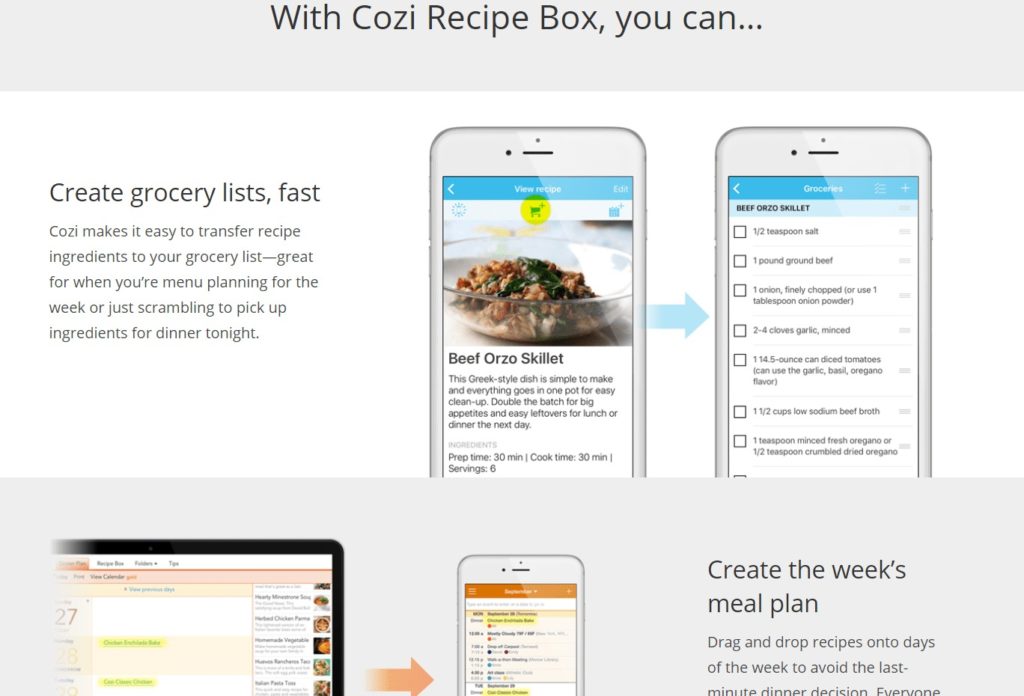

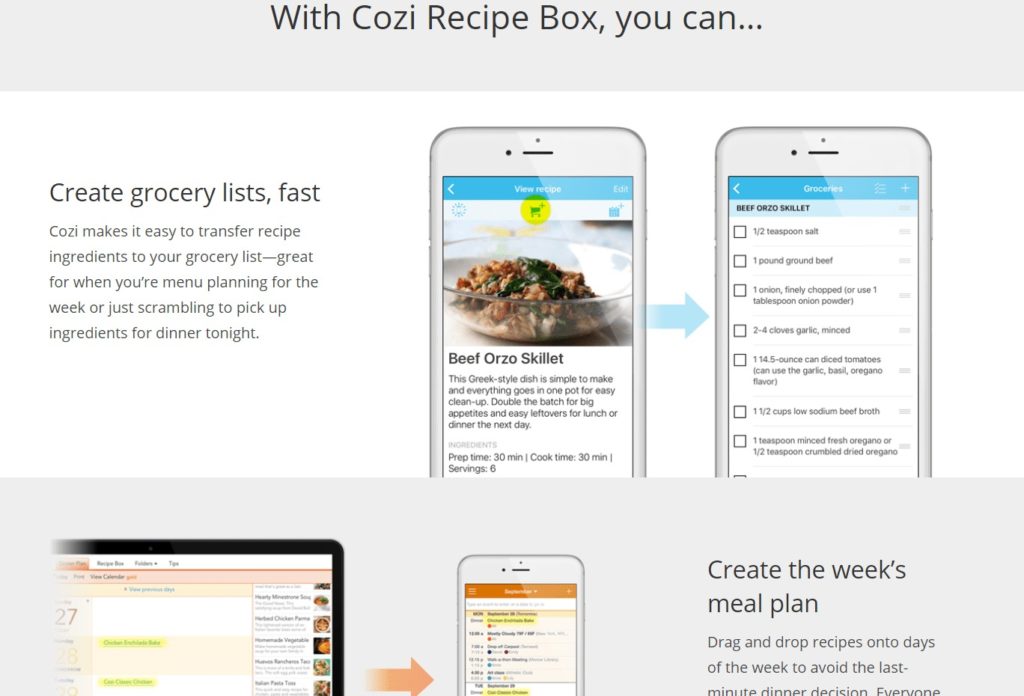

10. The Cozi Family Organizer

On paper, the Cozi Family Organizer may seem like any other shared calendar.

But it’s so much more.

If used correctly, Cozi can save you money.

How you ask?

Simple.

With its meal planning feature.

Studies have shown that meal planning not only saves time, but money.

If you have a weekly meal plan in place, you:

- Won’t waste money at restaurants last minute

- Can save money on ingredients by shopping in bulk, ahead of time

- Could use coupons for savings on what you need

- Will save on gas going back and forth to the store daily

The Cozi app has a bank of recipes its members can sift through, that can easily be saved into a recipe box tab.

You can save a week’s worth of dinner ideas, if you’d like.

Or, if you choose, you can import recipes from the Web… or add your own to the tab.

Either way, the meal plan feature will convert these recipes into a grocery list for you.. making shopping a snap.

Yes, there are other dedicated meal planning apps out there… but Cozi’s free version offers you a lot of bang for the buck that you’re trying to save.

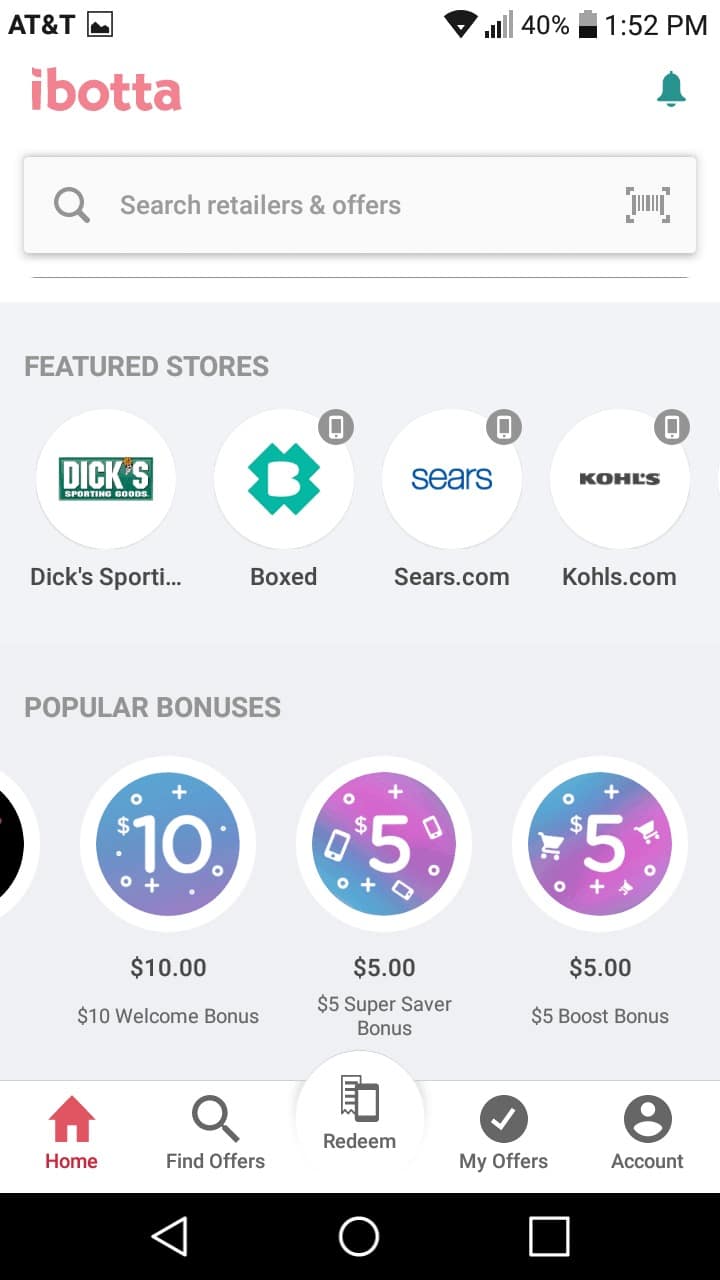

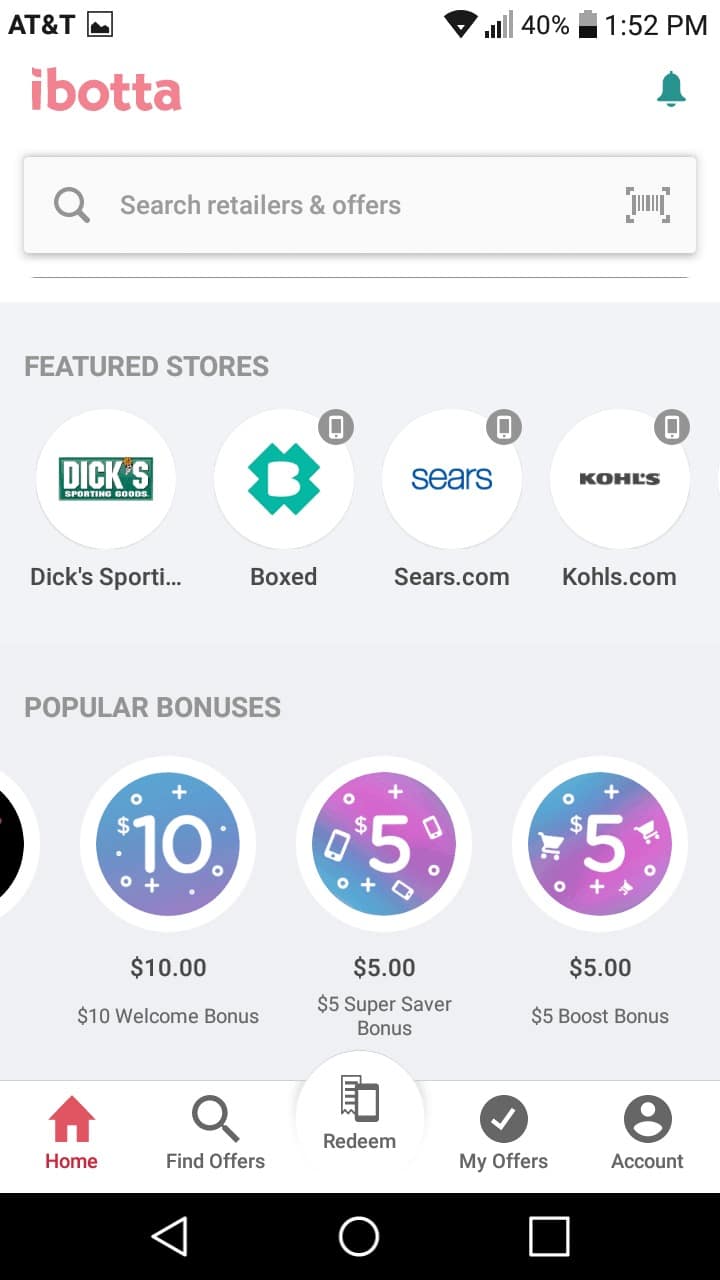

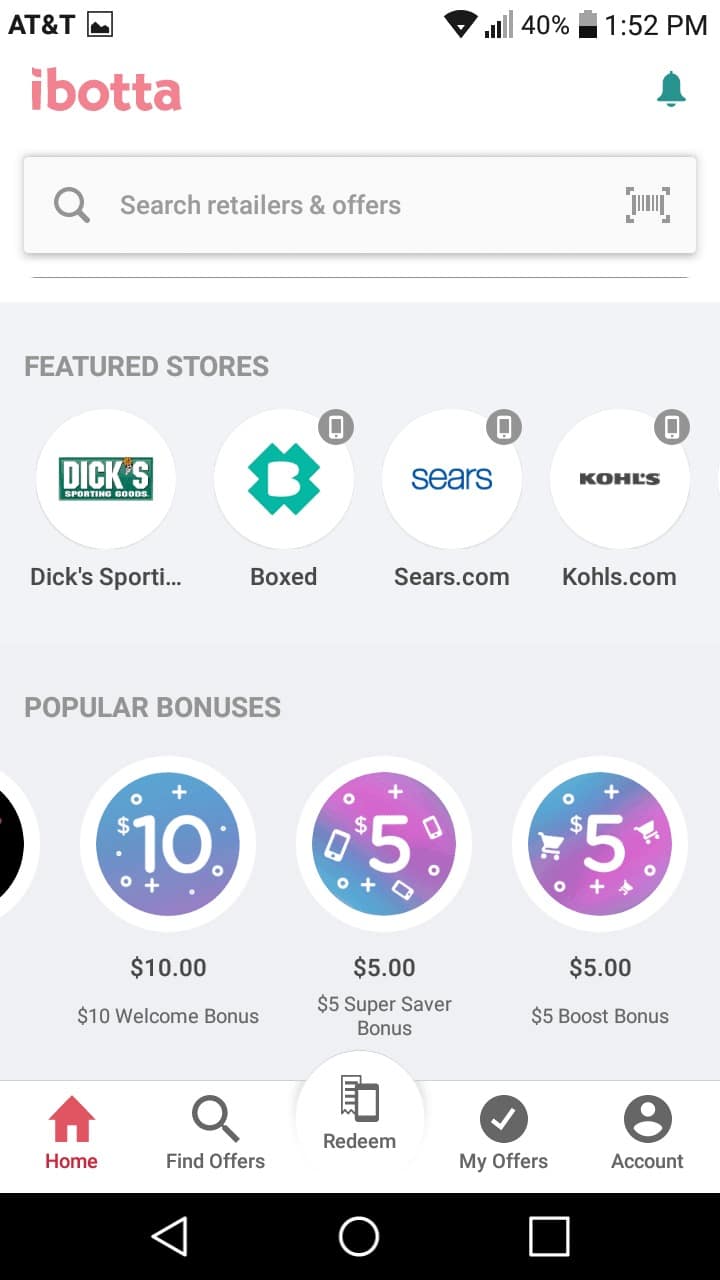

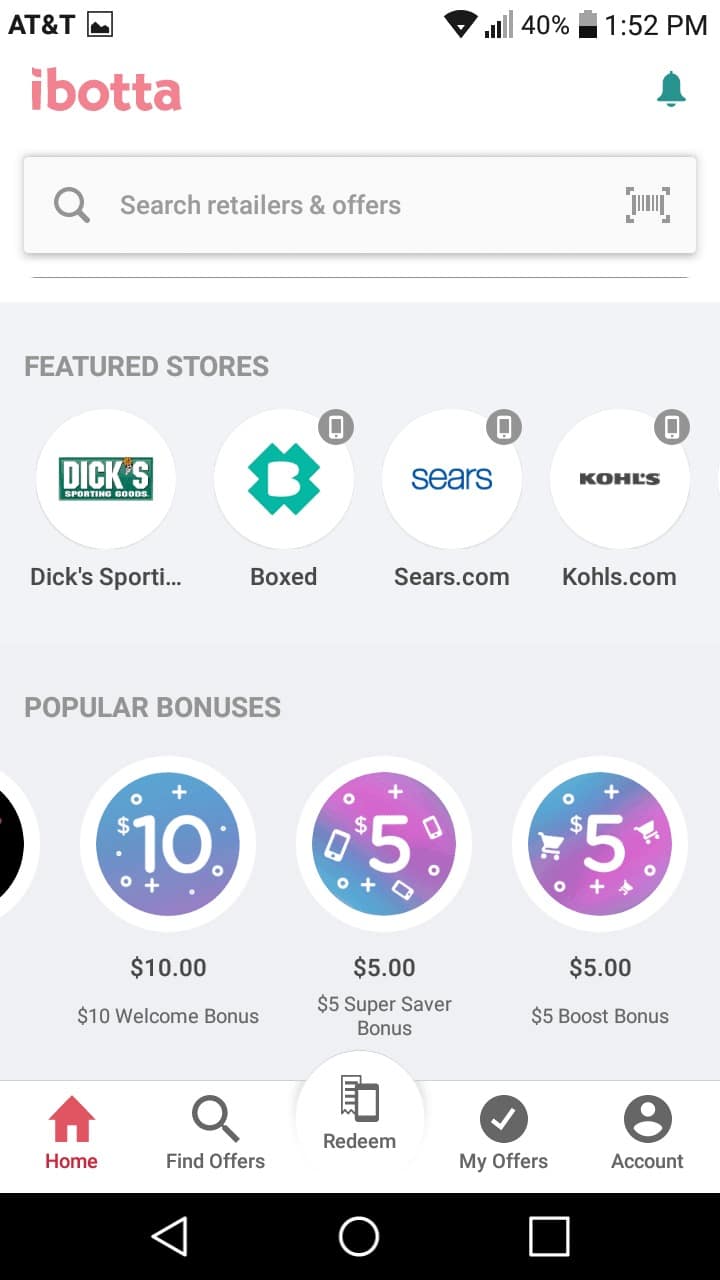

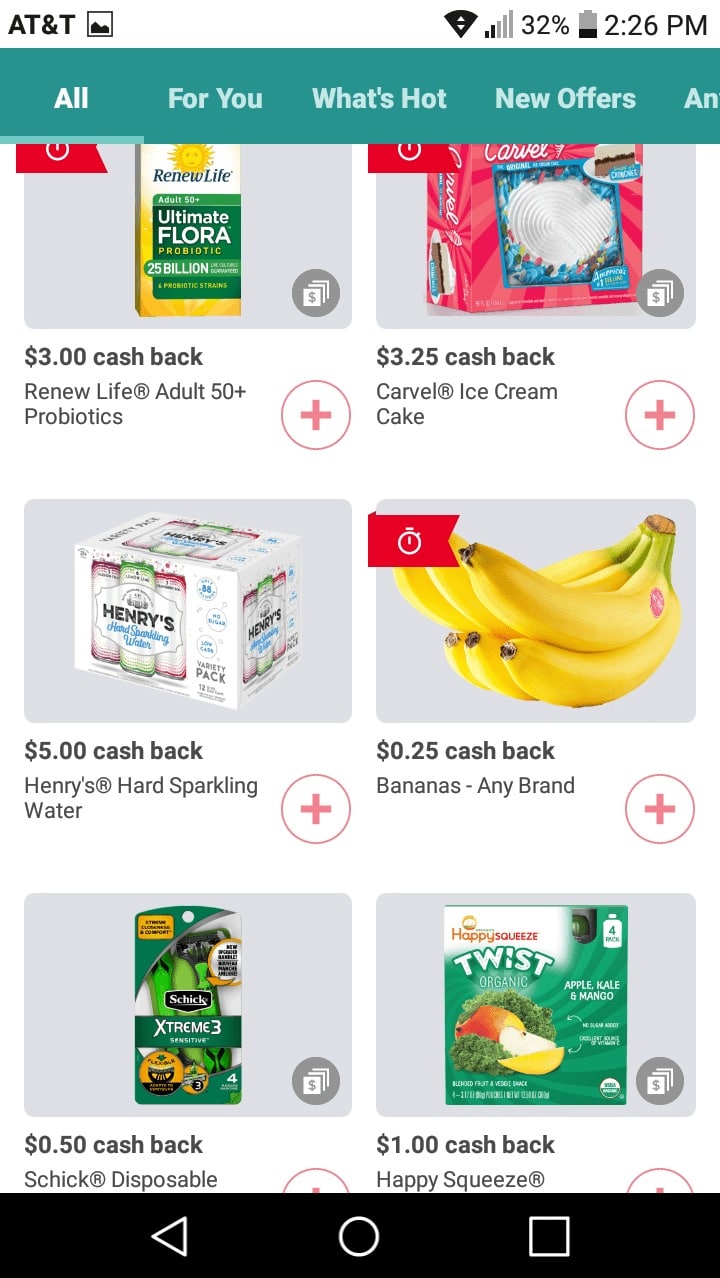

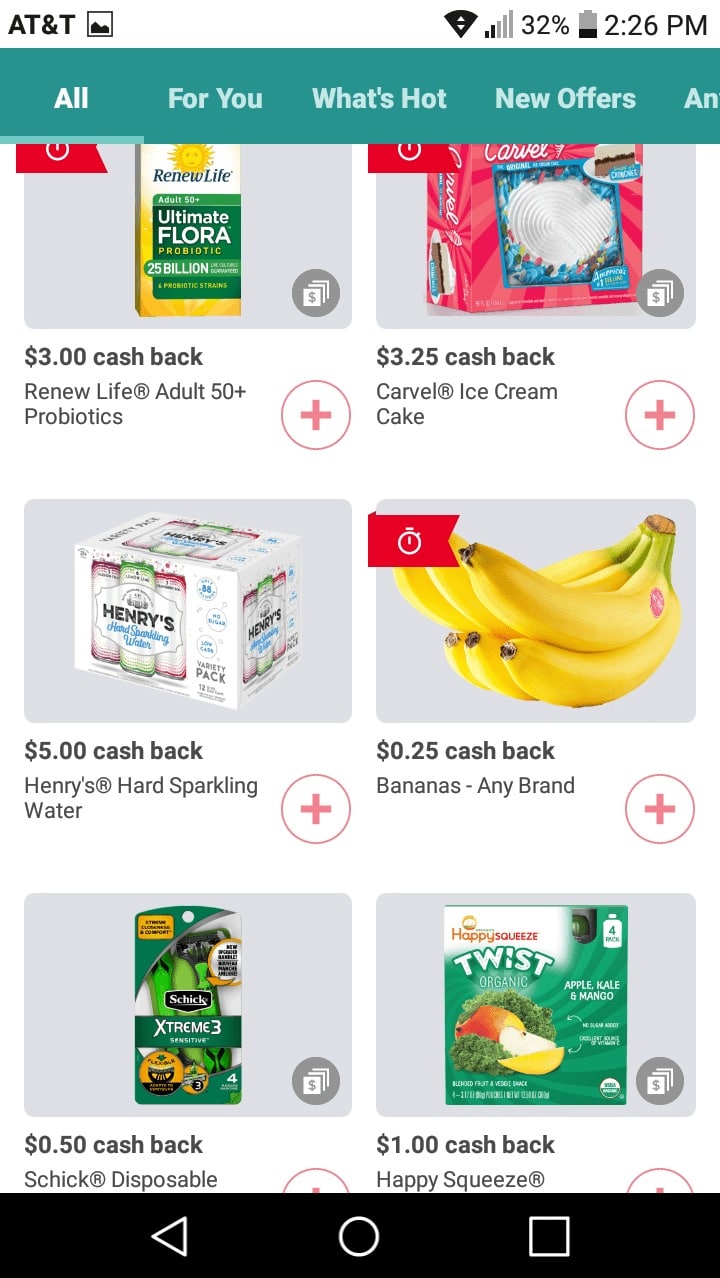

11. Ibotta

If you are in charge of shopping for everyday items for the family… you should familiarize yourself with Ibotta.

If you like saving money… you should familiarize yourself with Ibotta.

Seriously.

Think of Ibotta as your average “coupon clipping” app’s cousin.

That’s right.

They look the same… but have different parents.

Different creators.

Different minds behind the magic that is this app.

Ibotta allows users to earn cash back on items they purchase regularly. Things like milk, eggs, bread, butter, cheese, razors, toothpaste, toilet paper… even liquor.

Yes, even liquor.

Ibotta also offers discounts (typically ranging from 2% – 5% back) for shopping online at their partner stores.

You can also link a loyalty card from an Ibotta preferred partner store to your account, and it will track your eligible purchases for you.

Similar to Drop, once you sign up for an Ibotta account, it will ask you to select your favorites from a list of supported retailers… both brick and mortar, as well as online.

Also similar is an enticing offer to start spending right away… by offering you bonuses for hitting target levels.

For example, I was offered a $10 cash back bonus once I hit $10 in earnings.

I was also offered an additional $5 cash back bonus for mobile shopping with an online partner.

It’s important to note here that all shopping with online partners MUST go through the Ibotta app, which will then take you to the partner’s offer page. If you leave the supported Ibotta page, the discount will not apply.

Now I digress…

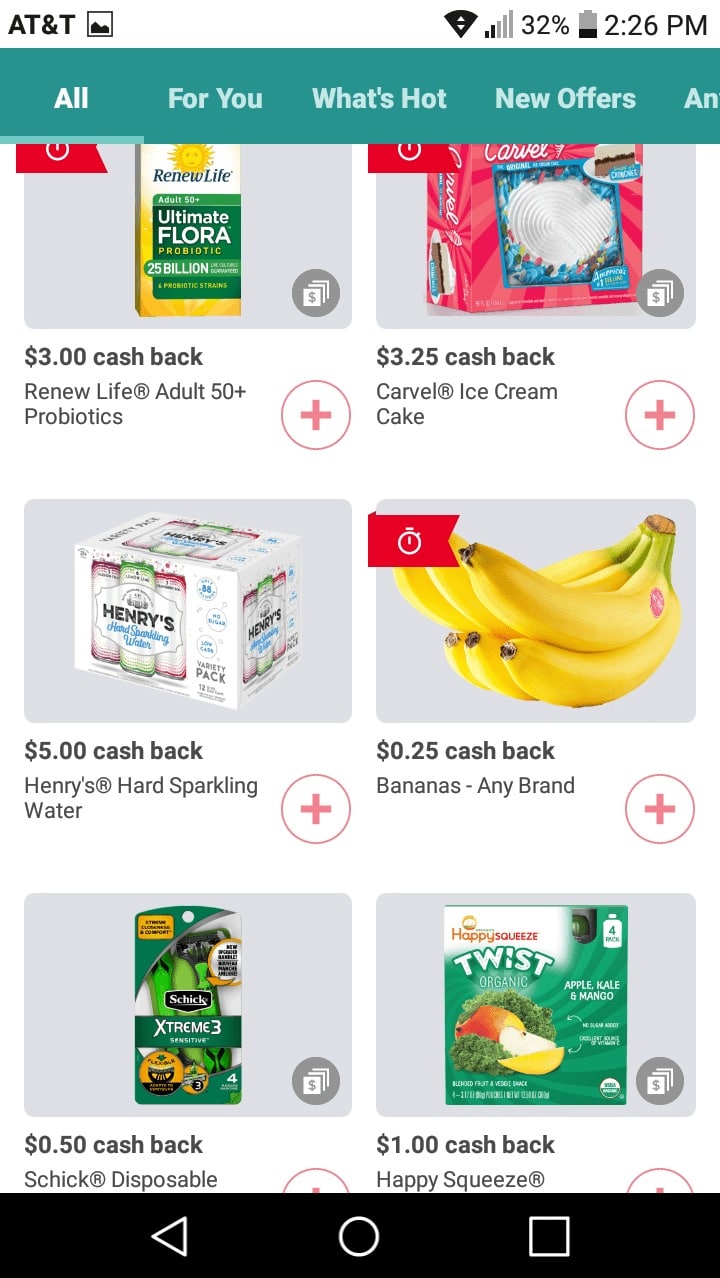

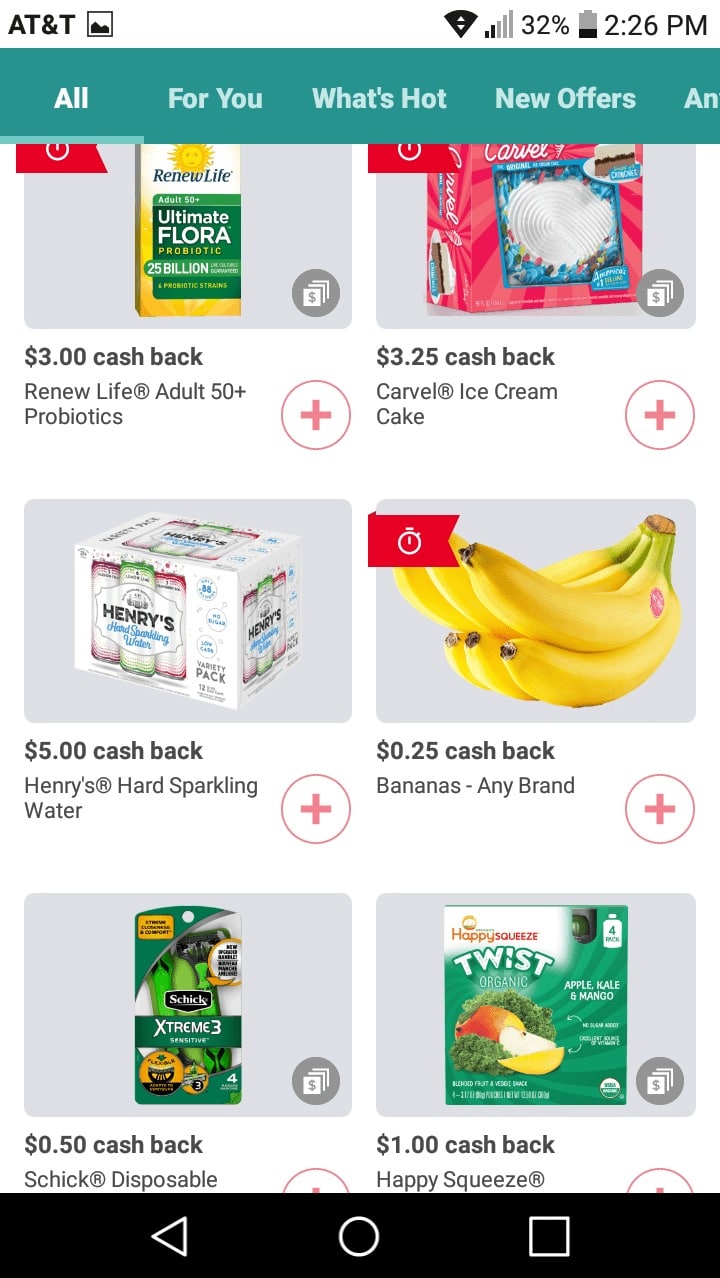

Once you’ve selected your favorite stores, you are bombarded with offers.

Simply sift through them and click on the ones that you like.

You may also choose the retailer you’ll be using these coupons at.

50-cents off this… 25-cents off that… $3.00 off vodka.

Sold!

Now, to go shopping.

This is where Ibotta really differs from the other apps, like Drop.

You’ll need to keep your phone handy and the app open while shopping to take advantage of the “scan” feature.

And I highly recommend you do in order to make sure you are buying the proper item associated with the offer. These deals are very specific when it comes to things like product size, quantity, flavors, exclusions, etc… similar to manufacturer’s coupons.

You don’t want to get caught up in trying to redeem your coupon… only to be denied because you purchased the wrong item.

I did this!

Twice!

And it sucked.

I had to return the item and was, quite honestly, just too lazy to do so.

So I actually lost money.

Live and learn.

Once you’re done shopping, simply scan your receipt in the Ibotta app and send it to them for approval. You’ll get a quick confirmation.

If everything checks out… you’ll get a second confirmation within a couple of hours of how much cash back you earned.

Shortly after that, voila!

The money is in your account.

Ibotta gives you three options for withdrawing the money:

- PayPal

- Venmo

- Merchant gift card

And you must have accumulated $20 before you can take any money out of your Ibotta account, which isn’t a big deal, but worth noting.

Bottom line… if you’re a frequent flyer at the grocery store, such as myself (Hello! Four kids!), Ibotta pays.

And it can pay well… if you play by the rules.

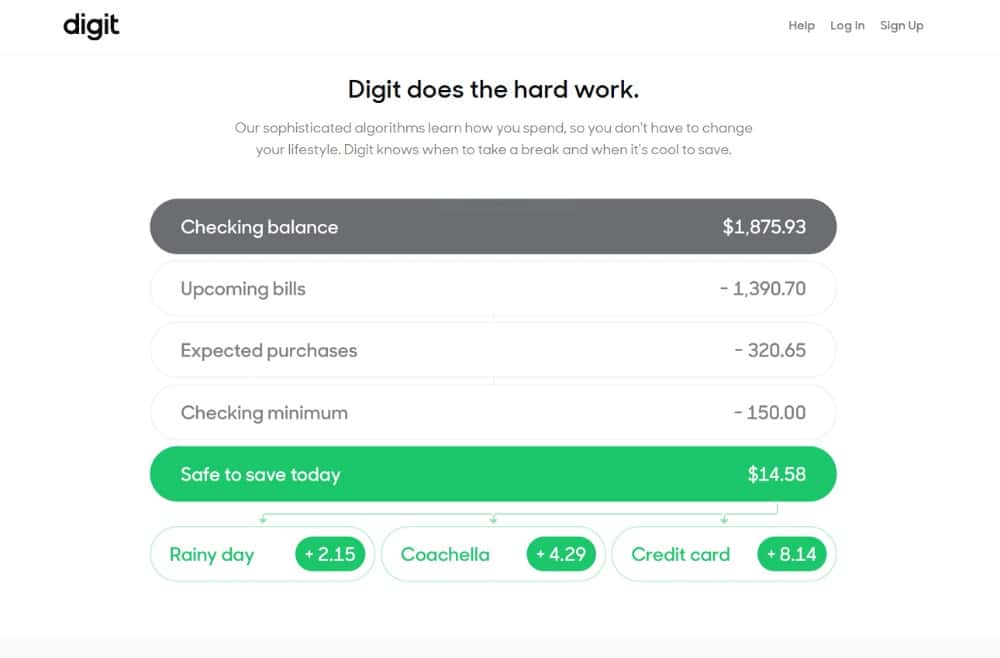

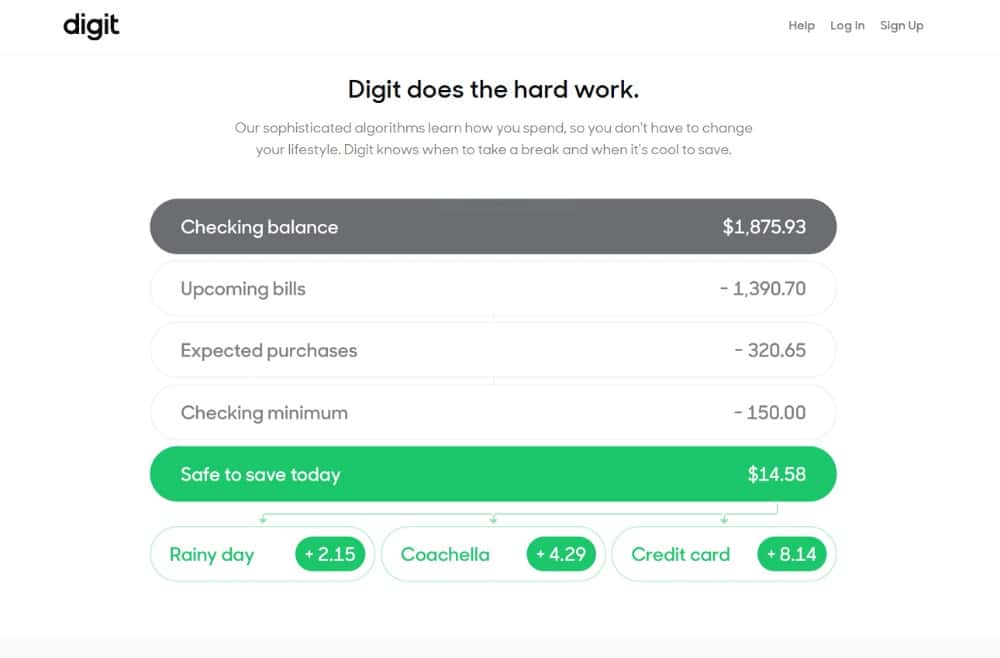

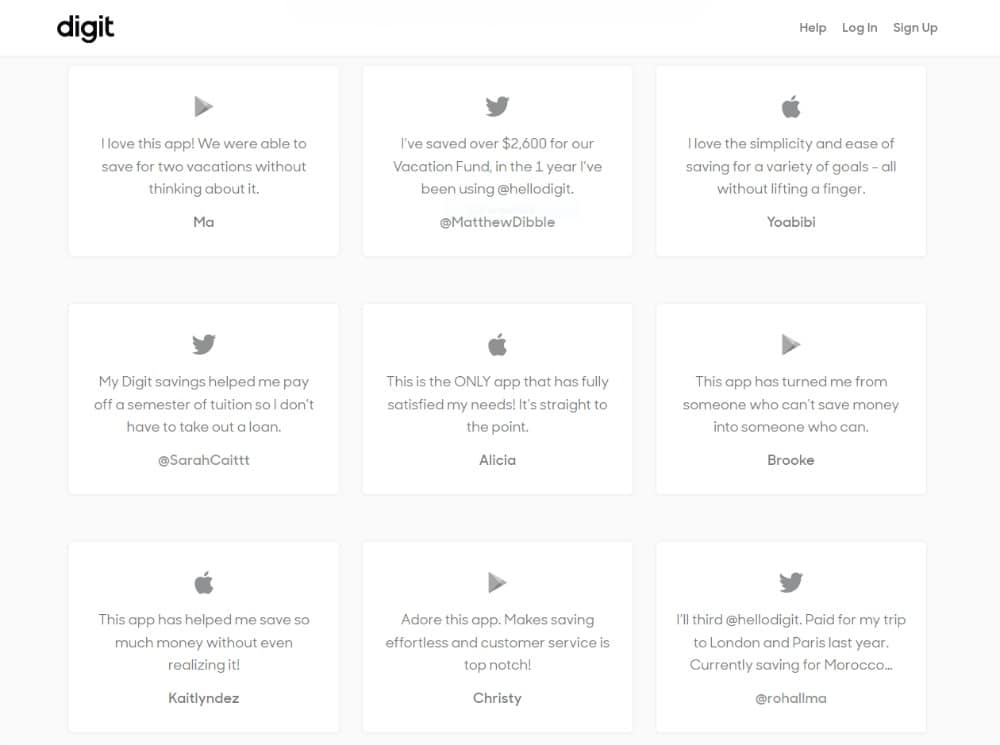

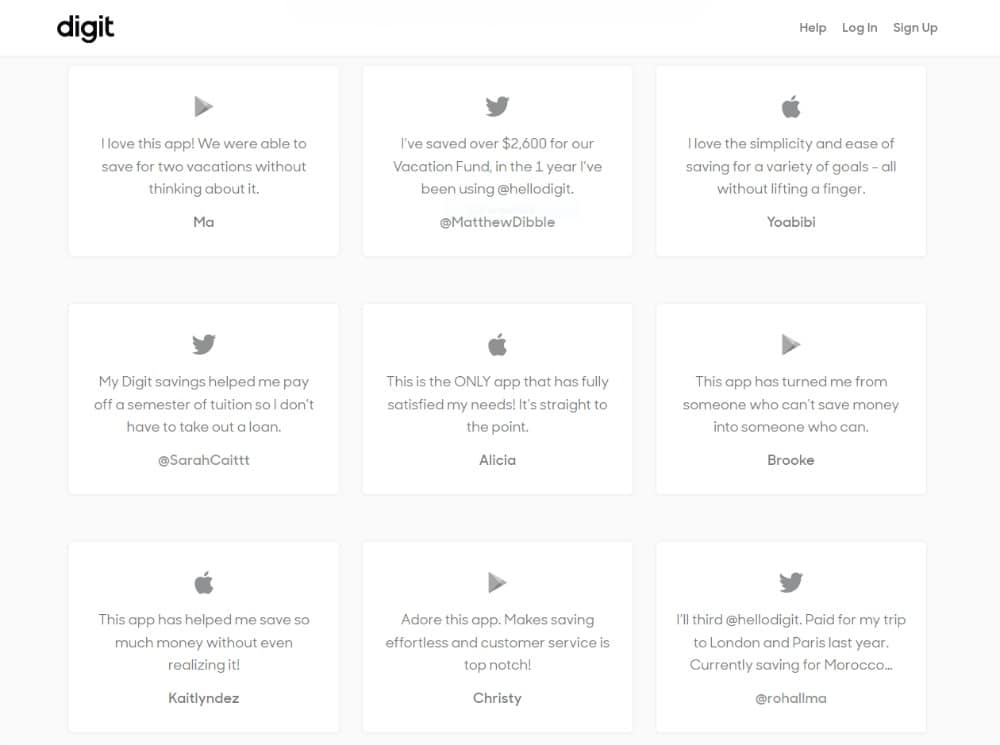

12. Digit

So, how would you like to save money and paydown debt… without having to think twice about it?

Digit believes it can be done.

And that it will be done… just by using their app.

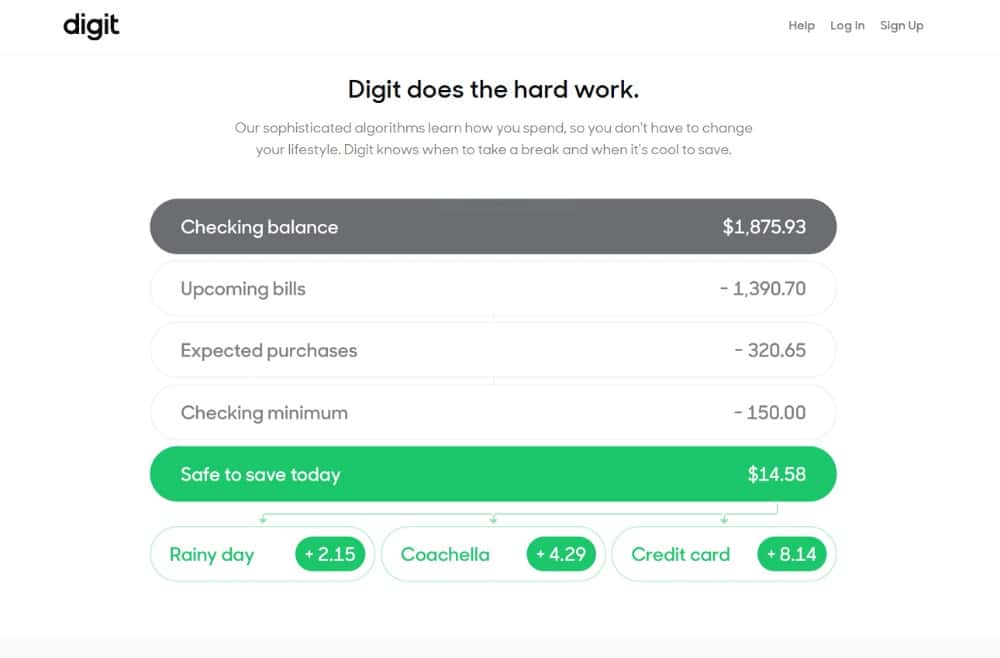

Digit analyzes your spending and automatically saves the perfect amount every day…so you don’t have to worry.

All you need to do is share some basic information, such as what you’re saving for (rainy day fund, goals, bills)… and Digit does the rest.

It looks for common or recurring transactions to figure out your income and debt.

It can then budget for your next vacation, pay off credit cards, or put money away for a rainy day.

Digit’s sophisticated algorithms learn how you spend, so you don’t have to change your lifestyle.

Digit knows when to take a break and when it’s cool to save.

Now that’s impressive.

If the app is able to find some money, Digit will auto-transfer those savings to your Digit account.

All funds in your Digit Account are held at FDIC insured banks for your benefit and are insured up to a balance of $250,000.

Digit is free to try for 30 days, then just $2.99 per month (or $35.88 per year).

That’s a drop in the bucket, compared to what you can save.

And Digit has saved its users tons of money! More than $1,000,000,000 securely saved… to be exact.

In addition to automated saving, Digit also offers its users:

You are also able to set a threshold, where Digit won’t try and save for you if your checking account balance falls below a certain amount.

Digit’s “Help Center” section is really thorough and should answer all of your questions.

I don’t know about you, but it sounds like a no-brainer to give the Digit app a whirl for 30 days.

You’ve got nothing to lose… only to save.

Even if it’s just enough for a fancy cup of coffee one day.

Come on! You’ve earned it.

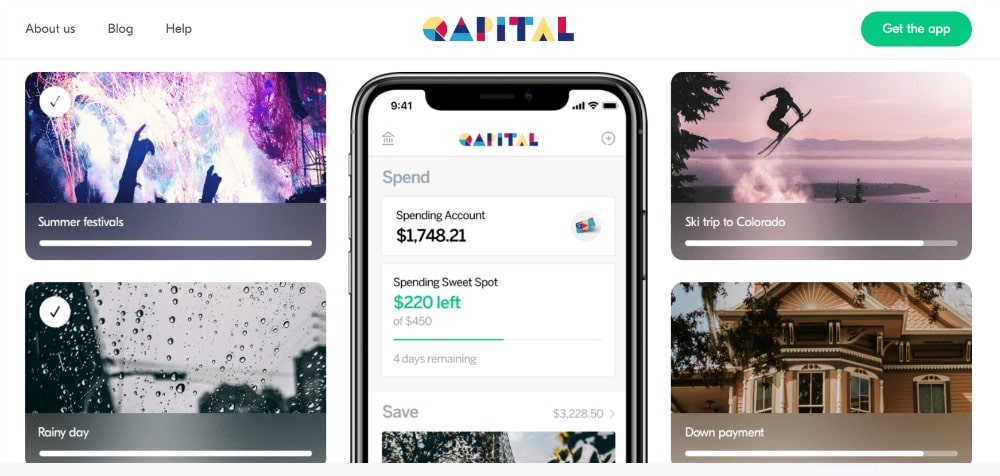

13. Qapital

So besides having a name that reminds me of an Atari 2600 game from the early 80s… Qapital is pretty cool.

PS, if you can guess that game I’ll give you a big ol’ virtual high five!

Put your money where your heart is.

That is their motto.

The company prides itself as being a complete financial solution by allowing you to stick to your money goals, save and invest for the future, and spend confidently in the present… all in one seamless app.

Simply link an existing funding account to your Qapital account and start saving… on your own terms. Here’s how:

- Set up a Qapital Goals account

- Establish Savings Goals

- Connect your funding account, choose Goals you would like to save towards, and apply Rules that automatically send money toward your Goals.

The money in your Qapital Goals account is FDIC-insured and held with one of our partner banks.

And your goals are yours… no judgement.

Maybe it’s a house. Maybe a vacation. That is entirely up to you.

Your dreams are yours.

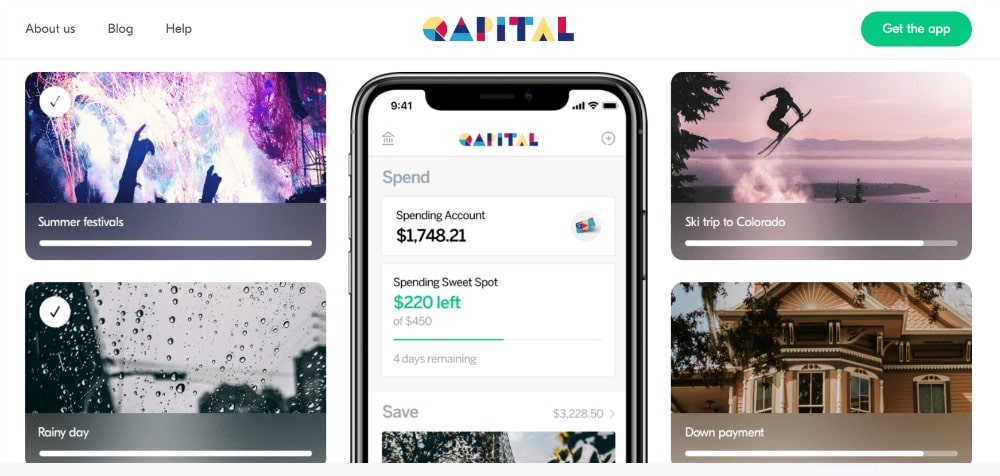

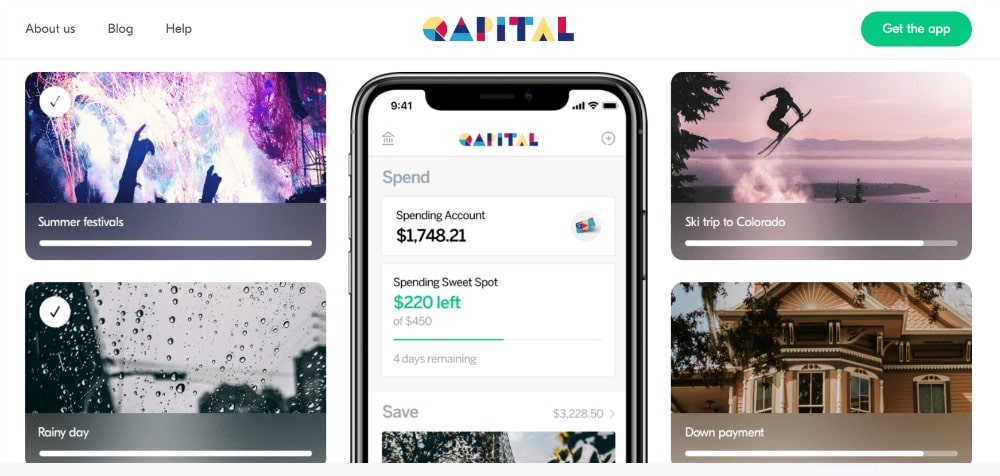

With the Qapital Goals account in place, you’ll have access to a Qapital Spending account, which links to the Qapital Visa® Debit Card. This is a checking account in your name, held with their partner bank. Benefits include:

- Better tracking of your weekly spending

- No account setup or overdraft fees

- Unlimited immediate transfers to and from your Qapital Goals account

- The ability to set up direct deposit to fund your Spending account

- The ability to transfer money directly to and from your funding account

Another feature of the Qapital app is the Qapital Invest account, which helps you reach your long-term goals.

Once you decide to set an investment Goal, your money is held in an ETF portfolio based on the risk level you are most comfortable with.

Putting money into a diversified portfolio of stocks and bonds gives you the benefit of compounding (letting your money make you money)… and the opportunity for long-term growth.

Note: you must have a Qapital Spending account in order to open an Investment account… and a $10 minimum is required in order to open an Invest Goal.

There is a lot more to Qapital, which is why it’s a good idea to check out their tiered membership plans. You can activate a Basic membership for as little as $3 per month. The Complete and Master memberships cost $6 and $12 per month respectively.

If you’re hesitant, Qapital offers a 30-day risk free trial… so you can make sure it’s a good fit for you.

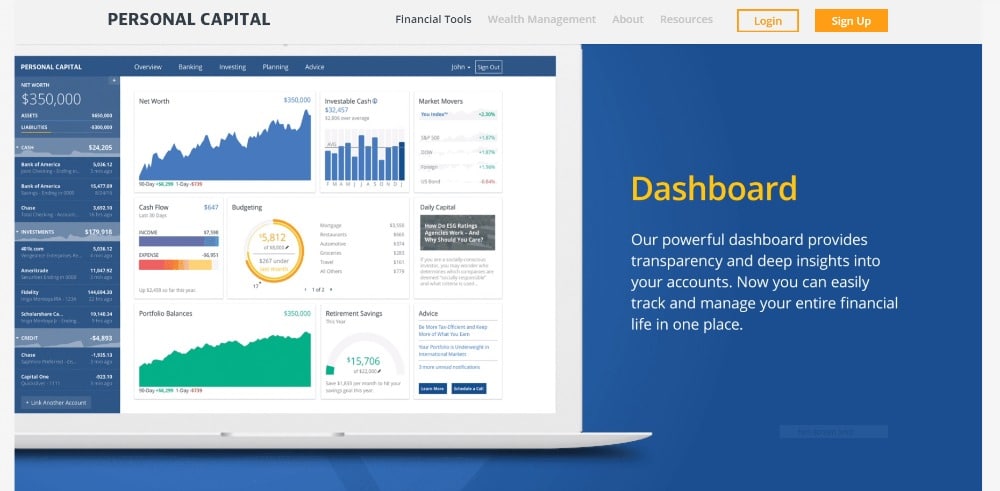

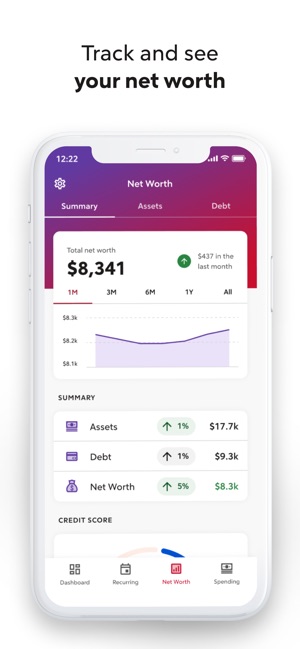

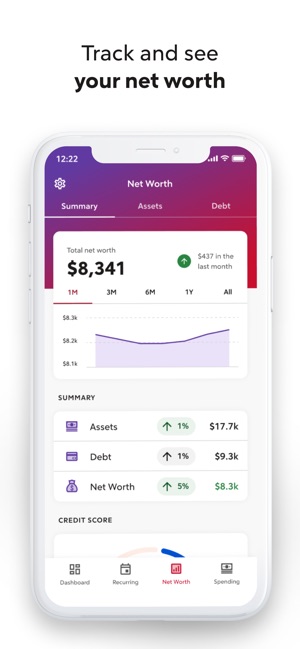

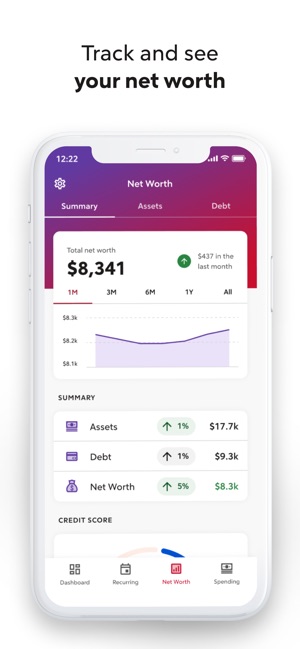

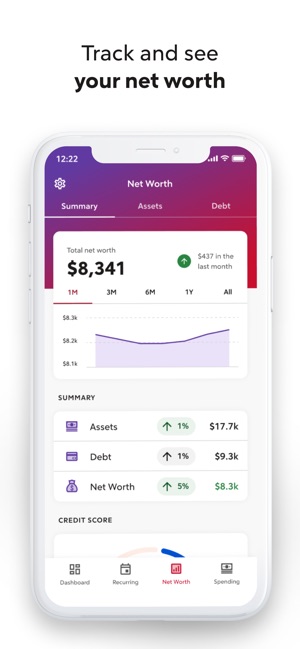

14. Personal Capital

Personal Capital is a whole new way to manage your money… or so they say.

And after one visit to their website, it does appear to be true.

Personal Capital allows you to link all of your financial accounts in order to see a clear, real-time view of your entire financial life.

And this feature is free.

Included are some useful tools to help your track things like:

- Your net worth

- Your investable cash

- Market movement

- Cashflow

- Budgeting

- Portfolio balance

- Retirement savings

- Fee analyzer

Sounds pretty cool, right?

And getting started is fairly easy too.

Step 1: Simply register and link all of your accounts

- IRAs

- 401ks

- Mortgages

- Loans

- Checking

- Savings

Step 2: Set up a free consultation and Talk with a Personal Advisor

Note, there are fees for this service after the initial consultation

Step 3: Create your Plan

While I find the basic app itself to be very user friendly… it is important to mention that access to Personal Capital’s other cool features, such as full access to the dashboard, are not free.

You’ll need to invest at least $200,000 to enjoy this feature, as well as other benefits such as a Financial Advisory Team and 401k advice.

If you have the money, it’s certainly worth checking out the different levels of monetary administration the app presents.

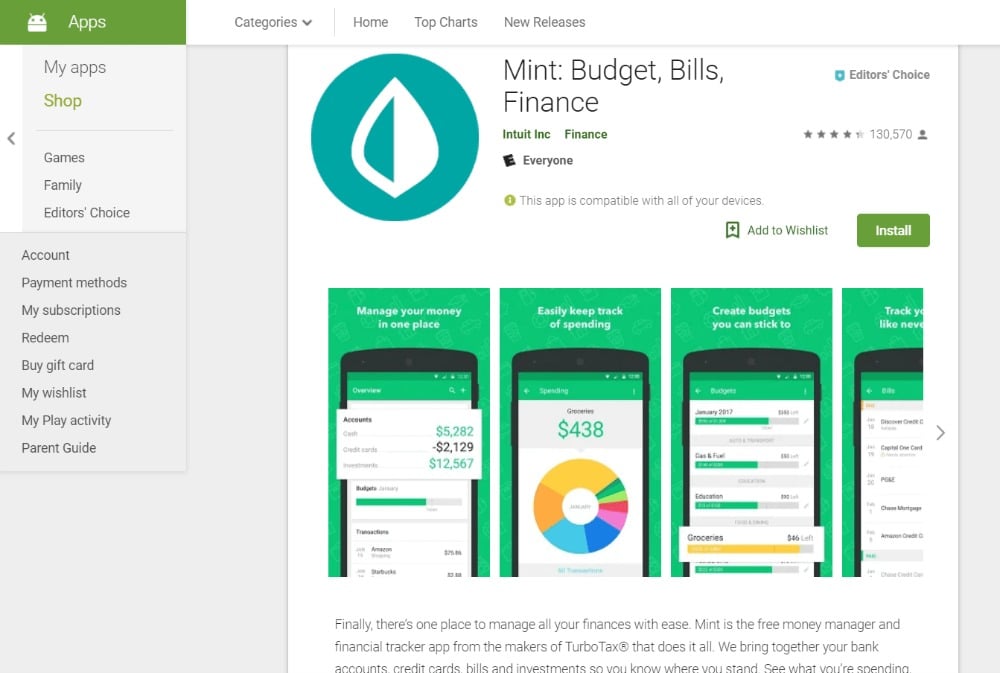

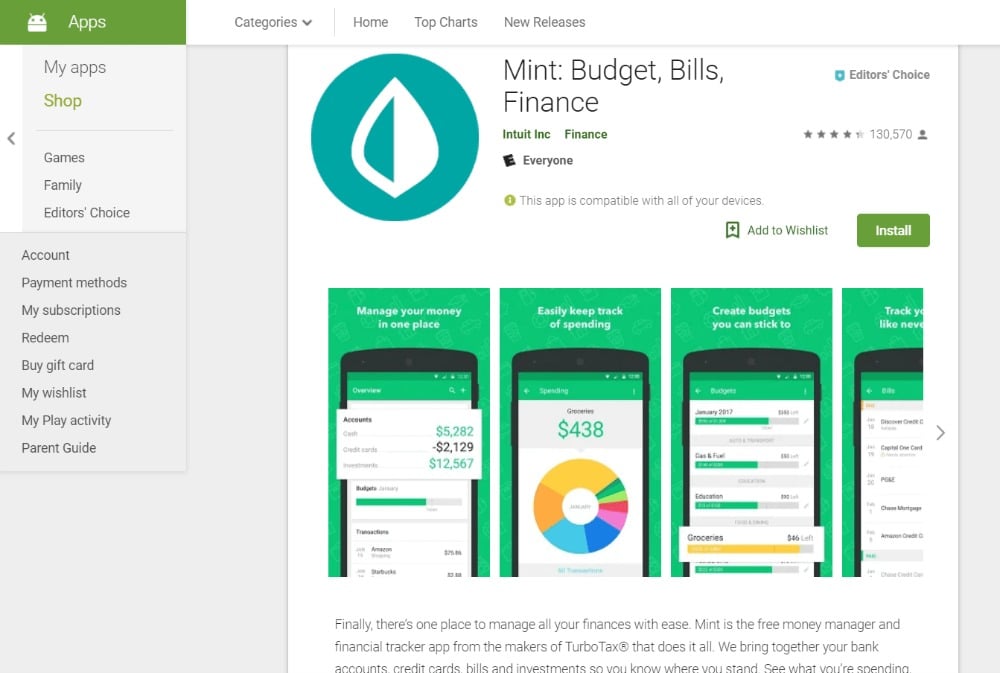

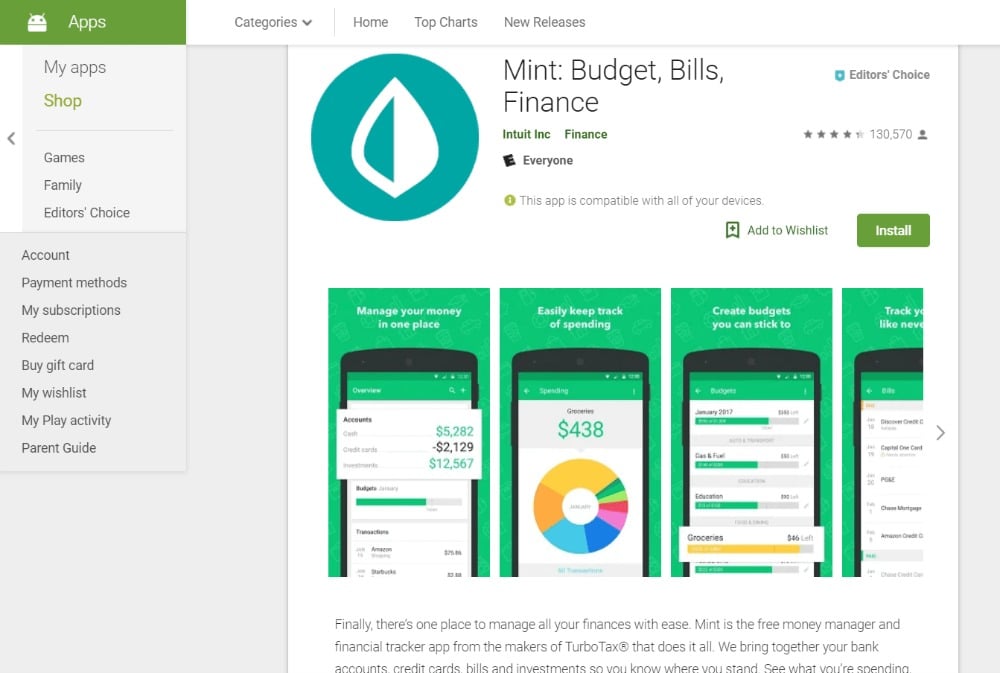

15. Mint

If you might have a number of various things in your monetary plate… you might need to examine Mint out.

If you might be acquainted with Quicken… you might need to examine Mint out.

Mint is from the minds at Intuit… which is thought for its monetary software program.

Basic.

Barebones.

Gets the job carried out.

Such is Mint.

While it isn’t as aesthetically interesting as among the different funds and funding apps, it does have some further benefits.

One of the distinctive options is it’s bank card match function, known as the “Find Savings” part. Based on the free credit score rating Mint lets you receive… you’re given a handful of bank cards you might be prone to be authorized for.

Under the identical umbrella, Mint additionally presents recommendations for:

- Checking and Savings Accounts

- Financial loans

- Insurance quotes

Mint additionally farms out funding recommendation, so to talk… offering you with an inventory of companions in a position that can assist you with issues comparable to:

- IRA rollovers

- Brokerage Accounts

- 401k optimization

Still, like lots of the different apps, Mint will:

- Track all of your payments on the go – from bank cards to utilities, lease to the babysitter. It’s multi functional place and straightforward to handle.

- View your entire funds at a look. You’ll know what’s due, when it’s due, and what you possibly can pay.

- Receive invoice reminders so that you pay on time and get alerts if funds are low.

While the app is a bit more consumer pleasant than Quicken, it not permits its customers to pay payments straight from the app… which some might view as a unfavorable.

However, in case you’re trying for a “no frills” free app that can get the job carried out relating to budgeting and multi account assessment… Mint is actually price a gander.

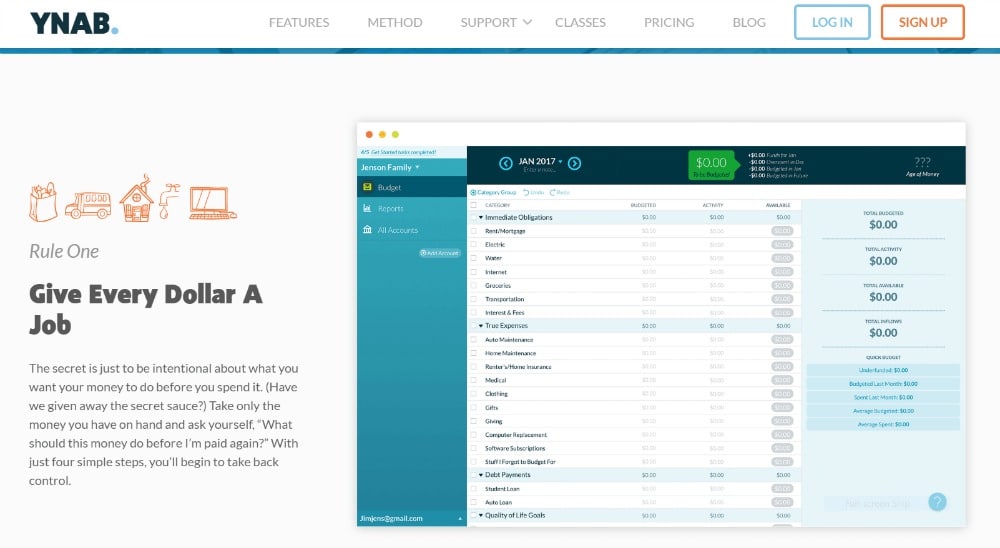

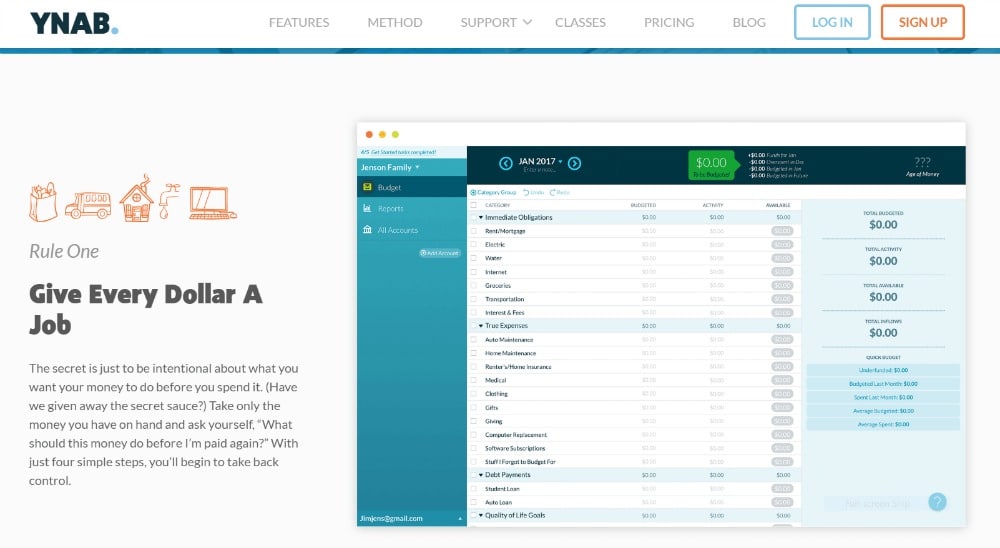

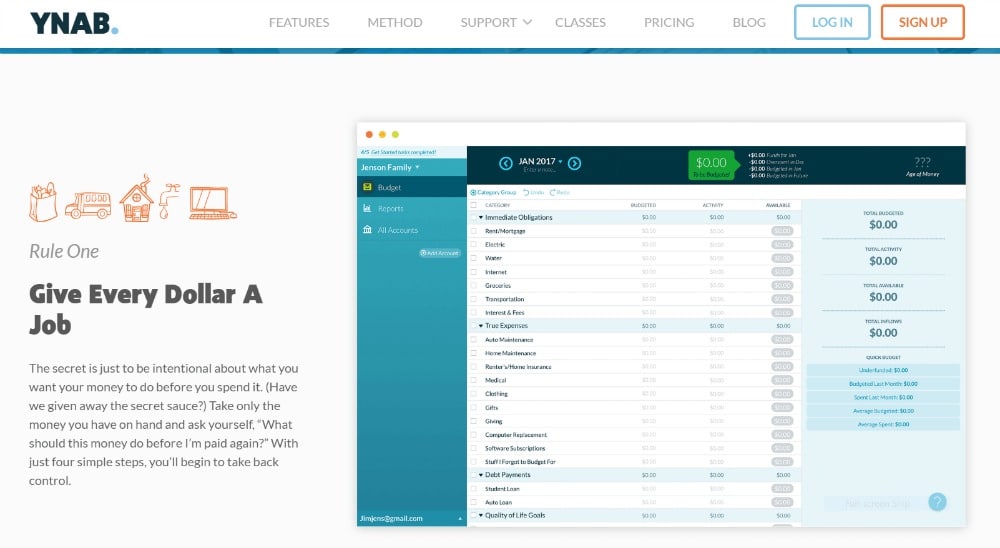

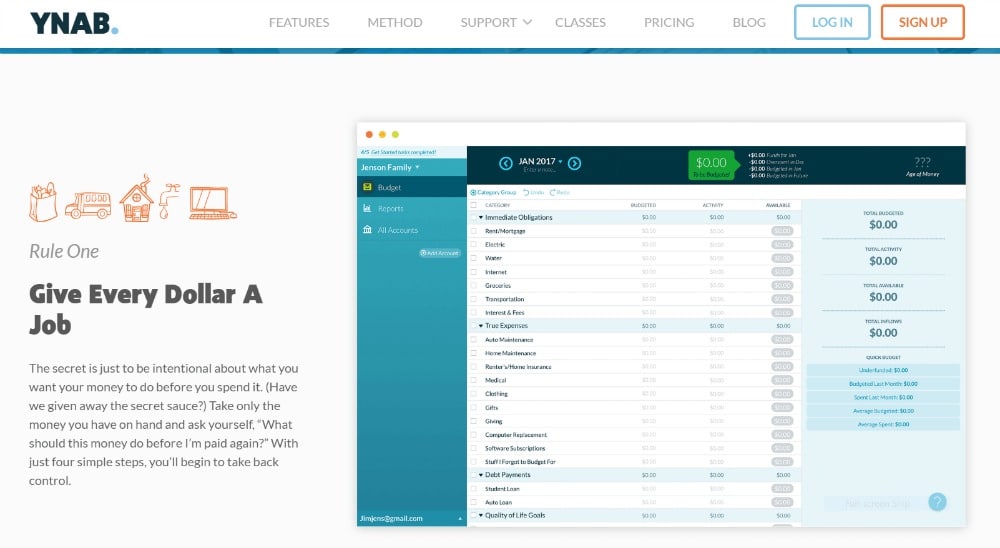

16. You Need A Budget

Stressed over dwelling paycheck to paycheck?

Well, now you don’t should be, in response to the laid again geniuses at You Need A Budget.

According to them, you can eliminate stress and actually save money by using their app. And it’s as easy as giving your money a job… more or less. There are just a few simple rules to follow.

Rule #1: Assign every dollar you make to something before you spend it!

Things like the car payment, rent, groceries, date night, dance lessons for your kid, fuel.

Rule #2: Plan for the Doozies (aka, the big expenses)!

Things like insurance premiums, income tax, property taxes, a kid’s birthday party, Christmas or Hanukkah.

By committing to put aside a little bit each month for these things, you’ll rescue yourself from that “oh no” moment of sheer panic months from now… when you realize you’d forgotten about it!

Rule #3: Roll with the punches!

Maybe you went a little over the entertainment budget this month by taking your daughter’s two best friends to the movies with you. Or maybe your grocery bill was a tad high from Thanksgiving dinner.

No worries… take some of the money from another category that has some flexibility or surplus – and simply shift it over. For instance, say you’ve been carpooling to work with a neighbor 3 days a week for the last month, you can probably afford to shift over some of your fuel expense money to the grocery category.

It will all balance out because you had a plan. The dollars were accounted for… someplace.

Rule #4: Age your Money!

Now, this is a tricky one, but if you can master the technique… you’re golden!

Basically, You Need a Budget wants you to spend money that is 30 days old.

The hope is that by assigning every dollar a job and following the rules that go along with it… you’ll eventually find yourself not spending your full budget each month.

And it will carry over to the next.

And the next.

And once you start seeing that happen, it will inspire you.

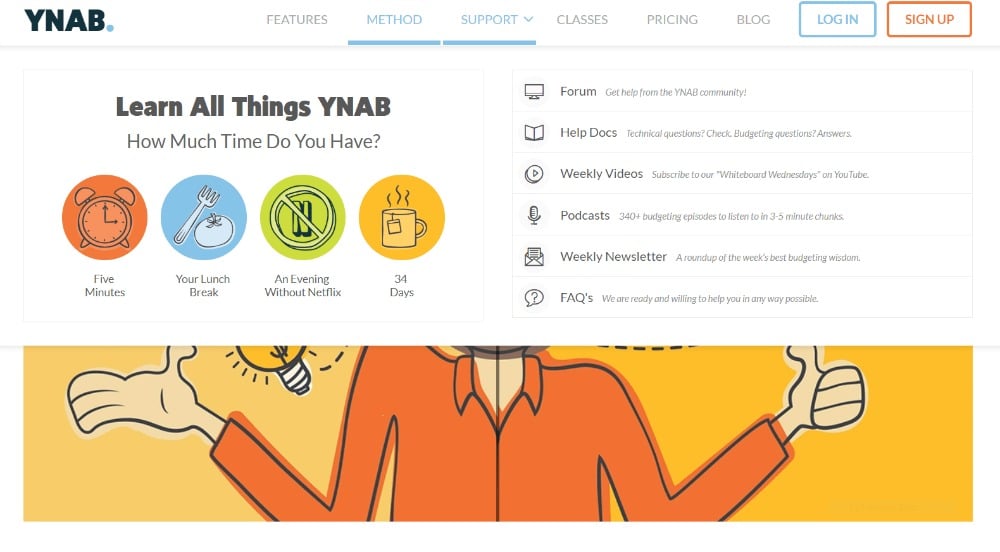

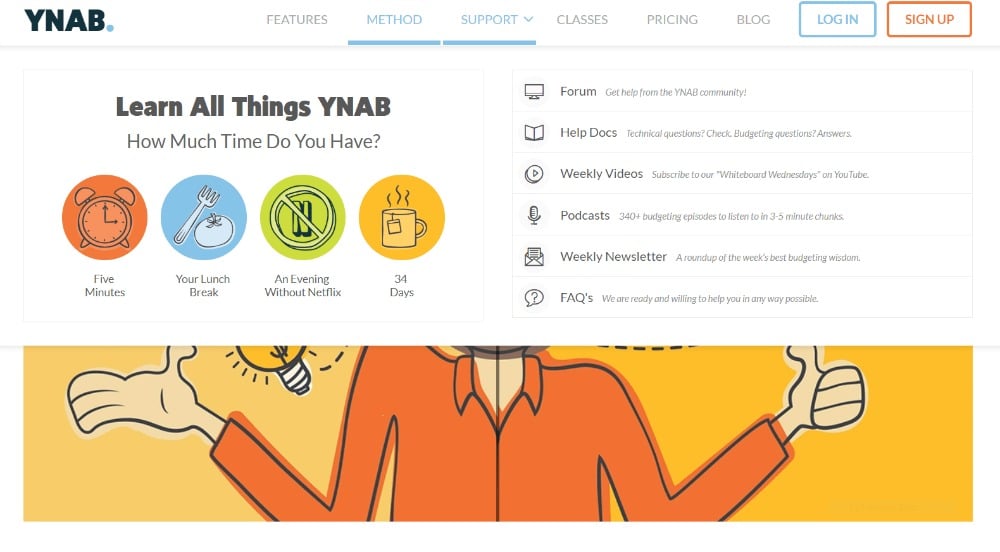

You need a budget offers a 34 day free trial. Yes, 34 days.

The interface is super colorful and just visually appealing. One of the best I’ve seen.

YNAB also makes things as simple as possible by being really direct. For instance, if you want to learn more, it asks you exactly how much time you’ve got.

Seriously?

That’s awesome… especially given I have four young kids, so my attention span for anyone other than them is typically 5 minutes or less.

The site also offers some other cool things, like:

- Free live workshops every day

- Support (like newsletters and videos, a user forum and blog posts)

These are all free… sort of.

You see, YNAB offers a 34 day free trial because it’s a paid only service after that… $7 per month to be exact.

However, the company claims their users save $6,000 on average in their first year… which isn’t terrible given it cost just $84 to do it.

That, my friends, is a $7,042.86 return on investment (ROI).

Before you go pretending you’re all impressed with my mad math skills… there are ROI calculators online.

Another pretty awesome thing about the company is the student trial offer. With proof of an active school ID card, transcript or tuition statement… YNAB offers currently enrolled college students 12 free months of the service. Plus the 34 day free trial.

To be honest, I’m a fan.

A fan of the company’s lingo.

Of the methods.

Of the price.

Of the ease of use.

Your information syncs seamlessly across all devices and provides real time updates.

But don’t just take my word for it… take it for a test drive for 34 days. If simplicity is your game, you won’t be disappointed.

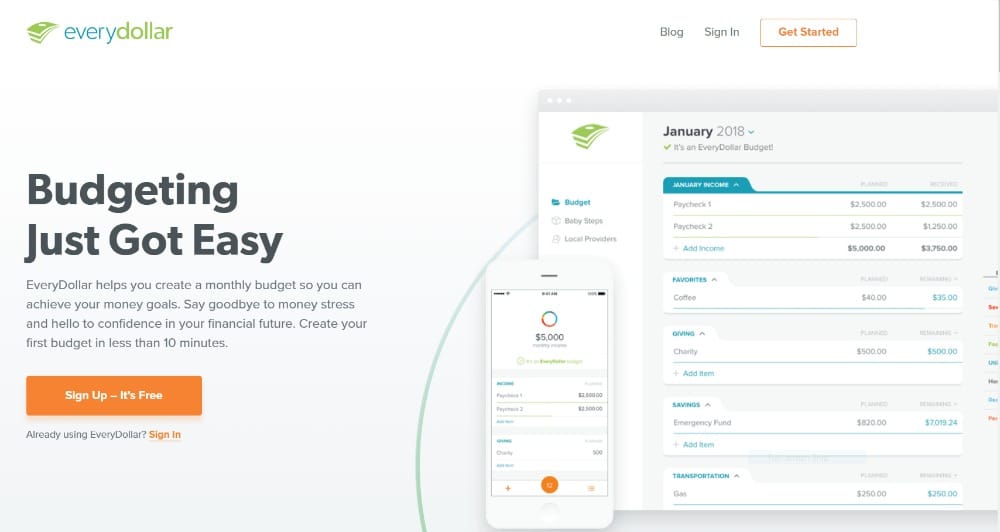

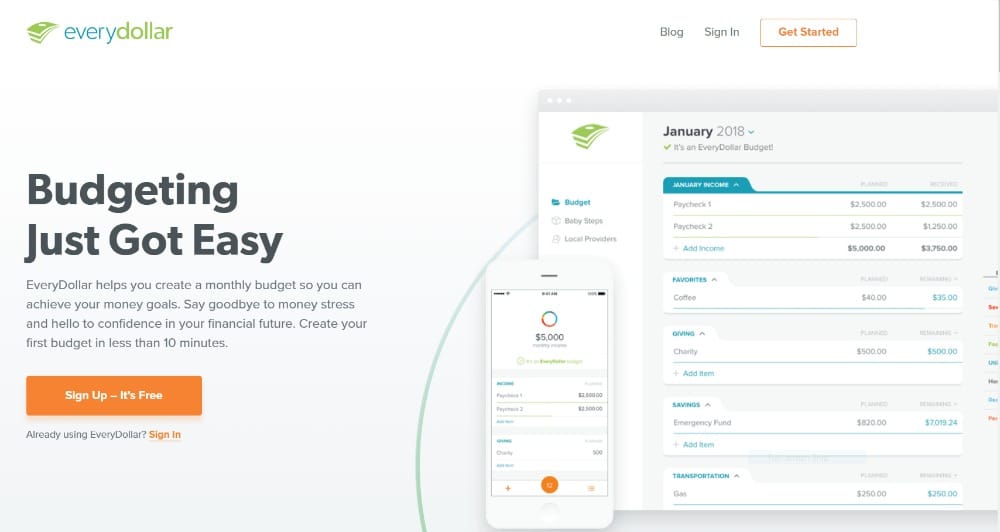

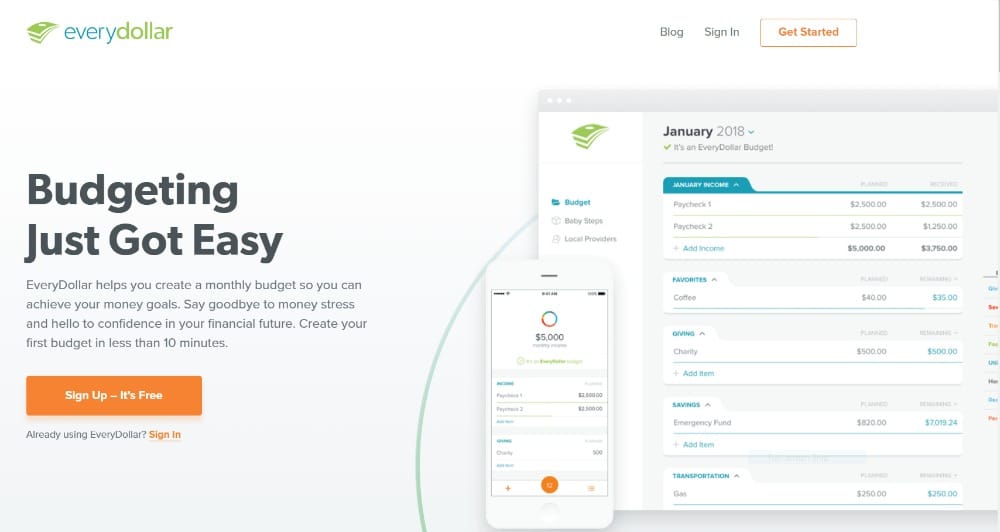

17. EveryDollar

As opposed to its hip competitor, You Need A Budget… EveryDollar seems a bit more geared towards the “mature” clientele.

The ones with families… or at least thinking about having a family.

After all, EveryDollar uses the zero-based budget approach, recommended by top personal money management expert Dave Ramsey.

Millions already use Ramsey’s proven financial planning method to create a monthly budget in just a few short minutes.

Similar to other budgeting apps, you start by entering your monthly income.

Then add your expenses.

EveryDollar comes with eight spending categories, but you also have the ability to create custom categories… such as saving accounts (for emergencies), which EveryDollar refers to as “Funds.”

Here, you can input your current balance as well as your savings goal.

Next to the typical categories, you can input the amount that is “Planned.” Next to the “Planned” portion of each category, you’ll find the “Remaining” category.

You can go back and forth between “Remaining,” which is the default setting, and “Spent” to see how much of your budget you’ve used.

And within each category… you have the ability to make notes, track transactions or convert it into a fund. But, when you make a category a fund, you are making it a savings goal — similar to what you can do with Mint.

If it’s a class you’ll be updating often, you possibly can “Favorite” it in order that it reveals up on the prime.

After setup, comes the upkeep.

If you’re utilizing the free model, here’s what Every Dollar will present:

- A completely customizable funds plan

- Access by way of the app or desktop browser

- Adjustable funds plans as life occurs

Other options embrace a Monthly Expense Tracker, the place you possibly can:

- Manage cash and observe spending because it occurs in seconds

- Split transactions throughout a number of funds gadgets

- Easily view what you’ve spent and what’s remaining for the month

The app additionally presents monetary planning with entry to a HUGE Endorsed Local Providers program… amongst which incorporates connections to actual property, insurance coverage and tax professionals.

This is included with the essential model.

The in-app improve model, EveryDollar Plus, permits you to:

- Link to your financial institution to import transactions to shortly observe spending

- Manage cash and examine account balances for linked monetary accounts

- Request a cellphone name to talk with the client help crew

The primary model requires you manually add transactions, whereas the paid model does this robotically for you.

The price for Every Dollar Plus is $99 per 12 months, so you might need to reap the benefits of the 15-day trial provide earlier than you commit.

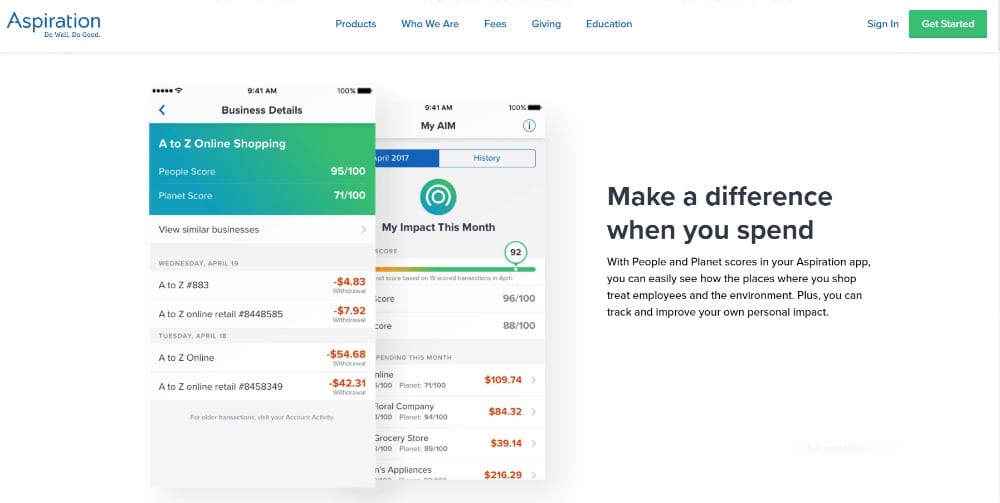

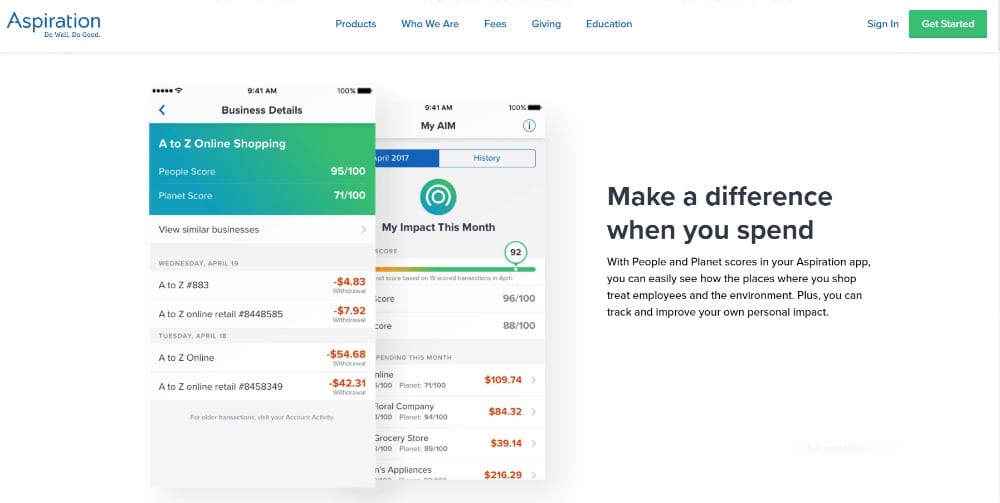

18. Aspiration

If you’re considerably political-minded…

If you care in regards to the state of the world round you…

If you care about serving to others…

If you care how your cash is invested…

Aspiration could also be your excellent match… deeming themselves the monetary agency with a conscience.

See, Aspiration believes that the large banks spend the cash they earn from you on lobbyists and marketing campaign contributions to get politicians to do their bidding…

That’s a fairly large accusation… however it’s true?

Truth or not, Aspiration commits to donating 10% of earnings to charities that help struggling Americans build a better life.

The program is called Dimes Worth of Difference.

Here’s the way it works:

Instead of shoppers paying a set account upkeep charge, they “tip” as a lot or as little as they need for Aspiration Bank’s companies.

10% of the following tips then go on to an inventory of charitable causes, listed on their web site.

Charities embody: Poverty, Water, Education, Environment, Health, Human Rights and the Aspiration Opportunity Funds (which gives small loans).

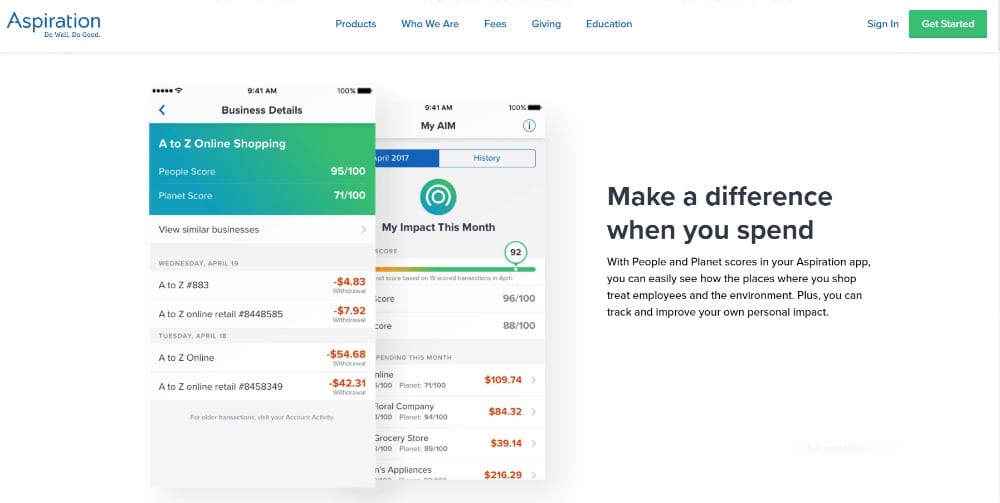

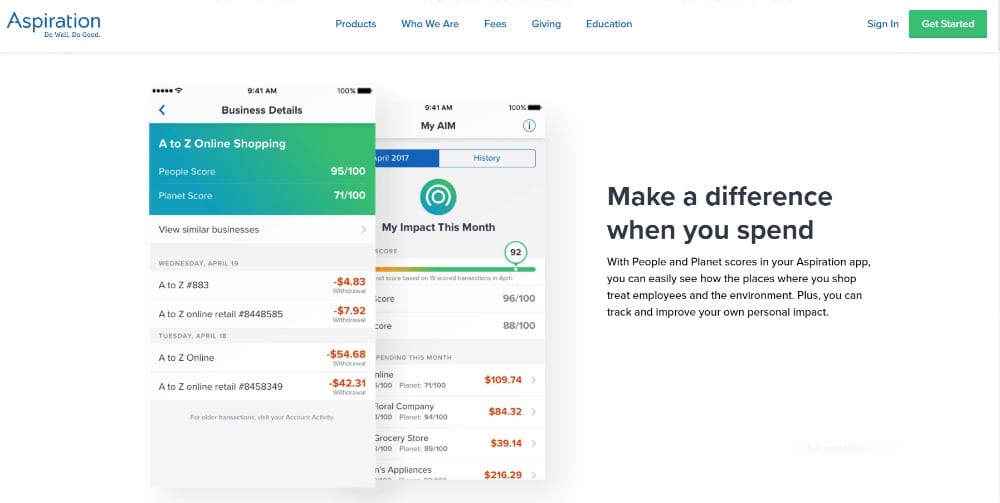

Aspiration additionally presents one other distinctive function known as “People and Planet”.

Here’s, you’ll really see the affect your cash has the place you store… as every service provider is given a rating for how they deal with their workers and the surroundings.

Plus, you possibly can observe and enhance your personal private affect… all throughout the Aspiration app’s dashboard.

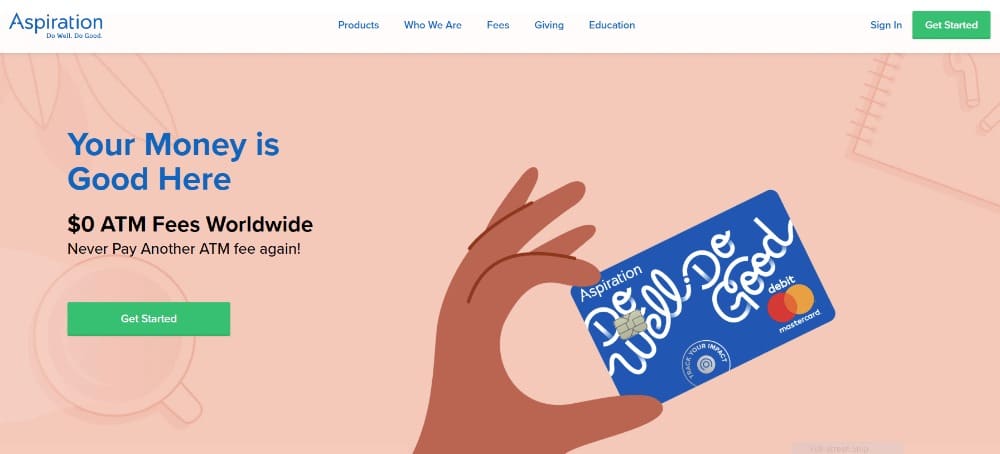

When you open the no-fee Summit Account with Aspiration Bank, you enjoy:

- A 1.00% Annual Interest Rate

- No monthly service fees

- Free access to every ATM in the world

- No minimum monthly deposit

If it sounds too good to be true… it just may be.

But I don’t think so.

And Aspiration doesn’t stop at banking… it ventures into Sustainable Investing as nicely.

With solely $100, anyone can invest easily with professionally managed funds which can be 100% fossil gas free or with fewer ups and downs.

Those identical funding corporations additionally provide Aspiration IRAs that allow you to save for your future, save in your taxes, and save the planet… all on the identical time.

Whether you’re a “bleeding heart liberal”… or simply care to make a small affect on this huge world… Aspiration has the product for you.

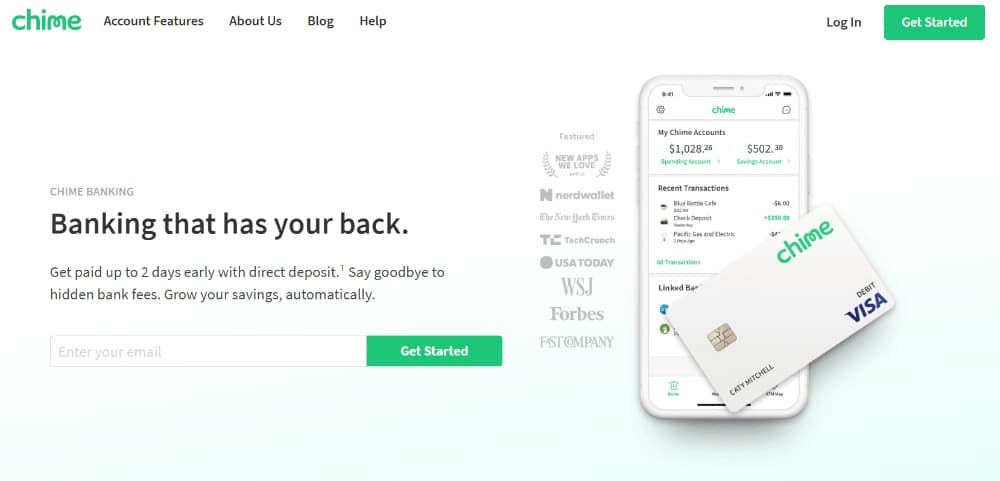

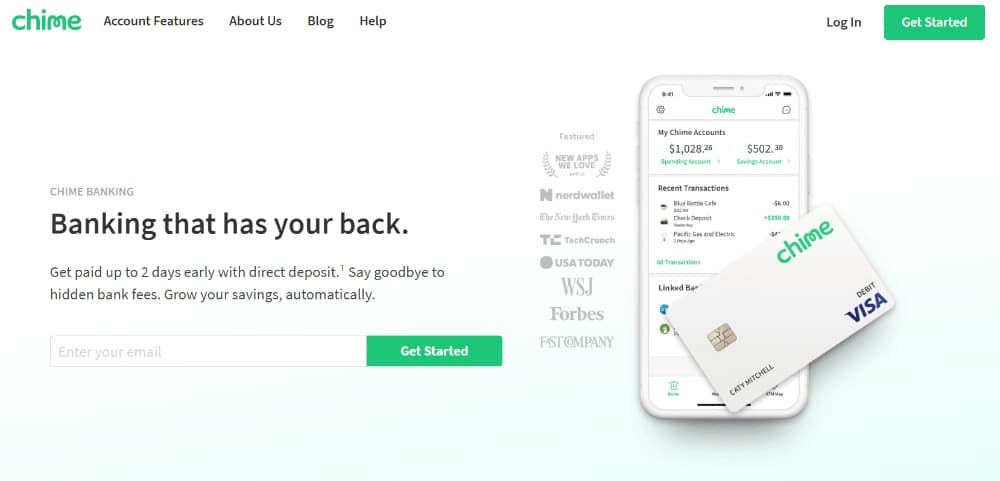

19. Chime

Another on-line solely financial institution, Chime believes they provide “Banking the way it should be”.

Banking for Millennials, created by a tech firm.

By opening a Savings Account with Chime, the free cellular banking platform permits you to profit from microsavings and rewards options each time you utilize the Chime debit card.

How?

With the Automatic Savings function.

Saving cash is a snap with the “Round Up” function that places additional change in your account with each buy. For instance, in case you spend $6.36 on a sandwich for lunch, Round Up will robotically fund your financial savings account with .64-cents.

Hey! It provides up.

Additionally, in case you select to fund the account through Direct Deposit out of your employer, Chime will mean you can obtain your paycheck up to two days earlier than your co-workers.

Guess drinks are on you!

Other benefits to the Chime Savings Account include:

- No overdraft fees

- No minimum balance requirements

- No monthly service fees

- No foreign transaction fees

- No transfer fees

- Real time transaction alerts

- Mobile payments

The mobile payment feature is similar to PayPal… allowing you to instantly send money via “Chime’s Pay Friends” to anyone with a Chime Spending Account.

Chime also offers a basic level Spending Account to simply help you track your finances better.

Sof if you want my advice, I’d tell your young bankers to give Chime a whirl… see how comfortable they are without a brick and mortar bank, while learning a little bit of responsibility along the way.

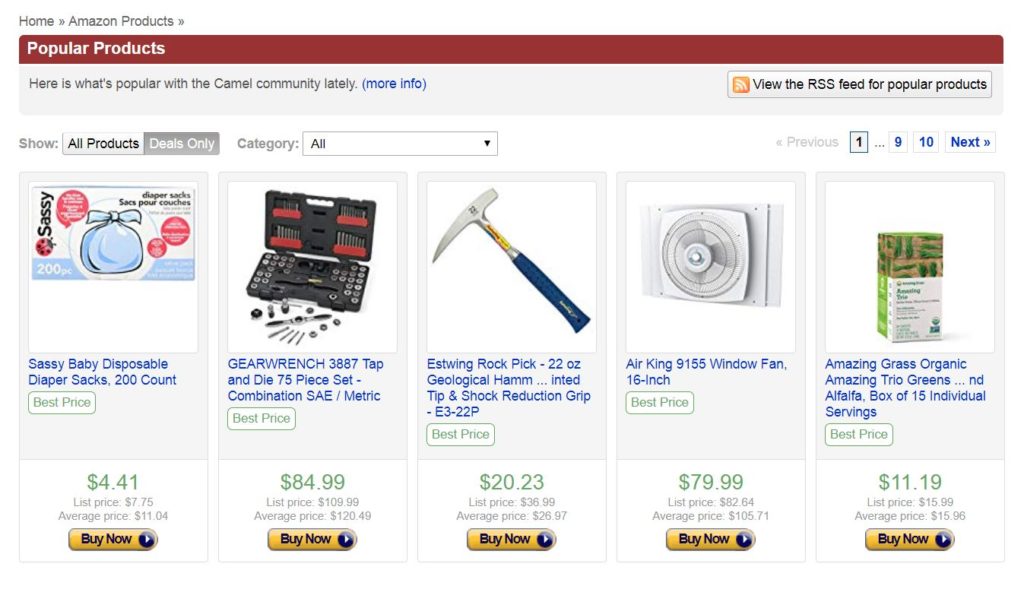

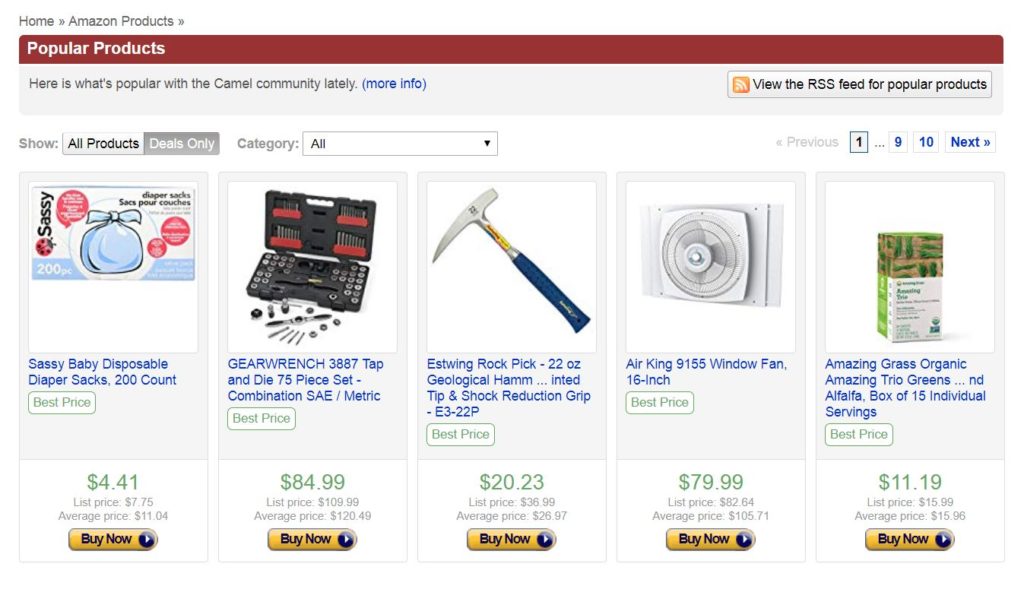

20. CamelCamelCamel

If you’re an Amazon junkie like me… than CamelCamelCamel could also be one of the best factor since sliced bread!

Plus the title is nice… not that I’m positive I get it.

If you do, let me know.

Anywho, Camel’s free Amazon value tracker displays tens of millions of merchandise and alerts you when costs drop, serving to you determine when to purchase.

Simply join and link your amazon.com account to get began.

From that second on, the Camel value tracker displays the costs of about 6 million Amazon merchandise throughout completely different nations (primarily all through the United States and United Kingdom).

When checking product costs, Camel breaks merchandise down into 9 teams primarily based on their central locale – and then breaks down every of these teams into 2 sub-groups.

The first, known as the “tracked” sub-group, accommodates all merchandise which have at the least one value watch.

The second, known as the “untracked” sub-group, accommodates the merchandise with no value watches.

All teams (and sub-groups) are then up to date in parallel, which normally means the smaller teams and sub-groups replace quicker than their counterparts.

The lesson right here is easy: in order for you a product’s value checked commonly and create a value watch.

Camel is free to enroll, giving entry to:

- Access to Wishlist importer

- Track all the merchandise in your Amazon wishlist robotically

- Centralized value watch administration

- Unlike customers with out logins, you possibly can handle your entire watched merchandise in a single place

- Track a number of value varieties

- Support for three Amazon value varieties; observe a number of utilizing our easy kind

- Twitter value drop alerts

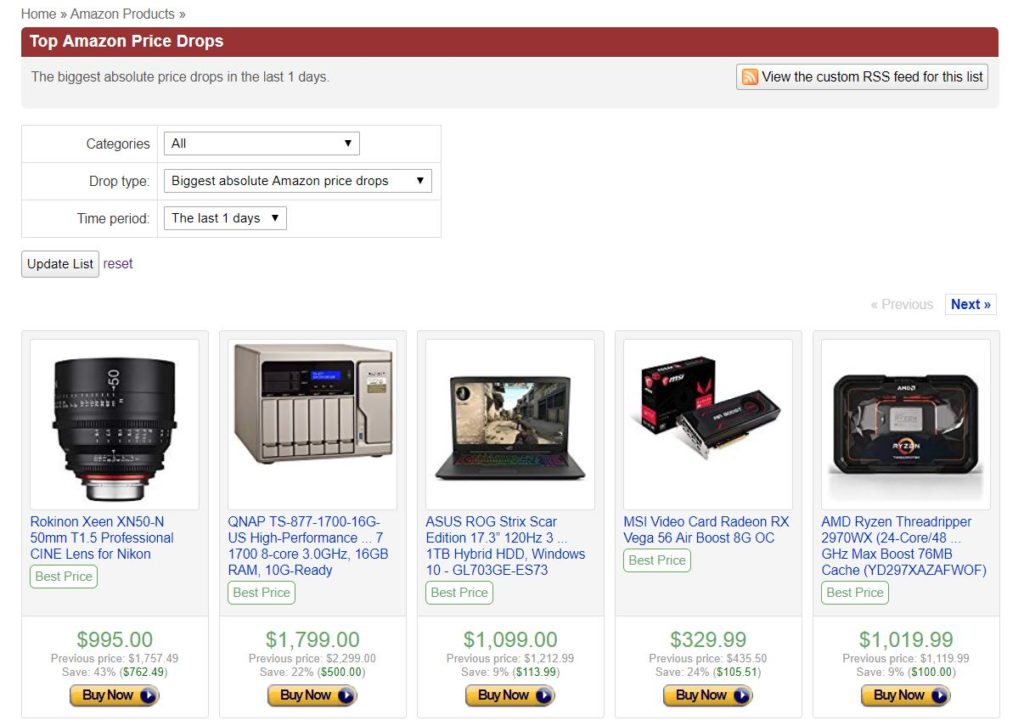

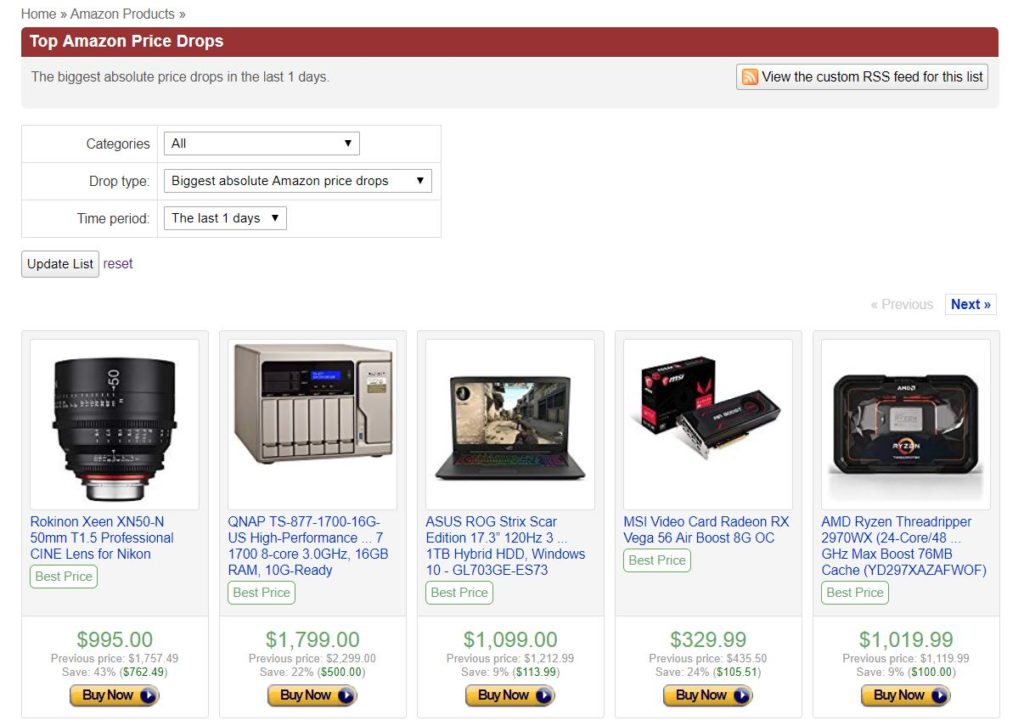

Camel additionally presents a “prime value drops” tab, which allows you to search by:

- Category

- Drop Type:

- Biggest Absolute Amazon Price Drops

- Biggest Relative (%) Amazon Price Drops

- Most Recent Amazon Price Drops

- Time Period

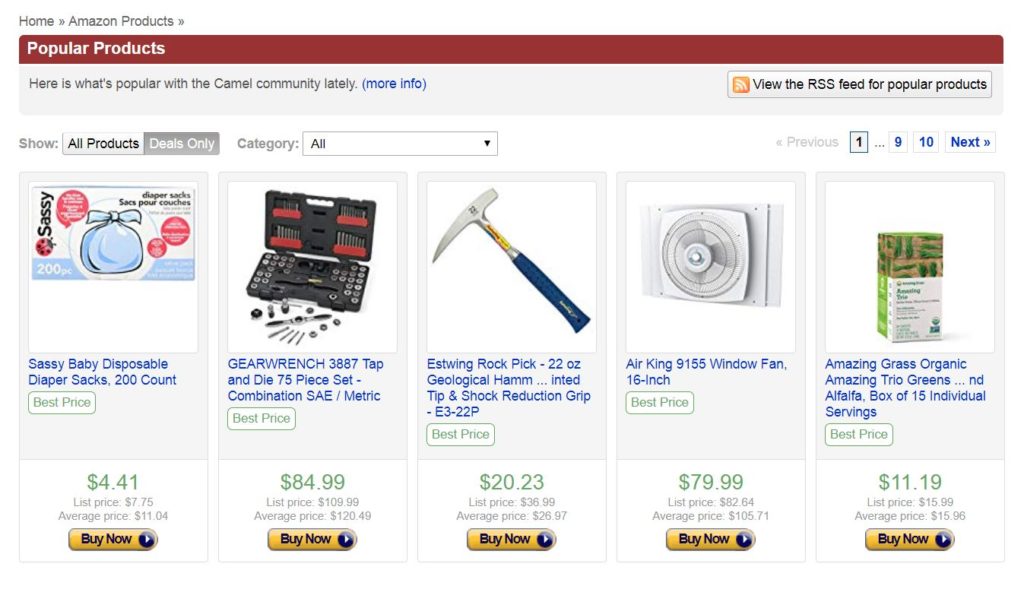

There is also a “popular products” tab which allows you to view Amazon’s daily price drops in two categories:

- Deals only

- All products

Camel will also entice you to add either a browser add-on or bookmarklet. The add-on places price history charts into your browser and allows you to view them directly from retailer product pages.

Not too shabby.

Camel also offers price watches for other companies such as Best Buy, Backcountry and Newegg… among others.

We also run a free hotel price tracker named Camelodge.

As far as value monitoring websites go, Camel’s been doing it lengthy… and doing it proper, in response to buyer opinions.

The solely factor to bear in mind in case you’re weary of shared information: CamelCamelCamel does maintain tabs on the merchandise you’ve tracked.

If you’re cool with that, you might simply be cool with Camel.

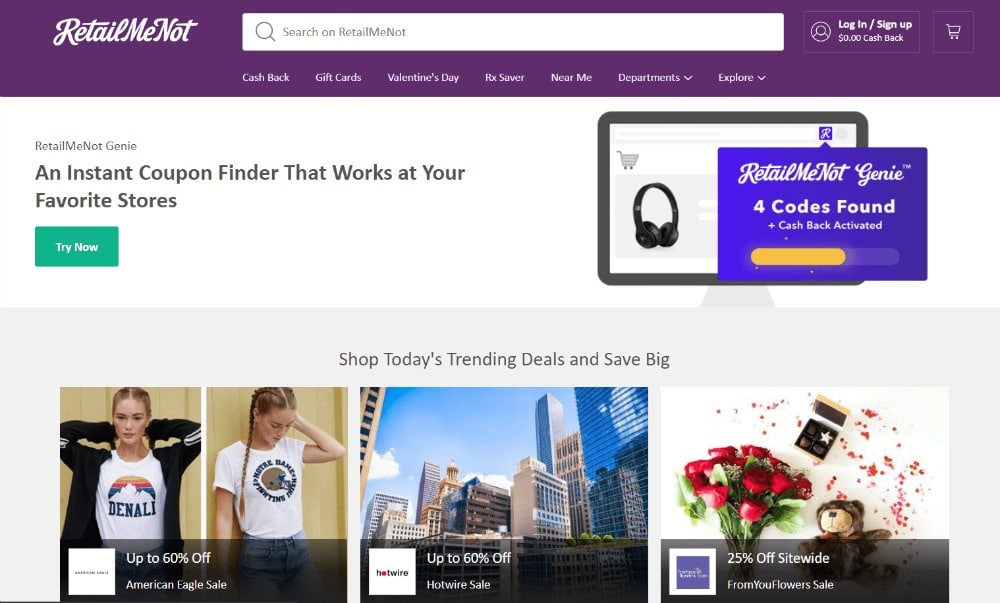

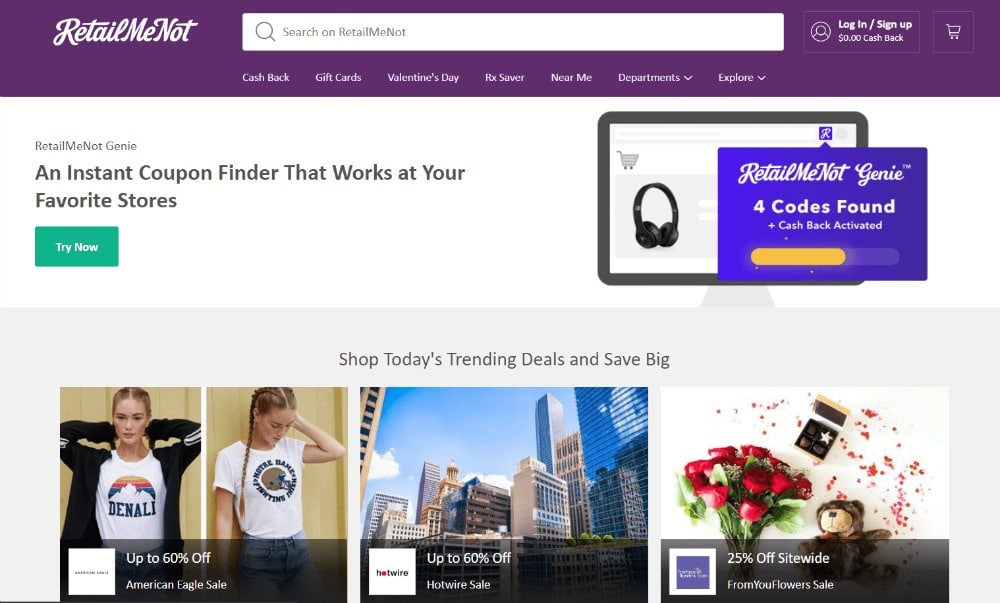

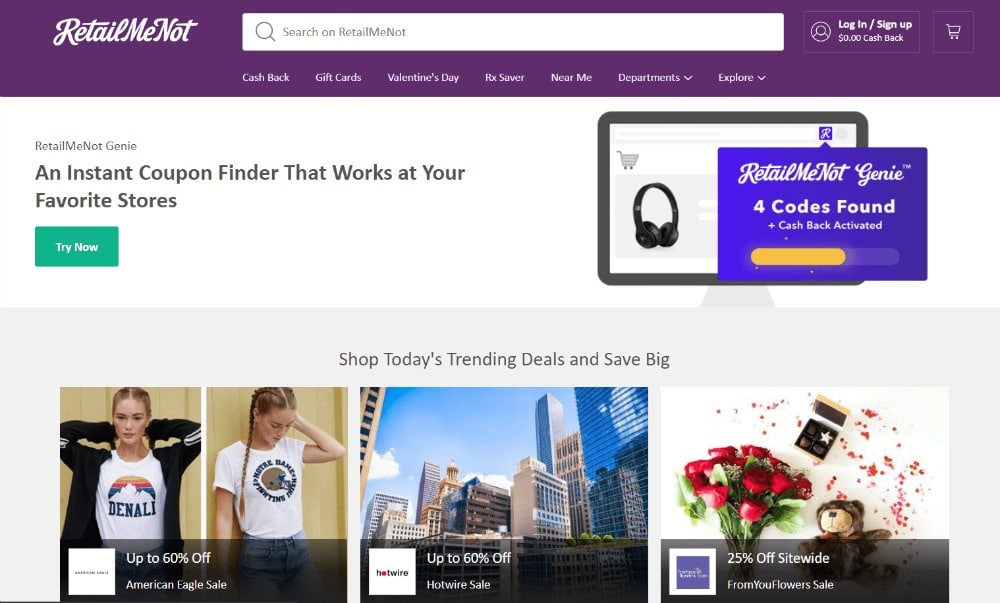

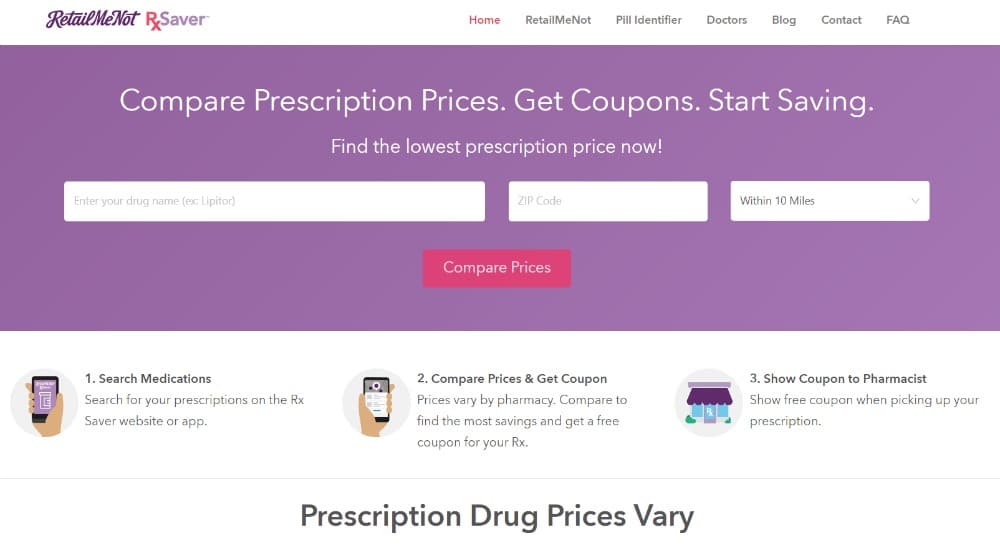

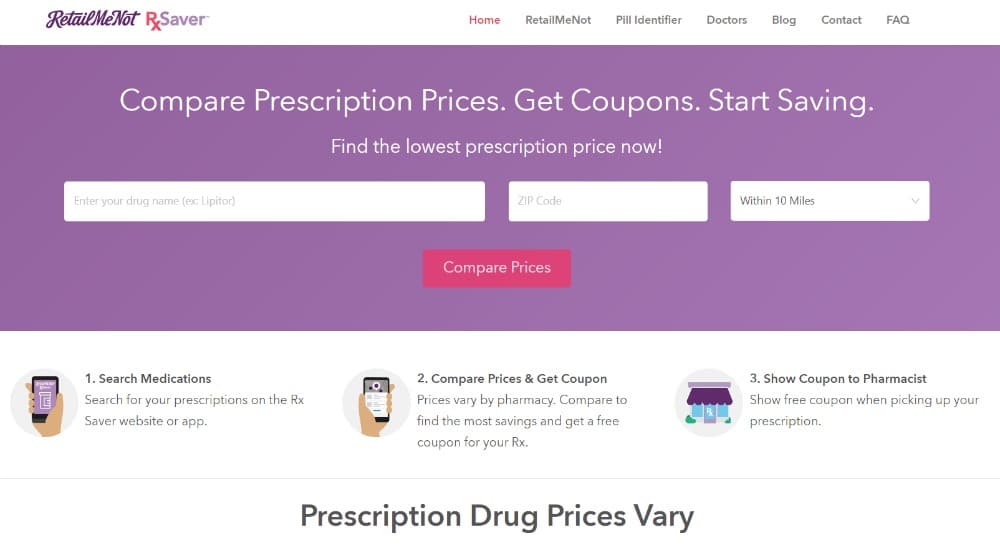

21. RetailMeNot

Imagine standing within the checkout line at your favourite clothes retailer and merely clicking a button in your smartphone to immediately get monetary savings!

Welcome to RetailMeNot, the app that permits you to search and add scannable coupons in your cellphone in seconds.

This is along with offering its members with greater than $400,000 price of coupon codes for brick-and-mortar shops, in addition to on-line procuring websites.

Not your typical coupon search, the app presents trending offers and huge financial savings… including cash back and gift card discount offers from their partners. All one needs to do is click on the offer to accept it.

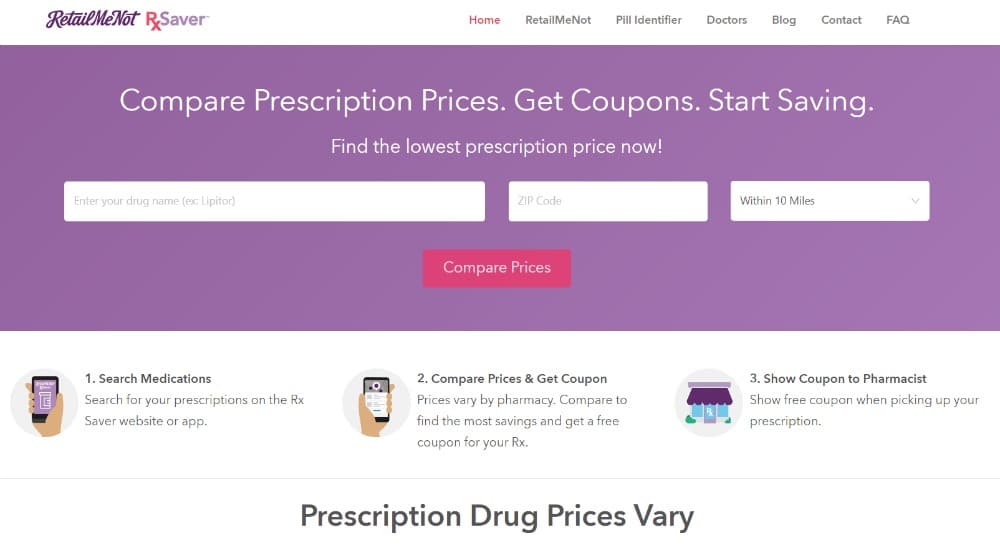

There is also a really great prescription medication search feature, which holds real value given the rising cost of healthcare today.

Similar to the store coupons, you are able to search for your prescriptions and compare prices at different pharmacies… then just claim the coupon you want and show it to the pharmacist when you pick it up.

This is one of my favorite apps for families.

Final thoughts on the Best Money Saving Apps

We all view saving money differently.

We also prioritize it differently.

Some of us live day to day.

Others want to plan for the future.

But whether you are concerned about your finances, or just want to grow your net worth and portfolio, there are apps out there that can help you succeed.

There are:

- Family organizer and planning apps

- Coupon clipping and shopping discount apps

- Investment planning apps

- Budgeting apps

- Banking apps

We’ve only covered a few here, but it’s a start.

And if you are serious about making an impact on your financial picture, I’d recommend checking the ones out that make the most sense for your life.

After all, where you are at now may not be where you are one year from now.

These 21 money saving apps are either free to try, or entirely free.

Those that require a small fee might still be something you find worthwhile in the grand scheme of things.

Again, it all depends on you.

Only you can decide how your money is spent.

Whether that means saving it up for a new car, a family vacation, college, a wedding, a house… or just wanting to pay down debt… it is ultimately in your hands.

But having these apps literally “in your hands” can make the journey so much easier.

Nicole Krause has been writing both personally and professionally for over 20 years. She holds a dual B.A. in English and Film Studies. Her work has appeared in some of the country’s top publications, major news outlets, online publications and blogs. As a happily married (and extremely busy) mother of four… her articles primarily focus on parenting, marriage, family, finance, organization and product reviews.