TVS Supply Chain Solutions is amongst India’s greatest and fastest-growing built-in provide chain answers suppliers on the subject of revenues in Fiscal 2022, in keeping with the RedseerReport. They supply provide chain control products and services for world organizations, executive departments, and massive and medium-sized companies. They have been promoted via the erstwhile TVS Group, probably the most reputed trade teams in India. They have controlled huge and sophisticated provide chains throughout a couple of industries in India and choose international markets thru custom designed tech-enabled answers.

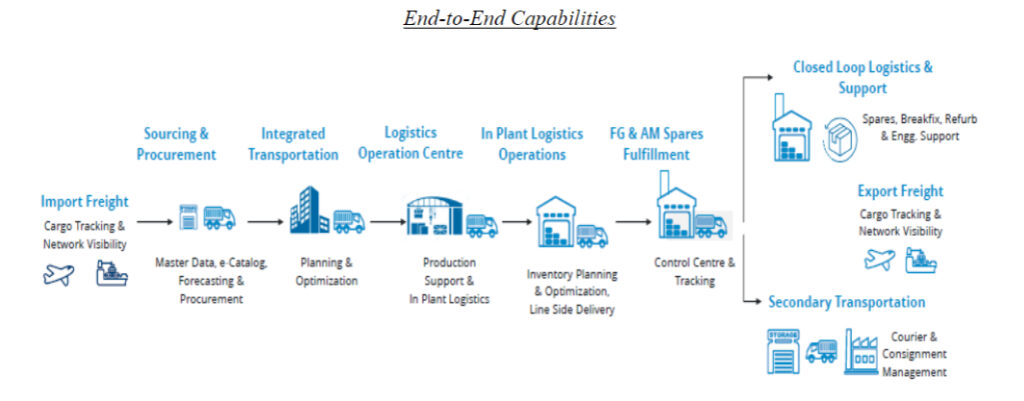

TVS Supply Chain Solutions spanning all of the price chain from sourcing to intake can also be divided into two segments: (i) built-in provide chain answers (“ISCS”); and (ii) community answers (“NS”). Their functions underneath the ISCS phase come with sourcing and procurement, built-in transportation, logistics operation facilities, in-plant logistics operations, completed items, aftermarket achievement, and provide chain consulting. Their functions underneath the NS phase come with international forwarding answers (“GFS”), which comes to managing end-to-end freight forwarding and distribution throughout ocean, air, and land, warehousing and at port garage and value-added products and services, and time-critical ultimate mile answers (“TCFMS”) which comes to closed-loop logistics and beef up together with spares logistics, break-fix, refurbishment and engineering beef up, and courier and consignment control.

Globally, The corporate supplied provide chain answers to ten,531 and eight,115 consumers all the way through Fiscal 2022 and the 9 months ended December 31, 2022, respectively, whilst in India, they supplied our answers to at least one,044 and 733 consumers, respectively, in the similar classes. Moreover, within the nine-month duration ended December 31, 2022, their 277 international consumers integrated 72 “Fortune Global 500 2022” firms, whilst their Indian consumers integrated 25 “Fortune Global 500 2022” firms. Some in their shoppers are Sony India Private, Hyundai Motor India, Johnson Controls-Hitachi Conditioning India, Ashok Leyland ), TVS Motor Company, Diebold Nixdorf, TVS Srichakra, Lexmark International Technology Sarl, VARTA Microbattery Pte Ltd, Daimler India Commercial Vehicles Private, Hero MotoCorp, Modicare, Panasonic Life Solutions India Private, Dennis Eagle, Electricity North West, Yamaha Motor India Private, and Torrot Electric Europa, S.A.

Objects of the Issue

- Prepayment or reimbursement of all or a portion of sure remarkable borrowings availed via the corporate and subsidiaries, TVS LI UK and TVS SCS Singapore

- General company functions.

TVS Supply Chain Solutions IPO Review (Apply or Not)

TVS Supply Chain Solutions IPO Date & Price Band Details

| IPO Open: | August 10, 2023 |

| IPO Close: | August 14, 2023 |

| IPO Size: | Approx ₹880 Crores |

| Fresh Issue: | Approx ₹600 Crores |

| Offer for Sale: | Approx 14,213,198 Equity Shares |

| Face Value: | ₹1 Per Equity Share |

| IPO Price Band: | ₹187 to ₹197 Per Share |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 10% |

| QIB Quota: | 75% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

TVS Supply Chain Solutions IPO Market Lot

The TVS Supply Chain Solutions IPO minimal marketplace lot is 76 stocks with ₹14,972 utility quantity. The retail buyers can observe up-to 13 loads with 988 stocks or ₹194,636 quantity.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 76 | ₹14,972 |

| Retail Maximum | 13 | 988 | ₹194,636 |

| S-HNI Minimum | 14 | 1064 | ₹209,608 |

| B-HNI Minimum | 68 | 5092 | ₹1,003,124 |

TVS Supply Chain Solutions IPO Allotment & Listing Dates

The TVS Supply Chain Solutions IPO date is August 10 and the shut date is August 14. The TVS Supply Chain Solutions IPO allotment might be finalized on August 21 and the IPO checklist on August 24.

| Price Band Announcement: | August 6, 2023 |

| Anchor Investors Allotment: | August 9, 2023 |

| IPO Open Date: | August 10, 2023 |

| IPO Close Date: | August 14, 2023 |

| Basis of Allotment: | August 21, 2023 |

| Refunds: | August 22, 2023 |

| Credit to Demat Account: | August 23, 2023 |

| IPO Listing Date: | August 24, 2023 |

You can take a look at IPO subscription standing and IPO allotment standing on their respective pages.

TVS Supply Chain Solutions IPO Form

How to use for the TVS Supply Chain Solutions IPO? You can observe for TVS Supply Chain Solutions IPO by the use of ASBA to be had for your checking account. Just pass to the net financial institution login and observe by the use of your checking account via deciding on the TVS Supply Chain Solutions IPO within the Invest segment. The different possibility is you’ll be able to observe for TVS Supply Chain Solutions IPO by the use of IPO bureaucracy downloaded by the use of NSE and BSE. Check out the TVS Supply Chain Solutions bureaucracy – Click BSE Forms & NSE Forms clean IPO bureaucracy obtain, fill, and put up for your financial institution or together with your dealer.

TVS Supply Chain Solutions Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2020 | ₹6793 | ₹7037 | ₹248.00 |

| 2021 | ₹7000 | ₹7166 | ₹76.34 |

| 2022 | ₹9300 | ₹9253 | ₹45.80 |

| 2023 | ₹10311 | ₹10266 | ₹41.76 |

TVS Supply Chain Solutions IPO Valuation – FY2023

Check TVS Supply Chain Solutions IPO valuations element like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) main points.

| Earning Per Share (EPS): | ₹1.04 in line with Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 5.50% |

| Net Asset Value (NAV): | ₹18.89 in line with Equity Share |

Peer Group

- TCI Express

- Mahindra Logistics

- Blue Dart Express

- Delhivery

- TVS MOBILITY PRIVATE

- T.S.RAJAM RUBBERS PRIVATE

- DHINRAMA MOBILITY SOLUTION PRIVATE

- RAMACHANDHRAN DINESH

TVS Supply Chain Solutions IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: [email protected]

Website: https://linkintime.co.in/

TVS Supply Chain Solutions IPO Allotment Status Check

Check TVS Supply Chain Solutions IPO allotment standing on Linkintime web site allotment URL. Click Here

TVS Supply Chain Solutions IPO Lead Managers aka Merchant Bankers

- Jm Financial Limited

- Axis Capital Limited

- J.P. Morgan India Private Limited

- Bnp Paribas

- Equirus Capital Private Limited

- Nuvama Wealth Management Limited

Company Address

TVS Supply Chain Solutions

10 Jawahar Road, Chokkikulam,

Madurai – 625 002

Phone: + 91 44 66857777

Email: [email protected]

Website: https://www.tvsscs.com/

TVS Supply Chain Solutions IPO FAQs

What is TVS Supply Chain Solutions IPO?

When TVS Supply Chain Solutions IPO will open?

What is TVS Supply Chain Solutions IPO Investors Portion?

How to Apply the TVS Supply Chain Solutions IPO?

How to Apply the TVS Supply Chain Solutions IPO thru Zerodha?

How to Apply the TVS Supply Chain Solutions IPO thru Upstox?

How to Apply the TVS Supply Chain Solutions IPO thru Paytm Money?

What is TVS Supply Chain Solutions IPO Size?

What is TVS Supply Chain Solutions IPO Price Band?

What is TVS Supply Chain Solutions IPO Minimum and Maximum Lot Size?

What is the TVS Supply Chain Solutions IPO Allotment Date?

TVS Supply Chain Solutions IPO allotment date is August 21, 2023.

What is the TVS Supply Chain Solutions IPO Listing Date?

TVS Supply Chain Solutions IPO checklist date is August 24, 2023. The IPO is to record on BSE and NSE.

Note: The TVS Supply Chain Solutions IPO value band and date are formally introduced. The IPO gray marketplace top rate (TVS Supply Chain Solutions IPO Premium) might be added to the IPO gray marketplace web page as it’s going to get started).

Follow for the Upcoming IPO news and their critiques, additionally stay following us on Twitter, Facebook, and Instagram. For our newest movies, subscribe to our YouTube channel.

Read Also:

– Source : IPOWATCH