|

Dry grasses encompass an indication in Kagel Canyon close to Los Angeles that encourages householders to clear vegetation that might gasoline a wildfire from round their properties. Source: Getty Images - Advertisement -

|

The pricing of potential reductions for householders is among the many factors of rivalry surrounding a just lately enacted California regulation that requires carriers to incentivize wildfire mitigation for policyholders on their properties.

The regulation, which went into impact on Oct. 14, lays out these mitigation actions within the Safer from Wildfires technique revealed by the California Department of Insurance, or CDI, and developed in partnership with the Golden State’s emergency response and preparedness companies.

The items on the CDI’s menu for mitigation are break up into two classes: safety of the construction and safety of its rapid environment. A 3rd factor covers the duties communities ought to undertake to forestall the unfold of wildfires.

Structural duties embrace having a roof rated Class-A for hearth resistance, sustaining ember-resistant zones across the house and having ember- and fire-resistant vents. Among the duties for the encircling property are clearing of vegetation and particles from underneath decks, transferring flamable sheds to no less than a distance of 30 toes, and trimming bushes and eradicating brush.

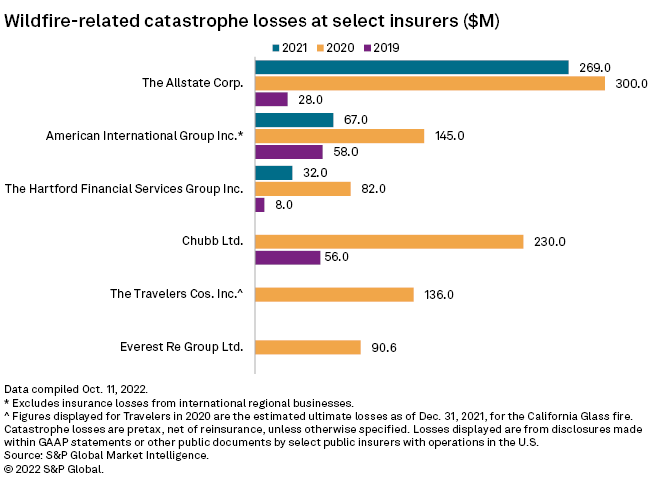

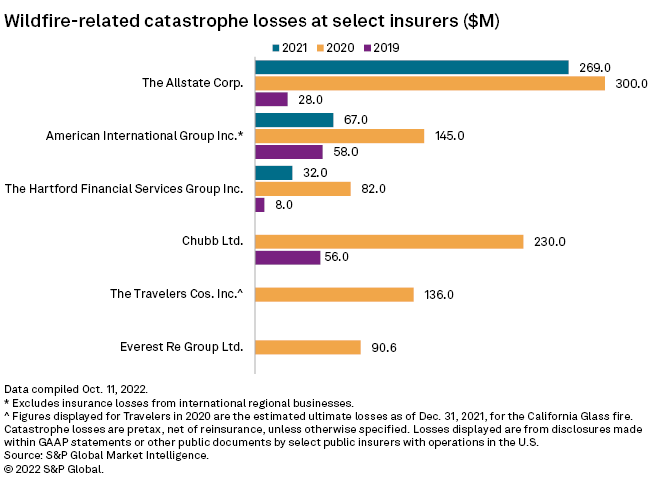

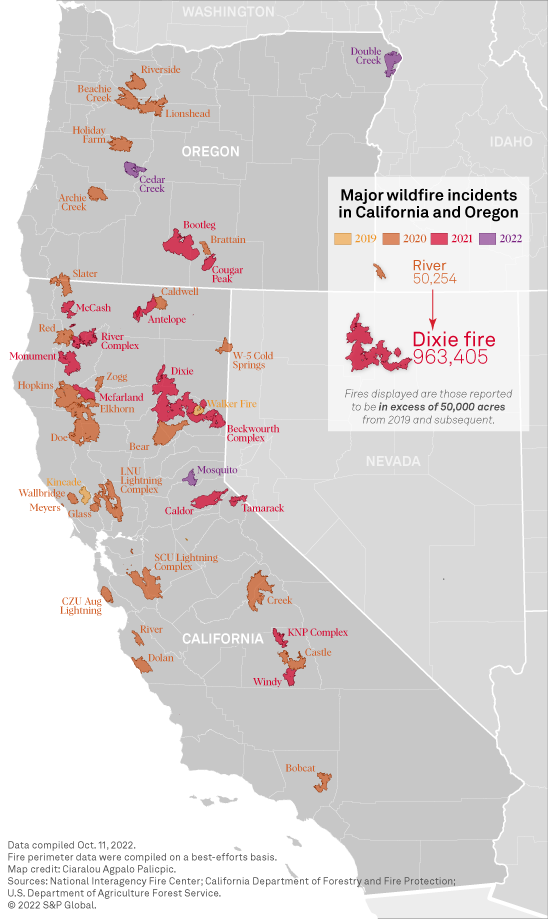

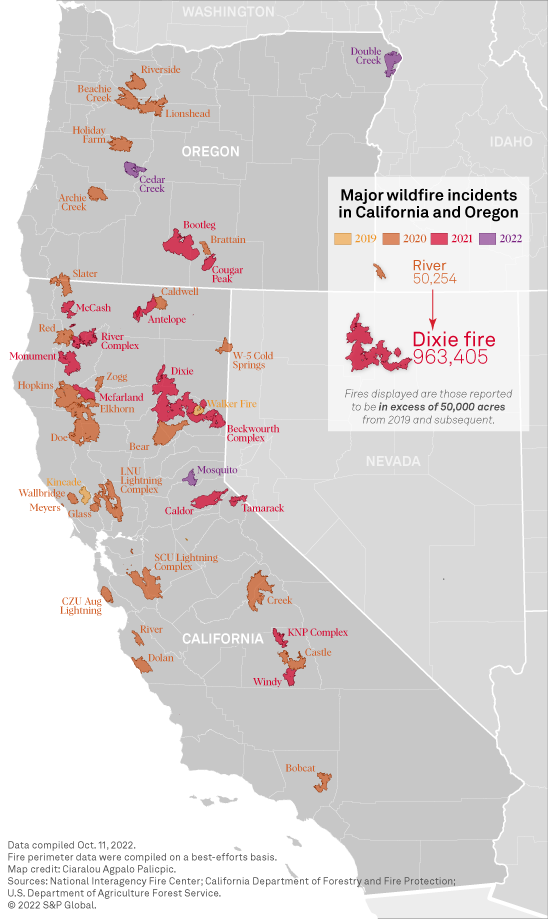

The new regulation comes as wildfire-related disaster losses have spiked in California lately, with 2020 being significantly excessive.

The regulation tells a house owner what must be executed, however insurers “have not yet figured out the relative value of all of these steps,” in keeping with Mark Sektnan of the American Property Casualty Insurance Association.

“Part of the equation is missing,” Sektnan mentioned in an interview.

However, Carmen Balber, government director of Consumer Watchdog, in an e-mail to S&P Global Market Intelligence mentioned the declare that corporations are battling pricing is “unfounded.” Balber, whose group was instrumental in securing the passage of Proposition 103, identified that, in keeping with the CDI, 40% of the insurance companies doing enterprise within the state provide discounts for mitigation.

Insurers already offering reductions embrace The Allstate Corp., Mercury General Corp., Nationwide Mutual Insurance Co. and Cincinnati Financial Corp.

Some or all?

Sektnan mentioned business skepticism additionally lies not within the mitigation measures themselves however within the variety of duties householders should full to qualify for reductions. The regulation could lead on householders to consider that they’ll choose any choice to qualify for a reduction, he mentioned.

He cited analysis performed by the Insurance Institute for Business and Home Safety that concluded all the advisable actions have to be accomplished to correctly mitigate a property. For instance, if a house owner covers the vents on the house however nonetheless has a cedar roof, Sektnan mentioned there is no such thing as a actual mitigation worth there.

“The expectation that a homeowner can do an individual item picked off the menu and get an insurance discount is going to be frustrating for most homeowners when they find out that’s not really what is scientifically based,” Sektnan mentioned.

Insurers have 180 days from the date the regulation is filed with the California secretary of state to unravel that equation and submit their general charge plan.

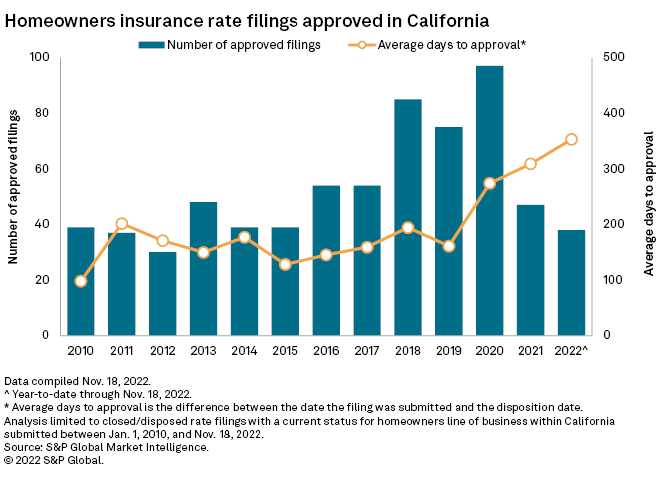

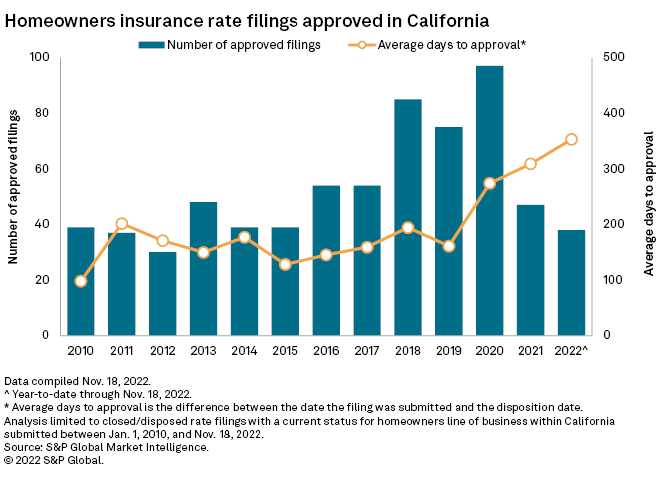

A Market Intelligence evaluation of charge filings for householders insurance coverage in California reveals that the variety of accepted filings has decreased in every of the final two years, and the common wait time for the approval of these filings has elevated dramatically.

The state regulator in 2021 accepted 47 charge filings with a median wait time of 309 days, in contrast with 97 filings accepted in 2020 with a median wait time of 274 days. So far in 2022, CDI has had 38 charge approvals, and the common wait time for these approvals jumped to 353 days.

Deputy Commissioner Michael Soller mentioned in an emailed response to Market Intelligence that the CDI “believes 180 days is appropriate and we will move quickly to review and approve these [rates].”

Modeling points stay

Computing the reductions and charges resurrects a persistent battle between insurers and the regulator. Carriers in California are required to take the common of precise losses for the earlier 20 years to set their charges, as an alternative of utilizing disaster fashions.

Janet Ruiz of the Insurance Information Institute mentioned insurers are all the time working with modeling corporations that present danger evaluation on components equivalent to local weather change.

“We’re all embracing the fact that there are climate risks, as do the Department of Insurance of the governor’s office,” Ruiz mentioned in an interview. “If the Department of Insurance will embrace modeling … then I think we could help people be able to afford insurance and get more insurance with admitted carriers.”

Soller mentioned the main focus of the regulation is to make individuals safer and decrease the chance.

“Catastrophe models don’t do that, and that is why Commissioner [Ricardo] Lara has not endorsed them,” Soller mentioned. “There’s no benefit for the consumer.”